Table of Contents

In the bustling financial landscape of 2024, the best money-saving apps are more than just digital piggy banks; they’re sophisticated tools that can help you automate savings, fund your goals, and monitor billing history all from a single dashboard. Whether you’re looking to deposit money into a best high-yield savings account, round up purchases to the nearest dollar to save and invest, or manage an emergency fund, there’s an app designed to cater to your financial needs.

Take control of your financial journey with apps like Acorns, which automatically invests your spare change, or utilize the Qapital app to set and achieve short-term goals through Qapital saving strategies. From canceling subscriptions with a subscription cancellation feature to maximizing savings account interest rates, these tools are designed to help you make the most of your money online. With the right budgeting app, such as YNAB, you can confidently navigate your financial future.

Top 10 Apps to Maximize Your Savings

Exploring the best apps to save money in 2024 means finding the perfect match for your financial goals. These money-saving apps range from those offering the best checking accounts and best CD rates, to the best money market accounts and online brokers. They cater to everyone from those seeking the best life insurance to those needing accounts for kids. The key is to find an app that aligns with your lifestyle and helps you make smart financial choices for a prosperous future.

1. Acorns – Invest Your Spare Change

Acorns is the quintessential app for those starting to invest spare change. Its round-up feature connects to your debit cards and rounds up your purchases, funneling those extra cents into a diversified portfolio. It’s ideal for young investors who want to dip their toes into the market with minimal effort. Acorns also offers retirement accounts like a Roth IRA, promoting long-term financial planning alongside daily saving habits.

By automatically investing your spare change, Acorns simplifies the investment process, making it accessible for everyone. The app’s algorithms are designed to craft a portfolio that aligns with your risk tolerance and financial goals, ensuring that your investments are working for you even when you’re focused on other life events. The ease of use and educational resources provided make Acorns a top contender among apps that help you save and invest effortlessly.

Acorns shines in making investment approachable, but it’s also about empowerment. By understanding that every cent counts towards building wealth, Acorns encourages consistent saving habits that can grow over time. It’s the gentle nudge many need to start taking their financial future seriously, without feeling overwhelmed by the complexities of the stock market.

Whether you’re a college student or a young professional, Acorns can be the best app to introduce you to the world of investing. Its automated approach allows you to grow your money without having to make investing your full-time job. With Acorns, your financial potential is just a few spare coins away.

- Automated savings

- Diversified portfolio

- Retirement accounts

- Investment education

- User-friendly

- Monthly fees

- Limited control

2. Chime® – Comprehensive Financial Management

Chime is a financial technology company that brings a refreshing take on traditional banking. With a focus on simplifying your financial life, Chime offers an array of services, including a Chime debit card which makes everyday transactions effortless. The standout feature of Chime is its automated saving tool; Chime automatically rounds up transactions to the nearest dollar and transfers the difference to your savings account, encouraging a save-as-you-spend habit.

Chime’s approach to savings doesn’t stop at rounding up change. With direct deposits, you can have your paycheck sent straight to your Chime account, often two days before traditional banks would make the funds available. This feature, coupled with the absence of hidden fees, positions Chime ahead of the curve when it comes to managing your money effectively.

The national average savings rate often pales in comparison to what Chime offers. By prioritizing high-yield savings, Chime ensures that your money isn’t just sitting idle; it’s growing. This commitment to providing value to customers is evident in every aspect of Chime’s service, from its automated savings feature to its user-friendly interface.

Chime’s vision extends to creating a banking experience that feels personal and proactive. The app’s notifications and automatic savings tools work together to keep you informed and engaged with your financial health. It’s a comprehensive financial management system designed to help you save more, without the stress of traditional banking.

- Automated saving

- Early payday

- No hidden fees

- High-yield savings

- Intuitive interface

- ATM limitations

- No physical branches

3. Qapital – Mastering the Art of Goal Setting

Qapital is an app that revolutionizes the way you save by turning it into a goal-driven process. With its automatic saving feature, Qapital allows you to set specific financial targets and save your spare change towards them. It’s as simple as deciding you want to save an extra 50 cents every time you buy coffee; Qapital handles the rest, automatically transferring the funds to your Qapital Goals savings account.

