Table of Contents

When managing personal finances, the choice between YNAB vs. Quicken hinges on your financial goals and the complexity of your financial situation. YNAB focuses on budgeting tools that break the paycheck-to-paycheck cycle and help users track expenses meticulously to achieve long-term financial stability. Quicken, on the other hand, offers a more comprehensive financial management approach, including features for tax preparation, investment strategy, and generating tax-related reports. This makes it an advanced financial tool suitable for those with complex financial planning needs, including tracking retirement accounts and investment accounts.

Both financial management tools offer real-time updates to help users track their progress, but they cater to differing financial needs and preferences. YNAB is ideal for those starting their financial journey and needing specialized budgeting software to align with their budgeting philosophy. Quicken, conversely, is an excellent choice for users looking for a more complicated tool that can manage various financial aspects, from personal finances and tax-related reports to retirement and investment accounts. Choosing between them requires an understanding of your financial accounts, the desire for a 30-day money-back guarantee, and whether you need to download the software or prefer a cloud-based service.

Exploring Financial Management with Quicken and YNAB

Delving into the YNAB vs Quicken debate, it is crucial to evaluate how each tool supports the management of financial accounts and assists users in making informed financial decisions. YNAB excels in helping users budget with every dollar and encourages a proactive stance on allocating funds for future expenses. Quicken, however, provides a broader view of personal finance, allowing for detailed tracking of expenses and investments, and even generating tax-related reports that cater to various financial aspects. Both budgeting software options offer unique approaches to managing money, and the right choice largely depends on individual financial needs and preferences.

YNAB’s Budgeting Philosophy

YNAB’s budgeting system centers around the philosophy that every dollar should have a job. This proactive approach encourages users to assign their income to specific categories, ensuring they live within their means and save for future expenses. By focusing on giving each dollar a purpose, YNAB helps users create a more intentional relationship with their money, promoting financial mindfulness and discouraging impulsive spending.

Quicken’s Comprehensive Financial Management Approach

Quicken offers various versions of the software, each with an annual subscription tailored to different levels of financial management. The desktop version, Quicken Deluxe provides a comprehensive suite of tools designed for a holistic view of your finances. From creating budgets to tracking investments, Quicken Deluxe facilitates a complete financial management approach that covers all bases, including creating tax-related reports and long-term planning.

Budgeting and Expense Tracking Capabilities

Both YNAB and Quicken offer robust budgeting and expense-tracking capabilities, yet they approach these tasks with different philosophies. YNAB is keen on assigning every dollar as soon as income arrives, ensuring that each dollar is working towards your financial goals. Quicken, conversely, offers a more traditional ledger-like system that allows for a comprehensive look at your financial picture, including past spending habits and future projections.

YNAB’s Envelope-Style Budgeting Method

YNAB employs an envelope-style budgeting method that helps users proactively allocate funds for immediate and future expenses. This method assists in managing monthly bills and adapting to unexpected financial changes, fostering a sense of control and financial resilience. The digital “envelopes” allow for a visual and interactive way to understand where money is going and where to cut back if necessary.

Quicken for Detailed Expense Tracking and Analysis

Quicken shines in its ability to provide detailed expense tracking and analysis. Users can categorize transactions with ease, allowing for a granular view of where money is being spent. This level of detail is particularly useful when tracking specific types of expenditures, such as medical expenses, and can be invaluable for those looking to optimize their spending or find areas to save more money.

Investment and Savings Management

Both YNAB and Quicken facilitate setting and achieving savings goals, but they do so with distinct methodologies. YNAB’s approach centers around budgeting every dollar with a purpose, emphasizing the importance of saving for future needs. Quicken, with its more extensive financial tracking capabilities, offers tools that are particularly useful for those with a more complex portfolio, including investment and retirement accounts.

Setting and Achieving Goals with YNAB

YNAB’s platform is designed to help users establish clear financial goals and work systematically toward achieving them. The software encourages users to set specific, measurable objectives and use their budget to fund those goals over time. This can be especially effective for users with straightforward savings targets, such as building an emergency fund or saving for a vacation.

YNAB’s strength lies in its simplicity and focus on immediate and long-term savings goals. By connecting budgeting directly to goal achievement, YNAB makes it easier for users to see the impact of their daily financial decisions and stay motivated on their path to financial wellness.

Quicken’s Investment Tracking Features

Quicken stands out with its advanced investment tracking features, which complement its budgeting software. Users can monitor their portfolios, assess performance, and make informed decisions based on real-time data. Tax-related reports generated by Quicken also simplify tax preparation, making it easier to handle the complexities of investment taxes.

