Table of Contents

What is rocket money premium? Rocket Money Premium is an enhanced subscription service that offers a suite of financial tools designed to help users manage their finances more effectively. From tracking expenses to optimizing subscriptions, Rocket Money’s premium features aim to provide a comprehensive financial management experience. With the addition of concierge services, users gain access to personalized support for tasks such as subscription cancellation and bill negotiation.

Delving into Rocket Money’s premium offerings, customers can expect a more hands-on approach to managing their money. The subscription service provides an array of exclusive features, including the subscription cancellation concierge, which assists users in identifying and terminating unwanted subscriptions, and a concierge service that offers tailored financial advice and support.

Understanding Rocket Money Premium

Rocket Money’s premium membership encompasses a concierge service that elevates the personal finance experience through expert assistance with financial tasks.

An Introduction to Rocket Money’s Services

Rocket Money extends a variety of services designed to manage financial accounts efficiently, providing users with a clear picture of their fiscal health.

Rocket Money Premium Explained

Rocket Money’s premium tier includes a concierge service, offering personalized financial management assistance.

Exclusive Features of Rocket Money Premium

Rocket Money Premium offers exclusive features such as advanced subscription management, basic budgeting tools, and the concierge service. Members can also access the Rocket Visa Signature Card, adding to the financial benefits on offer.

Key Features of Rocket Money

Rocket Money’s key features are designed to optimize the user’s financial profile, with the support of a virtual financial advisor.

1. Subscription Management and Optimization

Rocket Money’s customer service excels in managing recurring payments and helping users eliminate unwanted subscriptions, streamlining their monthly expenses.

2. Smart Savings with Bill Negotiation

Rocket Money charges a 10% upfront fee for its bill negotiation service, which utilizes budgeting tools to automatically identify savings opportunities among assets and liabilities.

3. Budgeting Tools and Insights

The personal finance app offers unlimited budgets and custom budgets, positioning itself as a strong contender among mint alternatives.

Crafting a Personal Budget

Using the Rocket Money app, individuals can create a personalized budget that aligns with their financial goals and habits.

Tracking Expenses and Income

The Rocket Money app simplifies the process of monitoring income and expenses, ensuring users stay on top of their financial game.

How Rocket Money Premium Enhances Your Finances

Rocket Money’s premium service provides tools and insights that can significantly improve a user’s financial situation.

Access to Advanced Financial Tools

Rocket Money Premium offers users advanced financial tools, including the ability to create unlimited budgets tailored to various spending categories. This personal finance app stands out among mint alternatives by allowing users to design custom budgets that align with their unique financial goals and lifestyle demands.

Net Worth Tracker and Credit Score Monitoring

With Rocket Money Premium, subscribers can utilize a net worth tracker that consolidates assets and liabilities for a clear financial picture. This feature is particularly useful for managing student loans and card debt, ensuring users are aware of their overall financial health. Credit score monitoring is another critical tool, providing regular updates and alerts to help maintain or improve credit standing.

The Premium Advantage: Beyond the Basics

The premium version of Rocket Money’s service goes beyond basic financial management by offering more detailed reports, personalized insights, and actionable recommendations to enhance users’ financial strategies.

Additional Support and Technology Enhancements

Rocket Money Premium users benefit from additional support and technology enhancements that streamline the process of managing finances. These upgrades include faster synchronization with financial accounts, more comprehensive data analysis, and priority customer support for any technical or financial queries.

Safety and Security Measures

Ensuring the safety and security of users’ financial information is a top priority for Rocket Money. The platform employs robust measures, such as multi-factor authentication and routine security audits, to protect against unauthorized access and potential threats.

Is Rocket Money Safe to Use?

Rocket Money’s commitment to security is evident through its use of 256-bit encryption, the same standard used by financial institutions, to safeguard users’ sensitive data. This advanced encryption technology is instrumental in maintaining a secure environment for managing personal finances.

Security Protocols and User Privacy

The platform adheres to strict security protocols, including regular updates to its systems and continuous monitoring for vulnerabilities. User privacy is also a cornerstone of Rocket Money’s security framework, with policies in place to ensure personal information is kept confidential and used solely for enhancing the user experience.

Protecting Your Financial Data

Rocket Money’s commitment to security is paramount when it comes to protecting your financial data. They employ strong encryption and security protocols to ensure that your sensitive information is safeguarded against unauthorized access. Furthermore, Rocket Money partners only with reputable service providers who meet their stringent standards for data security, giving users peace of mind that their financial details are in safe hands.

The Cost of Managing Money with Rocket Money Premium

Managing your finances with a premium Rocket Money subscription comes with a $95 annual fee. This premium version of Rocket Money provides enhanced features such as balance alerts and the ability to sync accounts from multiple financial institutions. While there is a cost associated with these advanced services, for many, the convenience and potential savings justify the investment.

Understanding the Pricing Structure

The pricing structure of Rocket Money is designed to cater to both basic and advanced personal finance management needs.