The app’s strength lies in its ability to make saving feel like a game. You set the rules, and Qapital plays along, turning mundane spending into an opportunity to get closer to your dreams. Whether you’re saving for a vacation, a new gadget, or just a rainy day, Qapital provides a clear path to your goals.

Qapital invests in user experience, ensuring that every feature is designed to encourage positive financial habits. The app’s interface is intuitive, making it easy for you to track progress and stay motivated. By providing a visual representation of your goals, Qapital keeps you focused on the prize, making saving an engaging and rewarding experience.

Ultimately, Qapital understands that saving is personal. It respects your financial journey and empowers you to take charge of it. Whether you’re a seasoned saver or just starting out, Qapital offers the tools and encouragement needed to build a stronger financial future, one goal at a time.

- Goal-oriented

- Automated transfers

- User-friendly

- Customizable rules

- Motivational design

- Monthly subscription

- Limited investments

4. Rocket Money – Expense Tracking Made Simple

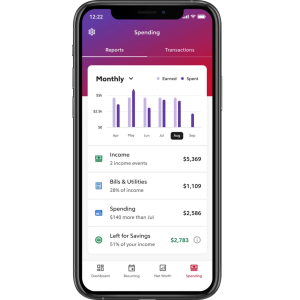

Rocket Money, formerly known as Truebill, is your financial command center for tracking expenses and managing subscriptions. This app excels at providing you with a comprehensive overview of your financial picture by syncing with your bank and investment accounts. With Rocket Money, you can see where every penny goes and make informed decisions on how to optimize your spending.

One of the app’s most lauded features is its ability to automate your savings. By analyzing your spending habits, Rocket Money identifies areas where you can cut back and helps you set aside money for savings without lifting a finger. It’s a proactive approach to managing your money, ensuring that you’re always moving towards your financial goals.

Rocket Money also tackles the often-overlooked aspect of canceling subscriptions. With just a few taps, you can review all your recurring charges and cancel any service you no longer need, potentially saving hundreds of dollars a year. It’s a simple yet powerful tool for keeping your finances in check.

At its core, Rocket Money is about empowerment. It gives you the knowledge and tools to take control of your money, rather than letting it control you. Whether you’re trying to save for a big purchase or simply want to get a handle on your monthly spending, Rocket Money has the features to help you succeed.

- Expense tracking

- Automates savings

- Subscription management

- Financial overview

- Money insights

- Service fees

- Some ads

5. You Need a Budget (YNAB) – Control Your Budget

You Need a Budget, commonly known as YNAB, isn’t just another budgeting app—it’s a philosophy. YNAB’s approach to money management is proactive, giving you the tools to assign every dollar a job, ensuring that you’re spending intentionally and saving diligently. With YNAB, you’re not just tracking expenses; you’re actively planning and managing your financial future.

YNAB stands out from other budgeting tools by emphasizing the importance of giving every dollar a role in your financial plan. This method helps you avoid the common pitfall of overspending and instead encourages you to think critically about your financial priorities. Whether it’s saving for a home, paying down debt, or investing in your education, YNAB helps you make those goals a reality.

The app’s focus on card or commitment means that it’s designed to work with your existing financial accounts, making it easy to get started. YNAB seamlessly integrates with your bank, credit card, and loan accounts, pulling in transactions and allowing you to see your entire financial picture in one place. It’s a central hub for all your financial decision-making.

YNAB is more than just a budgeting tool; it’s a community. With an extensive library of resources and a supportive user base, YNAB offers guidance and motivation to help you stick to your financial plan. It’s the perfect companion for anyone serious about taking control of their money and living with less financial stress.

- Proactive budgeting

- Financial planning

- Account integration

- Resource-rich

- Supportive community

- Learning curve

- Subscription fee

6. Oportun (Formerly Digit) – Simplified Saving Solutions

Oportun, previously known as Digit, automates the process of transferring amounts of money from checking to savings, making it easier for you to build a nest egg without feeling the pinch. With its ‘safe to save’ feature, Oportun analyzes your spending habits and determines the optimal amount to squirrel away, ensuring your daily expenses aren’t hampered. Users can download the app and experience a 30-day free trial to explore its full capabilities.