For individuals who actively manage their investments, Quicken provides a comprehensive solution that aligns with YNAB vs Quicken’s differing philosophies. Quicken’s tools are tailored for users who require a more robust system to keep track of their diverse financial assets and tax implications.

User Experience and Interface Comparison

The user experience and interface play a significant role in the YNAB vs Quicken debate. Both platforms prioritize usability but offer distinct navigation styles that cater to different user preferences. YNAB’s interface is clean and focused, designed to streamline the budgeting process while Quicken offers a more traditional, feature-rich environment that might appeal to users accustomed to desktop financial software.

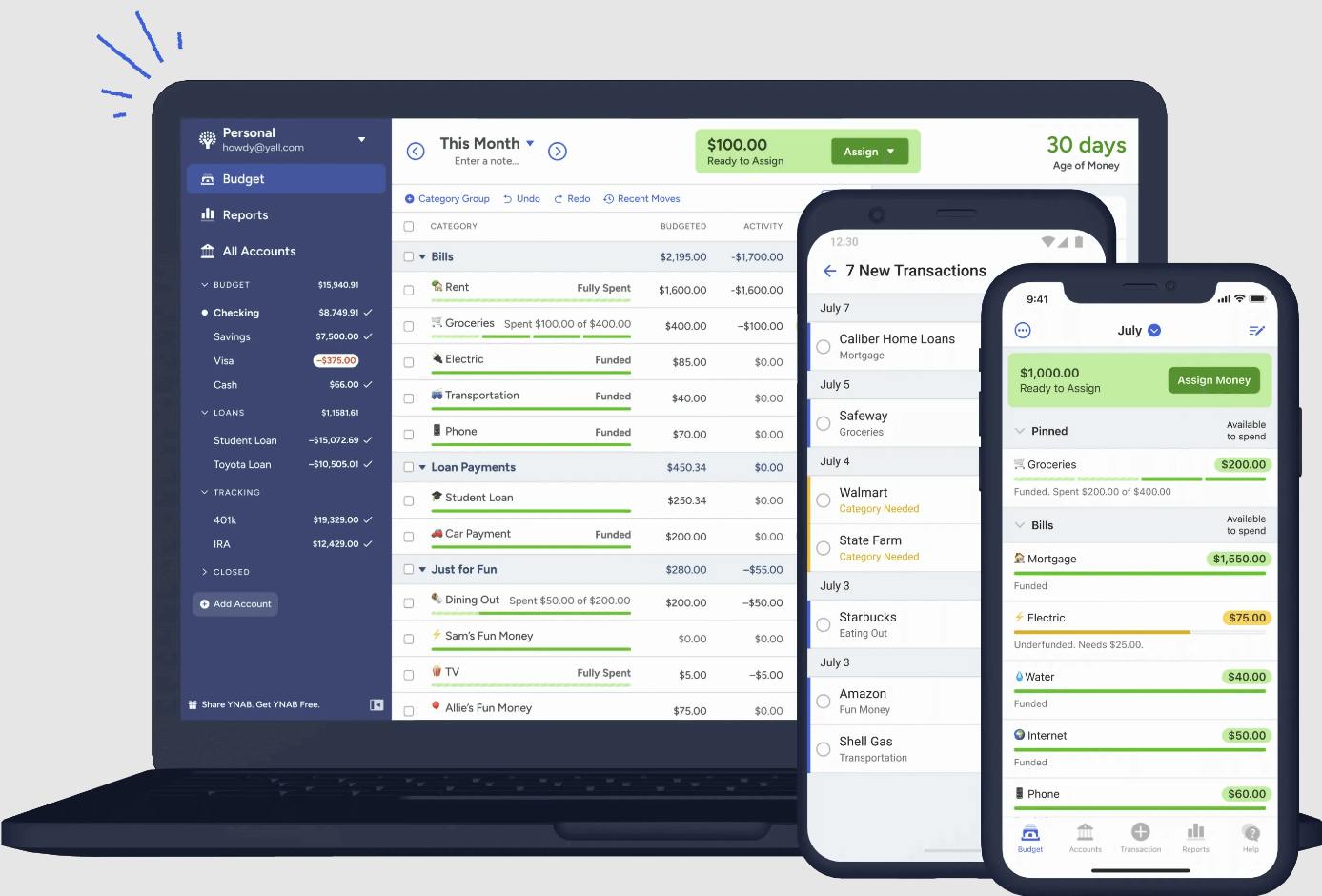

Navigation and Usability in YNAB

YNAB’s interface is designed with simplicity and ease of use in mind. The software guides users through the budgeting process, making it accessible for those new to financial management. YNAB’s emphasis on education and support helps users understand the fundamentals of budgeting and encourages them to take an active role in their monetary well-being.