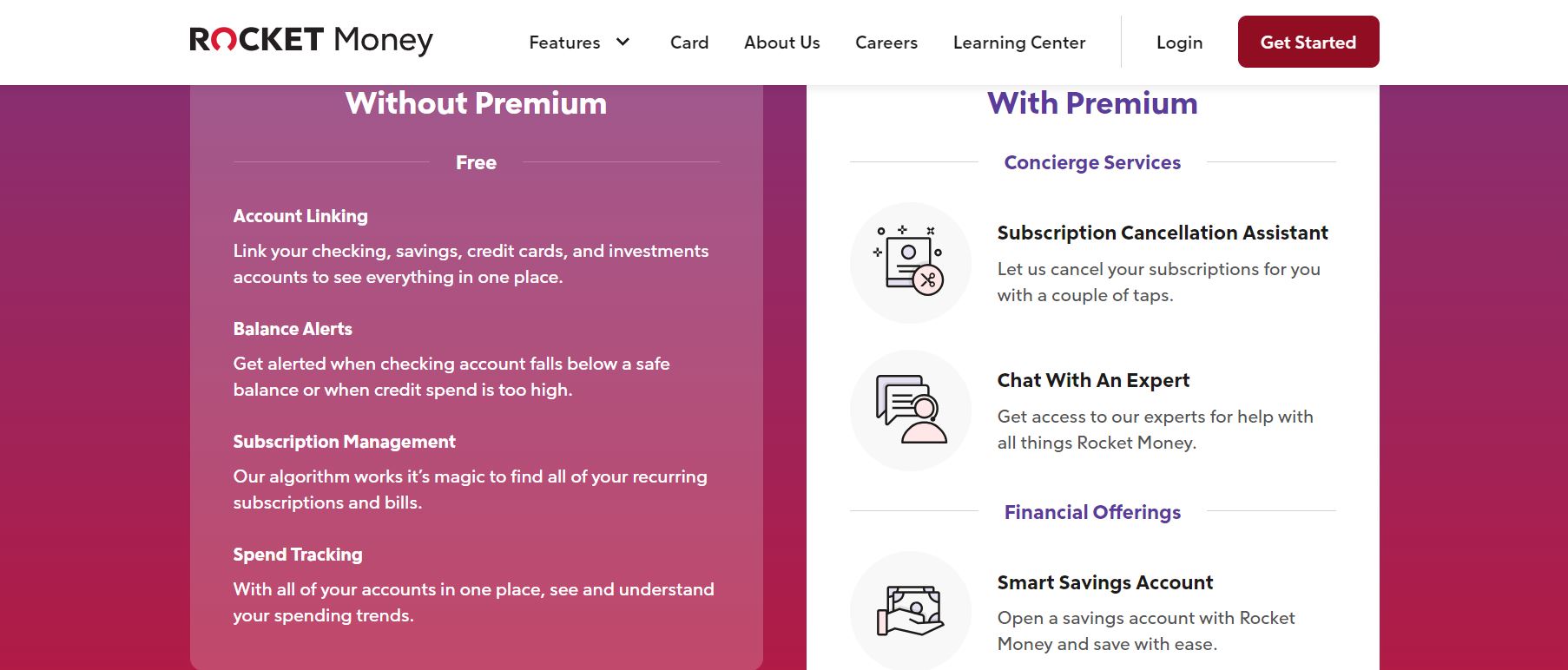

Free vs Premium: The Cost-Benefit Analysis

When evaluating Rocket Money’s free versus premium offerings, it’s essential to weigh the benefits against the costs. The free version offers basic tools for tracking expenses and managing subscriptions. However, the premium Rocket Money subscription unlocks a suite of advanced features that can aid in optimizing your financial health. This includes the ability to negotiate bills, monitor credit scores, and receive personalized budgeting advice, which, for some users, may equate to significant financial savings over time.

Analyzing the Value for Money

When considering Rocket Money Premium, value for money is paramount. Users must weigh the cost against the tangible benefits they receive, such as enhanced oversight of financial accounts and potential savings from bill negotiations. By streamlining monthly expenses and providing actionable financial insights, the service aims to justify its premium status. However, users should evaluate their individual financial situations to determine if the advanced features align well with their personal finance goals.

Rocket Money’s Customer Service and Support

Rocket Money’s commitment to customer service is evident in its support system, designed to assist users in navigating financial complexities. The platform provides resources and help guides, ensuring that users can find answers to common questions and troubleshoot issues independently. Additionally, the premium tier offers expanded customer support options, further enhancing the user experience for those who opt for the service.

Accessibility of Customer Care

Rocket Money’s customer care is designed to provide a seamless experience, with users often rating the service highly, typically at 5 stars, for its responsiveness and helpfulness.

Live Support for Premium Users

Premium users of Rocket Money enjoy the privilege of live support, a feature that underscores the company’s dedication to customer satisfaction. This tier of service ensures that subscribers have direct access to customer care representatives who can provide personalized assistance, potentially leading to faster resolution of issues and more tailored financial advice.

Rocket Money Versus Competitors

In the competitive landscape of personal finance apps, Rocket Money holds its own with distinctive features and services.