For those wanting more control, you can set a maximum daily save limit, so you never transfer more than you’re comfortable with. Oportun also offers a savings bonus for consistently saving, rewarding your good financial behavior. To avoid overdraft fees, the app keeps an eye on your minimum checking account balance, moving money back into your checking account if it dips too low.

When it comes to fees, Oportun charges a monthly subscription after the trial period ends, which can add up over time. However, for users with specific saving goals or those tackling student loans, the app’s algorithms can help by setting aside funds automatically, putting you on a stress-free path to achieving your financial objectives.

Oportun’s commitment to safe savings means that it employs robust security measures to keep your personal and financial information protected. This peace of mind allows you to focus on your finances without worrying about the safety of your data.

- Automated savings

- Spending analysis

- Savings bonus

- Overdraft protection

- Free trial

- Monthly fee

- Subscription cost

7. Goodbudget – Envelope Budgeting in a Digital Age

Goodbudget takes the tried-and-true envelope budgeting system and modernizes it for today’s tech-savvy users. By allocating funds to virtual envelopes, you can manage your spending according to category and avoid overspending. The app is particularly useful for individuals or families focusing on paying down debt, providing a clear structure for where their money should go each month.

With Goodbudget, you can sync and share budgets with family members or partners, fostering communication and transparency in financial matters. This feature is especially beneficial for coordinating household expenses or working together to reach a shared financial goal. The app also offers 10 annual reports, which give you a high-level overview of your annual spending and savings trends, allowing you to adjust your budget as needed.

One downside of Goodbudget is that it requires manual entry of transactions, which can be time-consuming for some users. Additionally, while the app does offer a free version, the full suite of features is only available in the paid version, which may not be suitable for everyone’s budget.

Goodbudget’s approach encourages discipline and awareness in financial management, making it a great tool for those who appreciate hands-on involvement in their fiscal planning.

- Envelope system

- Debt focus

- Family sync

- Annual reports

- Spending control

- Manual entry

- Paid features

8. Current – Modern Banking for Savvy Users

Current redefines the banking experience with its intuitive mobile banking app that integrates checking and savings accounts into one seamless interface. Its financial tools are designed to cater to the needs of modern users, making banking tasks both straightforward and accessible. With features like rounding up purchases to the nearest dollar and moves the change directly into your savings, Current helps you save money effortlessly.

The app provides real-time alerts on transactions, helping you stay on top of your spending and account balances. For those looking to save without having to think about it, Current’s automated saving feature takes the guesswork out of putting money aside. Moreover, the app’s user-friendly design makes managing finances less intimidating for novice savers.

However, Current’s reliance on automation might not appeal to those who prefer manual control over their savings. And while the app is full of features, some may find it complex if they are used to more traditional banking methods.

Overall, Current is a solid choice for users who want a modern twist on banking and savings, offering convenience and control right from their smartphones.

- Automated saving

- Financial tools

- Real-time alerts

- User-friendly

- Rounding-up feature

- Less manual

- Potentially complex

9. Albert – Intelligent Financial Assistance

Albert serves as your personal financial assistant, harnessing the power of intelligent algorithms to provide tailored advice and automation for your savings journey. The app’s proactive financial insights help you understand and optimize your spending habits. Albert also identifies savings opportunities and can automatically set money aside for you, making the saving process simple and efficient.

Albert’s Genius feature connects you to human financial experts who can offer personalized advice, which is a game-changer for those who need more than just automated guidance. Additionally, the app’s user interface is clean and engaging, encouraging regular interaction with your financial data.

Some users, however, may find the advisory service fee for Albert’s Genius to be a drawback. The app also tends to make frequent recommendations for various financial products, which can feel overwhelming or intrusive to some.

For those seeking a comprehensive financial tool that combines automation with human insight, Albert stands out as a forward-thinking choice in the realm of money management apps.