The platform’s intuitive navigation helps users quickly find the tools they need to manage their money effectively. With an interface that reduces complexity, YNAB makes it feasible for users to maintain their budgets consistently and without feeling overwhelmed.

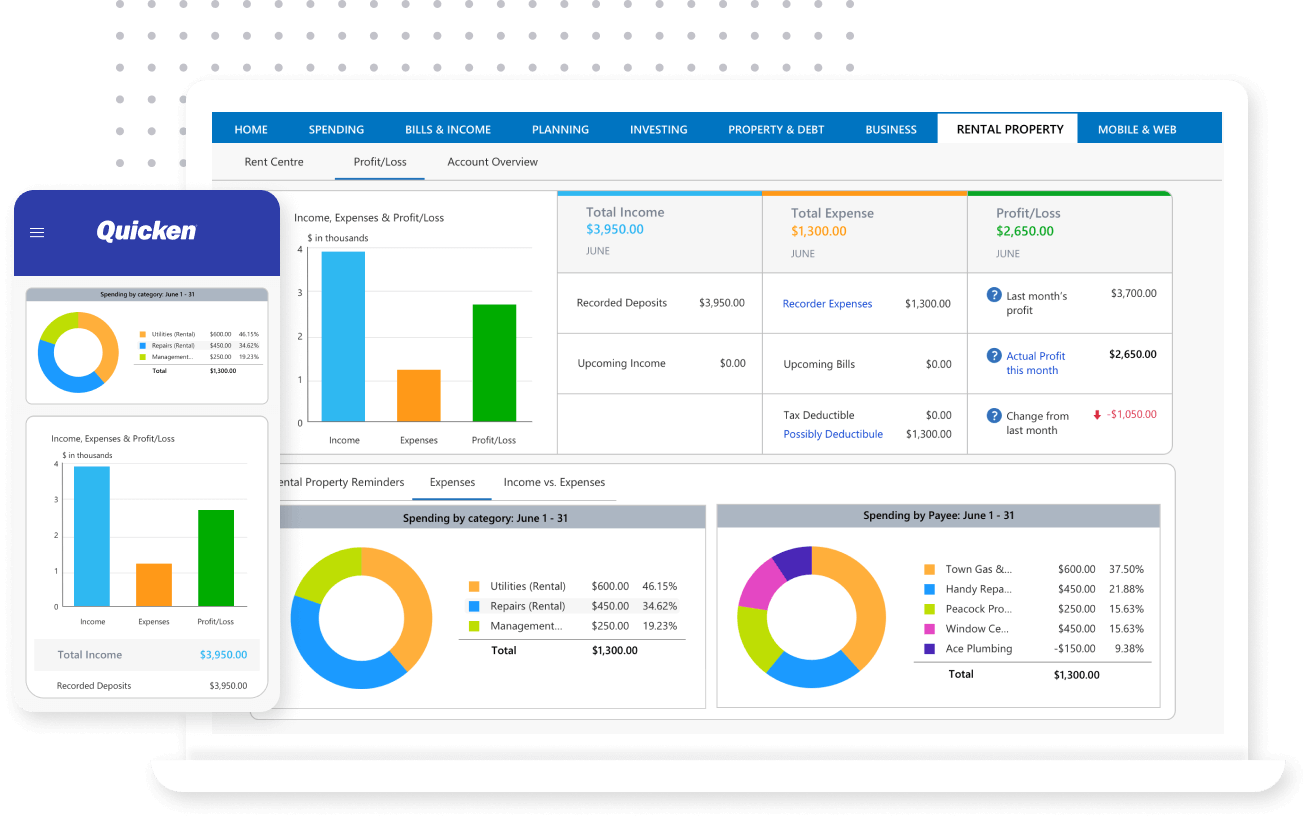

Quicken’s User-Friendly Dashboard

Quicken’s dashboard is designed to provide users with a comprehensive overview of their financial status at a glance. The interface is user-friendly, allowing for easy access to various financial tools and reports. Quicken’s dashboard layout is particularly beneficial for users who manage multiple financial accounts and need a centralized platform to view their overall financial picture.

