Table of Contents

Rocket Money’s innovative platform has revolutionized personal finance management by offering a suite of tools designed to streamline budgeting and optimize savings. With its multifaceted approach, Rocket Money provides users with a holistic view of their financial health, employing powerful negotiation services to ensure they’re not overpaying on bills. The simplicity and effectiveness of these services have made it a go-to solution for individuals looking to take control of their financial future.

By integrating personal finance tools with proactive bill negotiation service, Rocket Money not only helps users track their spending but also actively works to reduce their financial burdens. This dual strategy serves to empower consumers, giving them the means to achieve their financial goals with greater ease and confidence in 2024. Read till the end to learn how does rocket money work.

Understanding the Basics of Rocket Money

At its core, Rocket Money’s platform is about providing clarity and control over one’s finances. By consolidating various financial accounts in one place, users can effortlessly manage their money, while Rocket Money’s bill negotiation service works behind the scenes to lower monthly expenses, ensuring that users get the best possible rates on their services.

What Is Rocket Money?

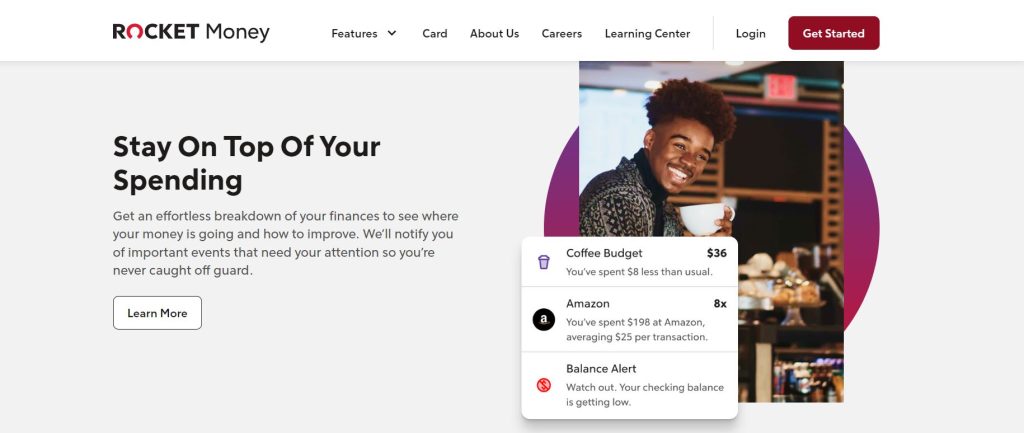

Rocket Money’s comprehensive financial toolkit offers a centralized solution for tracking expenses, managing subscriptions, and optimizing savings. Designed to cater to the needs of modern consumers, it simplifies the complexity of personal finance into an intuitive and user-friendly experience.

The Pros and Cons of Rocket Money

Like any service, Rocket Money has its advantages and disadvantages. Users must consider these to determine if it aligns with their financial management needs.

- Money-Saving Features – Rocket Money is equipped with a variety of money-saving features designed to help users reduce expenses and optimize their financial strategies. These tools include automated savings, bill negotiation, and subscription tracking, all intended to empower individuals to achieve their financial goals.

- Free Version Accessibility – The rocket money app’s free version offers users accessibility to essential financial management tools. It provides a solid foundation for budgeting and expense tracking, which can be particularly beneficial for those just beginning to organize their financial lives.

- Convenience of Subscription Cancellation – Rocket Money’s customer service is geared towards making subscription cancellation convenient. Users can easily manage unwanted subscriptions and recurring payments with the help of Rocket Money’s tools. To cancel a subscription, users simply upload a copy of the bill, and the service handles the rest, freeing them from the hassle of navigating through cancellation processes.

- Limitations of the Free Version – While the rocket money app’s free version is helpful, it does come with limitations. Users may find that some of the more advanced financial tools and insights are not available without upgrading to the premium service, which could impact their ability to fully manage their financial landscape.

- Accessibility of Advanced Features Behind Paywall – Access to Rocket Money’s most powerful tools, such as automatic savings and the subscription cancellation concierge, is behind a paywall. Users need to evaluate whether the benefits of these advanced features justify the cost, which operates on a sliding scale based on the level of service desired.