- Financial insights

- Human experts

- Automated savings

- Clean interface

- Engaging design

- Service fee

- Product recommendations

10. Allo – Mindfulness in Money Management

Allo introduces a unique approach to financial management by combining mindfulness with money management. The app encourages you to reflect on your spending decisions, promoting a more intentional and purposeful use of your finances. By focusing on mindful spending, Allo helps you align your financial choices with your personal values and goals.

The app offers a variety of tools to track spending and visualize where your money is going, making it easier to identify areas for savings. Allo’s interface is designed to be calming and reassuring, reducing the stress often associated with managing money.

However, the concept of mindfulness in finance might not resonate with everyone, and some may prefer a more straightforward budgeting tool. Additionally, the app’s newer status in the market means it may not have as many features as more established competitors.

Allo is an excellent option for those looking to combine their financial management with a holistic approach to their overall well-being, providing a refreshing alternative to traditional budgeting apps.

- Mindful spending

- Spending tracker

- Values alignment

- Calming interface

- Stress reduction

- Niche concept

- Fewer features

Factors to Consider When Choosing Apps to Save Money

When you’re on the hunt for money saving apps, it’s important to weigh various factors. Here are some of the factors:

• Features

Money saving apps come packed with features designed to bolster your financial health. From budgeting tools that help you allocate funds wisely to analytics that reveal your spending habits, these features can be transformative. The best apps will offer a variety of ways to save, whether by rounding up your purchases to the nearest dollar or offering cash-back rewards that boost your savings.

Another key set of features revolves around goal setting. Apps that allow you to set specific financial goals and track your progress can be incredibly motivating. Additionally, look for apps that offer educational resources. These can help you understand the nuances of personal finance and empower you to make informed decisions.

• Integration

Integration is crucial for a seamless experience in managing your finances. The best apps will integrate smoothly with your bank and credit card accounts, pulling in your transactions to give a real-time view of your financial life. This integration should be secure, ensuring your sensitive information remains private and protected.

Furthermore, integration with other financial tools and services can enhance the app’s utility. For example, if you use American Express for your expenses, finding an app that effortlessly syncs with your account can streamline tracking expenses and monitoring rewards. The goal is to have a one-stop-shop where all your financial data is at your fingertips.

• Security

Security is non-negotiable when it comes to apps that handle your financial information. Look for apps that offer bank-level encryption and secure login processes, such as two-factor authentication. Trustworthy money saving apps will prioritize protecting your data above all else.

Moreover, investigate the app’s history and policies regarding data breaches and their response strategies. A solid reputation for safeguarding user data is a good indicator of the app’s reliability in the security department. It’s worth taking the extra time to ensure your financial accounts will not be compromised.

• Compatibility

Regardless of how powerful an app is, it’s of little use if it’s not compatible with your devices. Ensure that the money saving apps you’re considering work with your smartphone’s operating system, whether it’s iOS or Android. The best apps are usually designed to function well across multiple platforms and devices.

Additionally, check if the app offers a web version that can be accessed on a desktop or laptop. This can be handy for more detailed financial reviews and planning sessions that benefit from a larger screen and more robust interface.

• Automation

Automation can transform the way you manage your finances. Apps that automate savings, like transferring small amounts of money to high-yield savings at regular intervals, take the guesswork out of saving. This can be especially beneficial if you’ve just built up some savings and are looking to grow it without daily intervention.

Also, consider whether the app can automatically categorize transactions and create budgets. This hands-off approach can help you save time and effort, allowing you to focus on other areas of life while your financial health is maintained.

• Ease of Use

An intuitive user interface is key for any app, especially when it comes to managing your finances. Money saving apps should be easy to navigate, with clear menus and simple instructions. This helps ensure that you can fully utilize all the features without frustration.

Moreover, quick setup and the ability to easily connect with your financial accounts can make a significant difference. You’re more likely to consistently use an app that doesn’t require a steep learning curve or constant troubleshooting.

• User Reviews

User reviews are a treasure trove of insights when evaluating money saving apps. They can highlight strengths and weaknesses from a user perspective, often pointing out issues or benefits that may not be immediately apparent.

