Table of Contents

When navigating the complex landscape of personal finance, tools like YNAB (You Need A Budget) and Empower stand out for their specialized approaches. YNAB takes a disciplined stance with zero-based budgeting, ensuring that every dollar is accounted for and directed toward specific financial goals. Empower, on the other hand, offers comprehensive financial management, integrating the budgeting process with investment tracking and retirement planning. Both platforms promise to revolutionize how users engage with their finances, but they cater to distinct needs and preferences.

YNAB focuses on budgeting with an immersive interface, encouraging users to take granular control of their finances. Empower delivers a broader spectrum of services, with extensive educational resources complementing its financial tools. The selection between these two powerhouses depends on whether the user seeks meticulous budgeting assistance or a more expansive suite of financial planning capabilities.

Unveiling the Contenders: YNAB and Empower

YNAB and Empower emerge as key competitors in the ring of financial planning tools. YNAB champions a zero-based budgeting approach, while Empower tailors its offerings to serve as a comprehensive financial assistant. Each platform brings unique strengths to the table, setting the stage for a detailed comparison.

YNAB: Budgeting with Precision

YNAB stands out with its strict adherence to zero-based budgeting, where users assign every dollar to specific categories, including an emergency fund, ensuring that no dollar is left untracked. With a focus on precise budget management, YNAB vs its competitors emphasizes accountability through its detailed categorization of expenses across various card accounts. The platform’s wealth of educational content further strengthens users’ budgeting skills.

Efficient and Goal-Focused Approach

The efficiency of YNAB’s money management software lies in its ability to transform the budgeting process into a goal-achieving journey. It encourages proactive financial planning, helping users set and reach milestones with clear, actionable strategies. This systemized approach makes YNAB an appealing choice for those intent on financial discipline.

Customization and Educational Support

YNAB’s platform extends beyond mere tracking, offering extensive customization to fit individual needs. The software’s considerable educational resources empower users to navigate their finances confidently, providing them with the knowledge to make informed decisions and tailor the budgeting process to their circumstances.

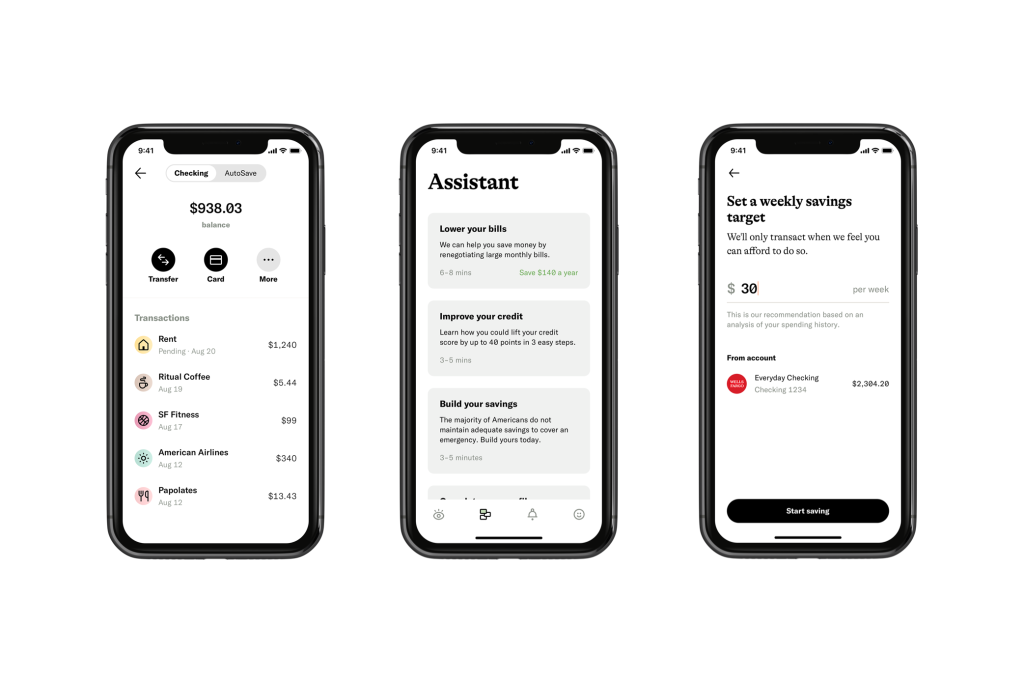

Empower: Your Financial Assistant

Empower positions itself as a personal financial assistant, harmonizing budgeting, investment accounts, and retirement planning in one intuitive package. This all-encompassing approach caters to users seeking a holistic view of their financial health, with tools designed to streamline their fiscal journey.