- Customer Support Availability Concerns – Despite Rocket Money’s array of features, some users express concerns over customer support availability. While the app receives praise for its functionality, the responsiveness of customer service does not always meet user expectations. In an era where instant assistance is valued, this aspect could detract from an otherwise stellar experience. Users considering Rocket Money should weigh the importance of support in their decision.

The Evolution of Rocket Money: From Truebill to Today

From its origins as Truebill, Rocket Money has evolved into a leading management and budgeting app, enhancing its capabilities to negotiate bills and support personal finances. Tailored to help users meet financial goals, Rocket Money is a bill management powerhouse, continually adapting to users’ needs for personal finance management.

How Rocket Money Simplifies Personal Finance Management

Rocket Money eases the stress of personal finance management by providing alerts for upcoming bills and organizing financial data in a digestible format. This proactive approach ensures that users are always ahead of their finances, promoting a sense of security and preparedness.

Navigating Rocket Money Features

Rocket Money’s array of features are crafted to grant users a comprehensive overview of their financial landscape. By integrating all aspects of personal finance into one platform, Rocket Money simplifies the process of financial planning and monitoring.

• Subscription Management: Keeping Track of Your Recurring Expenses

Rocket Money’s customer service stands ready to assist users in managing unwanted subscriptions. By allowing users to upload a copy of their bills, Rocket Money takes charge of identifying and cancelling recurring payments, ensuring financial efficiency and convenience.

• Automated Budgeting Tools and Spending Insights

The personal finance app goes beyond basic budgeting, offering unlimited budgets and breakdowns of your finances. These tools offer valuable spending insights and serve as mint alternatives, guiding users towards wise spending decisions.

• Bill Negotiation Services: How Rocket Money Lowers Your Bills

Rocket Money’s concierge service operates on a sliding scale, negotiating monthly subscriptions to secure lower rates. With no upfront fee, users gain access to spending insights and potential savings, making it a valuable asset for reducing monthly expenditures.

Evaluating Rocket Money Services

Evaluation of Rocket Money’s services reveals a robust platform dedicated to simplifying personal finance. From budgeting to bill negotiation, Rocket Money stands as a comprehensive tool for financial management.

1. Investment Tracking with Rocket Money

Rocket Money’s features include investment tracking, allowing users to diversify their portfolio and add various accounts to Rocket Money. This integration offers a clear picture of financial growth and investment health.

2. The Role of Credit Scores in Rocket Money

Rocket Money incorporates credit score monitoring, recognizing its importance in personal finance. Users can stay informed about their credit health, which is crucial for making informed financial decisions.

3. Smart Savings Strategies with Rocket Money

Rocket Money encourages smart savings by offering high-yield savings accounts that integrate with checking and savings options. With competitive 3 stars annual percentage yield, users can effortlessly move money into a savings account, maximizing their earning potential.

Rocket Money Premium: Is It Worth the Upgrade?

Rocket Money Premium elevates the user experience by providing enhanced access to investment accounts and other financial services. Users must consider whether the additional features align with their personal needs and financial objectives.

Premium Features Unlocked

The premium version of Rocket Money unlocks advanced subscription management and basic budgeting tools. Additionally, users can access the Rocket Visa Signature Card and concierge service, which further enriches their financial profile.

Determining the Value of Rocket Money Premium for Your Needs

Assessing whether Rocket Money Premium is right for you depends on your desired level of personal finance management. The premium upgrade enhances your experience with advanced features like automated savings, a subscription service for tracking and managing recurring expenses, and a subscription cancellation concierge service to help streamline the process of getting rid of unwanted subscriptions. The additional concierge service is especially useful for individuals looking for personalized assistance in managing their financial commitments.

Safe and Secure? Ensuring Your Financial Data is Protected

Protecting your financial accounts is a top priority for Rocket Money. As a user, the security of your personal and financial information is paramount. Rocket Money employs robust encryption and security measures to guard against unauthorized access and ensure that your data remains safe. This commitment to security enables users to confidently manage their finances using the platform.