While user reviews are valuable, it’s also important to approach them critically. Look for patterns in the feedback and consider whether the reviewers’ priorities align with yours. Remember that one person’s deal-breaker may be insignificant to your experience.

• Cost and Fees

When assessing money-saving apps, understanding the cost and fee structure is crucial. Many apps offer a basic version for free, providing essential features like expense tracking or budgeting. However, some may introduce subscription fees for premium features or advanced functionalities, enhancing the user experience. It’s essential to evaluate whether these premium features align with your specific financial needs before committing to a subscription.

Moreover, users should be vigilant about transaction fees or hidden costs that may arise during app usage. Some apps may charge fees for transferring funds, making investments, or linking external accounts. Reading the app’s terms of service and user agreements can uncover any potential hidden costs. Being aware of these fees ensures transparency and helps users make informed decisions about whether the app’s benefits justify the associated expenses, contributing to a more effective and economical financial management strategy.

• Customer Support

Assessing the customer support of a money-saving app is vital for a seamless user experience. Confirm the availability and responsiveness of the support team to address any issues or queries promptly. Reliable customer support ensures that users can resolve problems efficiently, enhancing their confidence in the app.

Look for platforms that offer multiple support channels, such as live chat, email, or phone assistance. A responsive customer support system demonstrates the app developer’s commitment to user satisfaction, making it easier for users to navigate challenges and optimize the app for their financial needs.

FAQs

Choosing the right money saving app can raise many questions, but the key is to focus on ones that are highly rated and align with your financial goals.

1. Are free-money saving apps reliable?

However, it’s important to read the fine print and understand the limitations of free services. Some apps may have restrictions or offer limited functionality compared to their paid counterparts. Always assess whether the free version meets your needs or if it’s worth investing in premium features.

2. How do I know if an app is secure with my financial information?

Compare the security features of the app with those of traditional savings accounts. If the app allows you to transfer money into a high-yield savings account, check if they offer similar or better security features. Also, inquire whether the app has a history of successfully protecting users who have built up some savings over time. Rates at online banks and their associated apps are often higher, but so should be their investment in security infrastructure.

3. Are there money-saving apps that work in both iOS and Android platforms?

When exploring options, make sure to check the app’s availability on your specific platform. Additionally, consider any differences in functionality or interface between the iOS and Android versions, as this may affect your user experience.

4. Can I trust user reviews when choosing a money-saving app?

Consider user reviews alongside other factors like security, features, and ease of use. For instance, if an app is an investing app, check if users have had a positive experience with the app’s investment features. Reviews that mention high-yield savings and other financial benefits can also be a good sign of an app’s effectiveness.

5. How can I ensure that the app is easy to use?

Another way to gauge ease of use is by checking if you’ve easily built up some savings using the app’s tools. An efficient app should simplify the saving process, making it almost effortless to set aside funds regularly. Additionally, read through user reviews for insights on the app’s usability. Positive comments on the user experience can be a strong indicator of the app’s approachability.

6. Do money-saving apps help with long-term financial planning?

Moreover, the best money-saving apps implement multiple security measures to protect your financial information, which is critical when planning for the long term. Trustworthy apps ensure that your data and savings are safe, offering peace of mind as you build your financial foundation. Look for apps with strong encryption, fraud alerts, and secure connections to your bank accounts to support your long-term financial health.

Conclusion: Best Apps to Save Money

Embarking on the journey to bolster personal finance is made easier with the right tools at your disposal. The top 10 mobile apps we’ve explored offer robust solutions to help you save money effectively. Whether it’s rounding up your change with Acorns, setting precise saving goals with Qapital, or managing expenses with Rocket Money, these apps safe-guard your financial growth. With dozens of apps available, it’s essential to choose one that aligns with your financial habits and goals. Remember, the best business decisions are made when you’re fully informed.

Moreover, consider how these apps integrate with your existing bank accounts, including your visa credit card, to provide a seamless financial experience. Personal finance is a journey of continuous learning and adjustment, and these mobile apps are valuable companions on that path. By leveraging technology, you can transform your smartphone into a powerful financial ally. Choose wisely, and watch your savings flourish in 2024 and beyond.