Retirement and Investment Planning

Empower analyzes users’ investment accounts with a sharp eye, offering a retirement planning tool and a fee analyzer to optimize portfolio performance. The platform’s capabilities extend to crafting a strategic path for retirement, ensuring that users’ investment decisions align with their long-term aspirations.

Centralized Financial Dashboard

Empower’s strength lies in its centralized financial dashboard, which facilitates reaching your financial goals by providing a comprehensive overview of one’s finances, including emergency fund status and debt paydown progress. This bird’s-eye view helps users stay on track and make informed decisions toward financial freedom.

Core Features Face-Off

YNAB and Empower offer distinct features tailored to different aspects of the financial spectrum. A detailed examination of their core functionalities is crucial to understanding how each platform can best serve its users’ needs.

1. Budgeting and Finance Management

The spine of both YNAB and Empower is their powerful money management software, each with a unique take on budgeting and finance management. YNAB delves deep into budgeting mechanics, while Empower provides a more generalized overview with added investment features.

YNAB’s “Give Every Dollar A Job” Philosophy

YNAB’s renowned “Give Every Dollar A Job” philosophy ensures that each cent is allocated purposefully within the user’s budget, fostering a sense of control and intentionality with one’s finances. This well-organized approach is the cornerstone of YNAB’s budgeting ethos.

Empower’s Comprehensive Financial Software Features

Empower integrates various financial dimensions into its platform, including oversight of investment accounts, which allows users to manage their wealth alongside their daily spending. Its comprehensive features cater to those who prefer a broad financial toolkit.

2. Investment and Wealth Growth Tools

Both platforms offer tools to aid in wealth growth, with each bringing unique features to the table. Investment and wealth management are integral components of Empower, while YNAB provides a more focused approach to budgeting and savings.

YNAB’s Approach to Investment Tracking

While YNAB focuses on budgeting, it provides users with a one-stop solution for managing finances, including rudimentary investment tracking capabilities. This allows for a consolidated view of one’s financial landscape, though it is not the platform’s primary focus.

Empower’s Investment Checkup and Retirement Planner

Empower’s investment checkup tool and retirement planner are designed to scrutinize investment accounts meticulously. These features serve users who prioritize long-term financial planning, offering insights and recommendations to enhance their investment strategy.

Assessing the User Experience

The user experience is paramount when choosing a comprehensive financial management tool. YNAB and Empower strive to provide an intuitive interface, but their approaches differ significantly, impacting how users interact with each platform.

3. Initial Setup and Ease of Use

The initial setup is a critical step that can influence their long-term commitment to a financial tool for new users. Both platforms aim to streamline this process to reduce any potential friction.

Getting Started with YNAB

YNAB simplifies the daunting task of budgeting by guiding users through the setup process. By focusing on income and expenses, the budgeting software educates users on allocating their funds effectively from day one.

Navigating Empower’s Platform

Empower, formerly known as Personal Capital, offers a personal finance dashboard designed for easy navigation, allowing users to quickly understand their financial picture and make informed decisions.

4. Synchronization Capabilities

The ability to synchronize financial data across devices is a feature that enhances the flexibility and convenience for users managing their finances on the go.

YNAB’s Device Syncing and Sharing Features

YNAB promotes collaboration with shared access to budgets, making it easier for users to stay on the same page with their spending categories and financial goals.

Empower’s Wealth Management Synchronization

As an investment platform, Empower excels in synchronizing users’ investment accounts, providing a comprehensive view of assets, and facilitating strategic wealth management.