The dashboard also includes customizable widgets that users can tailor to their personal needs, ensuring that the most relevant and frequently used features are always within reach. This customization fosters a more personalized user experience, which can be a determining factor for users deciding between YNAB vs Quicken.

Subscription Costs and Value for Money

When considering the subscription for budgeting tools, value for money is a vital factor. YNAB and Quicken both require a paid subscription, but they offer different pricing structures and features. Users must weigh the benefits of each service against their budgeting needs and the potential to alleviate financial stress. The decision often comes down to whether the user values YNAB’s focused budgeting approach or Quicken’s comprehensive financial management features.

Analyzing YNAB’s Pricing Strategy

YNAB’s pricing strategy is straightforward, with a single subscription model that grants full access to all budgeting features. The cost reflects YNAB’s commitment to helping users get out of debt, save money, and break the paycheck-to-paycheck cycle. Considering the personalized budgeting system and the educational resources YNAB provides, users must evaluate if the price aligns with the value they expect to receive in terms of financial organization and peace of mind.

Quicken’s Subscription Tiers and Pricing

Quicken offers a tiered subscription model that caters to various financial management needs. The Starter edition is geared towards basic budgeting and expense tracking, while the Deluxe and Premier editions provide more comprehensive features, including investment tracking and tax planning. The Home & Business version is tailored to small business owners, incorporating tools for managing personal and business finances. Pricing varies per tier, reflecting the complexity and breadth of features available, with annual renewal required to maintain service and access to the latest updates.

Support and Customer Service Showdown

When it comes to customer service, both Quicken and YNAB have distinct approaches to assisting their users. Quicken provides direct customer service options, including phone and chat support, which can be crucial for immediate assistance with complex issues. YNAB, on the other hand, emphasizes self-help resources and community-based support, encouraging users to seek answers through their knowledge base or discuss strategies within the YNAB user community.

YNAB’s Knowledge Base and Community Support

YNAB’s customer service is largely anchored in its extensive knowledge base and active community forums. The platform guides users towards self-sufficiency with detailed articles, tutorials, and a dedicated support team responding to queries. The community aspect is also strong, with fellow YNABers frequently offering advice and sharing experiences, creating a supportive environment for mastering YNAB’s budgeting philosophy.

Quicken’s Direct Customer Service Options

Quicken prides itself on providing direct customer service, particularly for the business version users who may require more specialized support. With an array of options including phone support, live chat, and an extensive FAQ section, Quicken ensures that users can get help with their specific issues promptly. This direct approach to customer service is part of what sets Quicken apart, especially for users who manage both personal and business finances within the software.

Comparing Security Measures for Safe Financial Management

The security of financial data is paramount in any financial management tool. Quicken and YNAB employ robust measures to protect user information, ensuring peace of mind when navigating personal finances. Quicken’s long history in the financial software space has led to the development of comprehensive security features, while YNAB’s focus on budgeting requires equally stringent protocols to safeguard data.

YNAB’s Security Protocols

YNAB’s security protocols protect users from accessing their budgeting tool on mobile devices and interfacing with various financial institutions. The Quicken app utilizes bank-level encryption to safeguard data transfers, ensuring that personal financial information remains confidential. While YNAB is primarily desktop-based, these security measures extend to its mobile application, offering a secure budgeting experience across platforms.

Quicken’s Security Features

Quicken’s security features are robust, providing peace of mind for users tracking their investments and managing their finances. The software employs multi-factor authentication, secure data access, and encryption technologies to protect user information. Quicken’s commitment to security is evident in its continuous updates and improvements, aiming to stay ahead of potential threats to users’ financial data.

Target Audience: Who Benefits More from Each Tool?

Identifying the right financial management tool often depends on the user’s specific financial goals and habits. Quicken and YNAB serve different target audiences, with YNAB catering to those focused on zero-based budgeting and Quicken offering a broader range of personal and investment tracking features. Understanding these distinctions can help users choose the tool best aligned with their financial management style.

Ideal Users for YNAB’s Budgeting System

YNAB’s budgeting system is ideal for users who prioritize proactive budget management and live by the philosophy of giving every dollar a job. Those looking to get out of debt, improve their spending habits, and build a buffer for the future will find YNAB’s methodology and features tailored to their needs. It is particularly suited for individuals who want an active role in their day-to-day budgeting process.