Rocket Money vs. Mint: A Comparison

Rocket Money and Mint both offer users insights into their checking and savings, but they differ in their approach and additional features. While Rocket Money focuses on bill negotiation and subscription cancellation, Mint provides broader budgeting tools and free credit score monitoring. Mint’s high-yield savings account feature also contrasts with Rocket Money’s bill negotiation service, earning Mint 3 stars for its savings potential.

Alternatives to Rocket Money Premium

There are several alternatives to Rocket Money Premium, each with unique features catering to different financial management needs.

1. Rocket Money vs YNAB

Rocket Money and YNAB (You Need A Budget) serve users with different priorities. YNAB’s robust budgeting methodology emphasizes zero-based budgeting and offers more granular control over spending habits. In contrast, Rocket Money provides a broader range of services, including subscription management and the option to negotiate monthly bills, appealing to users looking for an all-in-one financial solution.

2. Rocket Money vs Monarch Money

Monarch Money is another strong competitor, offering detailed financial planning tools and collaborative features for couples and families. Rocket Money differs by focusing on individual financial oversight, subscription management, and bill negotiation, positioning itself as a tool for those who want proactive management of their recurring expenses.

3. Rocket Money vs Empower

Empower stands out with its personalized financial coaching and straightforward budgeting tools. While Empower encourages users to take a more hands-on approach to managing their finances, Rocket Money’s premium offering aims to automate and simplify the process, particularly when it comes to identifying and canceling unnecessary subscriptions.

Real User Experiences with Rocket Money Premium

Real users of Rocket Money Premium often share their experiences, noting how the service has impacted their financial lives. These anecdotes provide valuable insights into the effectiveness of the app’s features and the tangible benefits it can offer to individuals looking to take control of their finances.

Testimonials from users highlight the convenience of integrating Rocket Money with popular financial platforms such as American Express and Cash App. They often praise the app for providing a clear view of their finances and helping them make informed decisions, which can lead to significant savings over time.

Making the Most Out of Rocket Money

To truly benefit from Rocket Money, users should actively engage with the app’s features, customize settings to their personal financial goals, and regularly review and adjust their budgets and savings plans to stay on track with their financial objectives.

Consistently updating your account information ensures that Rocket Money provides accurate and helpful financial insights. Adding your Apple Card to Rocket Money is straightforward. Users can simply log in to their Rocket Money account on an iOS or Android device, navigate to the ‘Accounts’ section, and follow the prompts to securely link their Apple Card. This integration allows for seamless tracking of transactions and balances across devices.

The Bottom Line on Rocket Money Premium

Rocket Money Premium offers tools that can transform the way users handle their monthly bills and invest with online brokers. With a focus on saving and optimizing finances, the service may justify the cost for those seeking to manage more than 10 accounts or looking to save beyond 12 months of expenses. It’s a financial companion for the serious saver and investor.

Is Rocket Money Premium Worth the Investment?

Assessing the benefits against the cost is essential when considering Rocket Money Premium.

When to Consider Upgrading to Premium

Upgrading to Rocket Money Premium should be considered when users find themselves needing more than the basics to manage their finances. If the constraints of the free version are impeding their financial growth or if they are not achieving their savings and budgeting goals, it may be time to unlock the premium features. Advanced financial tools and personalized support can make a substantial difference in achieving financial milestones.

How Rocket Money Premium Stacks Up in the Market

When comparing Rocket Money Premium to other financial tools, it holds a distinctive position. Its rich feature set, which includes personalized budgeting insights and bill negotiation services, sets it apart from many competitors. Rocket Money’s focus on subscription management also offers a unique angle for users looking to trim recurring costs. While some services may offer similar individual features, Rocket Money Premium’s comprehensive approach to personal finance management often makes it a more holistic solution for users.

How to Decide If Rocket Money Premium Is Right for You

Deciding on Rocket Money Premium comes down to your financial needs and habits. Assess the complexity of your personal finances, including recurring subscriptions and the need for in-depth budgeting analysis. If you find yourself regularly seeking financial advice or struggling to keep track of upcoming bills, Rocket Money Premium’s advanced features might be the necessary step to gain more financial control.

FAQs

Explore common inquiries about Rocket Money to help you understand how it can fit into your financial life and assist with managing your money more effectively.

1. How does Rocket Money lower bills?

2. How to cancel Rocket Money if needed?

3. How does Rocket Money make money?

4. Who owns rocket money?

5. How much is Rocket Money without premium?

Closing Thoughts on What Is Rocket Money Premium?

Rocket Money Premium presents a robust platform for individuals aiming to take control of their financial life. With its suite of advanced features, from smart savings accounts to net worth tracking, it empowers users to reach their financial goals. Although it comes at a cost, the potential savings and financial clarity it provides could well justify the investment for those seeking a comprehensive money management solution.

The value of Rocket Money Premium hinges on individual financial situations and goals. For users with complex personal finances, multiple subscriptions to manage, and a desire to optimize spending, the premium features could provide significant benefits. However, for those with simpler financial needs, the free version of Rocket Money offers a solid foundation without the added cost of a premium subscription.