Evaluating Support and Education

Support and education are critical components of any financial service, ensuring that users have the resources they need to successfully navigate the platform and achieve their financial objectives.

5. Customer Service Showdown

In customer service, both YNAB and Empower offer responsive and helpful assistance to users, recognizing the importance of support in financial management.

YNAB’s Support Network

YNAB’s support network is built around the philosophy of empowering users, with an emphasis on providing prompt and constructive help for any budgeting challenges encountered.

Empower’s Customer Assistance

Empower, fka Personal Capital maintains a dedicated customer support team, ready to assist users in navigating their personal finance dashboard and addressing any concerns.

6. Learning Resources and Community

Both platforms offer a variety of learning resources and foster communities that encourage users to share experiences and knowledge, further enriching the user experience.

YNAB Classes and Financial Guidance

YNAB’s educational offerings include classes and guidance focused on helping users set savings goals and create effective debt paydown strategies.

Empower’s Financial Tool Education

Empower provides users with information on how to maximize the benefits of their annual subscription, ensuring they can leverage all features for optimal financial management.

Delving into Pricing Structures

Understanding the pricing structures of financial tools is essential, as the cost can significantly affect the long-term value and utility of the service for users.

7. YNAB: Investment in Budgeting Excellence

YNAB stands out in the “YNAB vs Empower” debate for its meticulous approach to budgeting, allowing users to meticulously assign every dollar a role. This software excels at handling card accounts, ensuring that every transaction is tracked and categorized. Moreover, YNAB offers a wealth of educational resources, providing users with the knowledge to manage their finances effectively. Its mobile apps further enhance the experience, making it possible to budget on the go with precision.

8. Empower: Free vs Premium Options

Empower offers a tiered approach to financial management, with free and premium options catering to diverse needs. Users can engage in online budgeting and investment tracking without cost, while the premium version enriches the budgeting process with more comprehensive financial management capabilities. Empower positions itself as one of the Mint alternatives, providing extensive educational content to support users in mastering personal finance.

Personalization and Adaptability

In the realm of personal finance, adaptability, and a personalized approach are key. Both YNAB and Empower address these aspects, tailoring their services to fit the diverse financial situations and goals of their users. This adaptability ensures that individuals can find a fitting solution, whether they need a detailed budgeting tool or a comprehensive financial planner to manage a growing investment portfolio.

9. YNAB’s Individualized Budgeting Experience

YNAB champions a highly individualized budgeting experience, enabling users to craft a budget that mirrors their financial landscape. This personalized journey is rooted in YNAB’s philosophy to give every dollar a specific purpose, fostering a sense of control and clarity over one’s finances. The platform’s customization options empower users to build a budget that aligns seamlessly with their unique financial objectives.

10. Empower’s Adaptability in Financial Planning

Empower demonstrates its adaptability in financial planning by offering users a centralized platform for overseeing various financial aspects. From budgeting to investment oversight, Empower tailors its features to accommodate the evolving financial needs of its users. The platform’s flexibility ensures that individuals can adjust their financial strategies as their circumstances change, making it a versatile tool in any financial toolkit.

Potential Drawbacks and Limitations

While YNAB and Empower boast robust features for budgeting and financial planning, they are not without limitations. YNAB’s focus on detailed budgeting may come at a higher cost, and its basic version might lack particular investment tools. Empower, while offering a balanced suite of budgeting and wealth management features, could present challenges for users seeking more specialized budgeting functionalities or trying to avoid sales pitches within the platform.

11. YNAB: Cost Consideration and Investment Features

YNAB’s premium pricing structure reflects its commitment to providing a detailed budgeting experience, but it may be a consideration for users weighing costs against benefits. Although YNAB helps track an investment portfolio, it does not offer extensive tools for investment analysis, which may be a limitation for users seeking in-depth investment features within their budgeting platform.

Premium Pricing

YNAB’s financial tools come at a premium price, requiring users to invest in a subscription to access its full suite of budgeting features. This cost can be a significant factor for individuals determining the value of the service, as it necessitates a financial commitment to maintain the budgeting excellence YNAB is known for.