Is Rocket Money Safe?

Yes, Rocket Money is designed to be a safe platform for managing your financial accounts. It uses industry-standard security protocols to ensure that your connection to financial institutions is secure and your sensitive data is protected from threats. This focus on safety allows users to engage with the service with peace of mind.

Measures Rocket Money Takes to Protect User Data

Rocket Money takes your privacy seriously and implements several measures to protect user data. These include using encryption for data in transit and at rest, regular security audits, and compliance with privacy laws. Your financial accounts are safeguarded with these stringent security practices.

Rocket Money’s Costs and Fees Unveiled

Understanding Rocket Money’s costs and fees is straightforward. Users can choose between a free version, which offers basic budgeting and expense tracking, and a premium subscription service that provides a more comprehensive suite of money management tools. The fee for the premium service is disclosed upfront, ensuring transparency.

Understanding the Free vs Premium Cost Structure

The rocket money app presents users with a clear choice between a free version, which covers basic budgeting needs, and a premium version, which offers an extended subscription service with advanced features. The cost structure is designed to cater to both casual users and those who want in-depth financial management tools.

Exploring the “Pay What You Want” Model

Rocket Money offers a unique “Pay What You Want” model for certain services, empowering users to decide how much they value the service provided. This approach reflects a customer-centric philosophy, allowing for greater flexibility and personalization of the user experience.

In-Depth Review: Examining Rocket Money’s Offerings

An in-depth review of Rocket Money’s offerings reveals a comprehensive suite of tools designed to empower users with financial control. The app’s capabilities extend beyond basic budgeting to include features that cater to a variety of financial needs, making it a potentially pivotal tool for those seeking a holistic approach to money management.

• A Look at Rocket Money’s Budgeting-tool Options

Rocket Money provides users with a robust set of budgeting tools, including the ability to track upcoming bills and monitor spending across different categories. These tools are engineered to help users create a budget that aligns with their financial goals, fostering a proactive approach to managing their personal finances.

• Analyzing the Technology Behind Rocket Money

The technology powering Rocket Money is a blend of financial data aggregation, user-friendly interfaces, and machine learning algorithms. These components work in harmony to provide personalized financial insights and automate key aspects of financial management, such as categorizing transactions and identifying savings opportunities.

• The Company’s Reputation and Reliability

Rocket Money’s reputation and reliability are built on a foundation of user trust and the proven efficacy of its services. Customer service plays a significant role in this perception, as timely and effective support can bolster confidence in the app’s ability to safeguard and enhance users’ financial health.

• How Does Rocket Money Generate Revenue?

Rocket Money generates revenue through its premium subscription model, offering advanced features for a fee. Additionally, the company benefits from commission-based earnings when users save money through its bill negotiation service and from referral fees when users sign up for recommended financial products.

• Cancelling Your Rocket Money Subscription: A Step-by-Step Guide

If you’re ready to part ways with Rocket Money, cancelling your subscription is straightforward. Begin by logging into your account and navigating to the settings. Look for the ‘Subscription’ section and select the option to cancel. Follow the prompts, including stating your reason for cancellation. Ensure you receive a confirmation email to avoid future charges. This process helps those managing card debt or student loans maintain control over their financial tools.

FAQs

For those wondering, yes, Rocket Money is a legitimate budgeting app that has helped countless users manage their personal finances more effectively. It is recognized for its comprehensive budgeting tools and user-friendly design.

1. How to add payment methods like the apple card to rocket money?

2. Who will benefit most from rocket money?

3. When to consider alternative financial management tools?

Wrapping Up: How Does Rocket Money Work

As we conclude, it’s clear that Rocket Money offers a robust platform for managing personal finances. With its user-friendly interface and diverse features, it stands out as a potentially invaluable tool for those looking to streamline their financial management and achieve their monetary goals.

Our review highlights Rocket Money’s comprehensive features, from tracking your subscriptions to facilitating smart savings accounts. The premium subscription offers additional tools, and the app’s integration with services like Cash App makes it a versatile financial companion. All in a package designed to be accessible within 10 min.