Quicken’s Fit for Diverse Financial Needs

Quicken caters to diverse financial needs, from individuals tracking personal expenses to businesses managing complex portfolios. The versatility of Quicken’s suite of tools makes it suitable for users with diverse financial tasks, including those looking for detailed investment insights, property management features, and extensive reporting capabilities. Quicken is a fit for anyone seeking an all-encompassing financial solution.

The Strengths of Quicken and YNAB

Both Quicken and YNAB offer unique strengths that can be leveraged to improve financial health. Quicken boasts a comprehensive suite of tools for managing personal and investment finances, while YNAB promotes a proactive approach to budgeting that can transform financial habits. Understanding these core competencies can guide users to the right tools for their financial journey.

Unique Selling Points of YNAB

YNAB promotes a budgeting philosophy that encourages users to be intentional with their money, aligning with its four basic rules. The platform’s focus on education, goal tracking, and accountability sets it apart, along with features that enable users to connect to financial institutions, import transactions, and access real-time data for accurate budgeting.

Quicken’s Standout Features

Quicken’s suite of tools offers comprehensive solutions for personal finance management. Users can track their spending, manage investment accounts, and even handle rental documents for property management. The business edition includes features for creating schedules C and E, making tax time easier. Quicken for Mac and Windows ensures users can access Quicken data directly from their desktop or mobile device, offering flexibility and control over financial planning.

Considering Alternatives in the Market

When considering financial tools, you must evaluate how each option aligns with your financial health objectives. Alternatives to Quicken and YNAB each present unique features, from simplified financial dashboards to specialized budgeting functions. Weighing the pros and cons of these alternatives can lead to a more informed decision that resonates with individual financial strategies.

Other Budgeting Tools Compared to YNAB

Compared to YNAB tools, other budgeting applications in the market might offer a different financial management platform experience. Some may prioritize basic rules for spending, while others provide more comprehensive features, including investment tracking or advanced reporting. Considering these differences, along with the availability of real-time data and user experience, is vital when exploring alternatives.

Financial Software Alternatives to Quicken

For those seeking other options beyond Quicken, there are several financial software alternatives worth considering. Personal Capital excels in wealth management and investment tracking, offering a comprehensive view of your financial picture. Mint provides a free platform for budgeting and expense tracking, appealing to cost-conscious users. Meanwhile, Tiller Money leverages the flexibility of spreadsheets, allowing for a high degree of customization in managing personal finances. Each of these tools offers unique features that may align better with specific financial goals and user preferences.

Deciding Between Quicken and YNAB

Choosing between Quicken and YNAB requires a thoughtful analysis of your financial management needs. While Quicken offers a robust suite of features encompassing everything from budgeting to investment tracking, YNAB focuses on proactive budgeting and helping users to ’give every dollar a job.’ Your decision may hinge on prioritizing a comprehensive financial overview or a dedicated budgeting system that encourages a change in monetary behavior.

Summary of Key Differences and Similarities

Quicken and YNAB differ significantly in their approach to financial management. Quicken is a multi-faceted tool, suitable for individuals with a broad range of monetary activities, including investments and property management. Conversely, YNAB’s methodology is rooted firmly in zero-based budgeting, making it ideal for those intent on rigorous budget discipline. Both platforms offer automated transaction import, categorization, and digital accessibility, streamlining the financial management process.

When comparing similarities, Quicken and YNAB provide secure, encrypted data storage and have built-in reporting features that facilitate financial oversight and planning. They also share a subscription-based model, although their pricing and the value offered at each tier vary. Quicken may appeal to users with complex financial portfolios, while YNAB resonates with users committed to a strict budgeting philosophy.

Final Insights: Quicken vs YNAB

In discerning the best fit for managing your finances and planning for the future, it is essential to consider the unique features of Quicken and YNAB. Quicken, launched in 2003, offers a robust platform with various tools, including investment tracking and long-term tax planning. This makes it suitable for users with diverse financial needs—from tracking income and expenses to managing investment portfolios. If you aim to have a comprehensive overview of all financial aspects, including investment accounts and real-time syncing with your banks, Quicken Simplifi may be the more compelling choice.

On the other hand, YNAB focuses on basic budgeting principles where every dollar is assigned a job, promoting a proactive approach to control your finances. It excels with its budgeting platform, featuring the YNAB direct import tool, which makes it easy to allocate funds to each spending category. For those who prioritize budgeting above all and prefer a mobile app for on-the-go management, YNAB could be the ideal budgeting system. Both services provide valuable support, but your decision should align with whether your financial strategy is centered around meticulous budgeting or encompasses broader wealth management and planning.