Absence of Extensive Investment Tools

While YNAB excels at budgeting and finance management, it lacks extensive investment tools that some users may seek. The platform’s strength lies in helping users allocate their income and control spending, rather than offering comprehensive investment analysis and advice. This absence might steer users with a strong focus on investing towards other platforms that specialize in investment management.

12. Empower: Balancing Budgeting with Wealth Management

Empower strives to balance budgeting with wealth management, offering users an integrated investment platform for overall financial oversight. While categorizing transactions and setting monthly budgets, users can also utilize cash flow tools and basic budgeting features. This holistic approach aims to streamline financial processes, though some users may find the budgeting functionalities less detailed compared to dedicated budgeting platforms.

Limited Budgeting Functionality

Empower’s strength in providing a comprehensive wealth management service may come at the expense of detailed budgeting functionality. Users seeking intricate budgeting capabilities might find Empower’s offerings too normal, as the platform prioritizes a broader financial management approach over granular budgeting features.

Encountering Sales Pitches

Empower users may occasionally encounter sales pitches for additional services or products, particularly related to investable assets. While these offers can provide value, they may also detract from the user experience for those solely interested in the platform’s budgeting and financial planning tools.

YNAB vs Empower: Which Financial Tool Triumphs?

In the YNAB vs Empower showdown, the triumph of one over the other hinges on user priorities. YNAB’s proactive approach to budgeting and spending shines for those seeking a dedicated budgeting tool with extensive educational content. Conversely, Empower wins favor with its empower dashboard, offering a broad spectrum of investment management and financial planning features. While direct import and financial accounts management are robust in both, the downside of YNAB may be its annual fee, and Empower may fall short in budgeting depth. Ultimately, it’s a question of whether one values the YNAB app’s precision or Empower’s versatility in setting goals and tracking spending.

Deciding Factors for Optimal Money Management

When deciding between YNAB and Empower, Monarch Money emerges as a deciding factor for optimal money management. Users must weigh the specific features and benefits against their personal financial needs to determine which tool best supports their financial journey.

Personal Capital and Financial Goals

Personal finance software like YNAB and Empower offers various budgeting tools and wealth management services designed to align with one’s financial life. YNAB for budgeting is well-suited for those with specific savings goals and spending habits, offering a 34-day free trial to test its effectiveness. Empower, as a financial app, provides a wealth management service for a broader asset allocation strategy. Both offer customer service support, aiming to assist users in reaching their financial goals and managing spending patterns with effective money management tools.

Desired Budgeting Depth and Investment Oversight

When choosing between YNAB and Empower, individuals must assess their needs for detailed budgeting versus comprehensive investment oversight. YNAB shines with its meticulous budgeting system, ideal for those who wish to allocate every dollar and closely monitor spending habits. On the other hand, Empower offers a broader wealth management perspective, appealing to users who prioritize investment tracking and retirement planning alongside budgeting. The decision hinges on whether one’s financial focus leans more towards immediate budget control or long-term investment growth and oversight.

Conclusion: Empowering Your Financial Future with the Right Tool

Choosing the right financial tool is a pivotal step in securing one’s financial health. YNAB offers a user-friendly interface that encourages users to allocate every dollar purposefully, thus promoting a proactive approach to budgeting. With features that allow for a high degree of customization and accounts to track every aspect of personal financial activity, it stands as a robust budgeting solution. On the other hand, Empower regularly updates its platform to include bank-level security and a suite of investment tools, making it a strong contender for those looking to delve into alternative investments and broader wealth management.

Ultimately, the decision between YNAB and Empower hinges on individual financial goals and the level of granularity desired in budgeting and investment oversight. Whether one prioritizes meticulous budgeting or seeks a comprehensive tool for managing finances and investments, both platforms enable users to make informed decisions that can lead to improved financial outcomes. By aligning with a tool that complements one’s financial journey, users are well-positioned to take control and empower their financial future.

Related posts:

No related posts.