Table of Contents

As we forge ahead into an era where financial literacy is paramount, the debate between PocketGuard and Empower intensifies, centering on their ability to enhance cash flow, improve financial planning, and offer an empowered personal dashboard. With the proliferation of budgeting apps, selecting the optimal tool for tracking your spending has never been more critical. The proper app can make all the difference in achieving your economic aspirations, especially in the United States, where financial independence is a cherished goal.

My years of experience in personal finance reveal that the key to successful budget management lies in tracking expenses and understanding and optimizing your cash flow. Both PocketGuard and Empower promise to deliver robust financial planning tools, yet they each have unique features that cater to different user needs. From the empowered personal dashboard to the nuances of tracking your spending, this showdown will dissect the capabilities of each app, guiding you to make an informed decision for your financial well-being.

Whether you are a budgeting novice or a seasoned financial planner, understanding the strengths and weaknesses of each app is crucial. As we delve into the specifics, we will examine how these tools align with your financial goals and lifestyle, ensuring have all the information at your fingertips to take control of your finances. Let us embark on this journey to financial empowerment together, with a clear view of what PocketGuard and Empower have to offer.

Introduction to Budgeting App Dynamics

Understanding the dynamics of budgeting apps is vital in today’s fast-paced economy. These digital tools give users a comprehensive view of their finances, enabling them to adjust their spending habits accordingly. By offering insights into where money is being spent and identifying areas where savings are possible, budgeting apps serve as a personal financial advisor that fits in your pocket.

The Importance of Choosing the Right Budgeting Tool

Choosing the right budgeting tool is a critical step toward financial stability. A well-suited app can help you identify unnecessary expenses, set realistic budgets, and stay on track toward your financial goals. The multitude of options available can be overwhelming, but by focusing on your individual needs, you can find a budgeting tool that not only fits your lifestyle but also simplifies the complexities of managing money.

As someone who has navigated the financial planning landscape for decades, I can attest to the transformative power of the right budgeting tool. It is not just about recording transactions; it is about gaining a clear understanding of your financial picture, which can lead to informed decision-making and, ultimately, financial peace of mind.

How Budgeting Apps Can Transform Your Financial Health

Budgeting apps do more than just monitor expenses—they provide a structured approach to managing your finances. With features like multi-factor authentication, these apps help safeguard your sensitive financial information and empower you to take control of your spending. By offering a snapshot of your financial health, they encourage proactive financial management and can lead to a more secure financial future.

Particularly for young adults, these tools serve as an educational platform, teaching the fundamentals of budgeting and saving. Armed with this knowledge and the right app, users can avoid common financial pitfalls and build a strong foundation for their financial journey. The impact of these apps on financial health cannot be understated—they are a critical ally in the quest for monetary freedom.

Defining PocketGuard and Empower

PocketGuard and Empower stand out for their innovative approaches to managing cash flow and financial planning in the budgeting apps world. PocketGuard simplifies the process of tracking your spending, providing a clear view of where your money goes, while Empower offers a thorough empowered personal dashboard that caters to a more holistic financial planning experience. Both apps harness technology to give users a better handle on their finances, but each offers different tools and methodologies to achieve this goal.

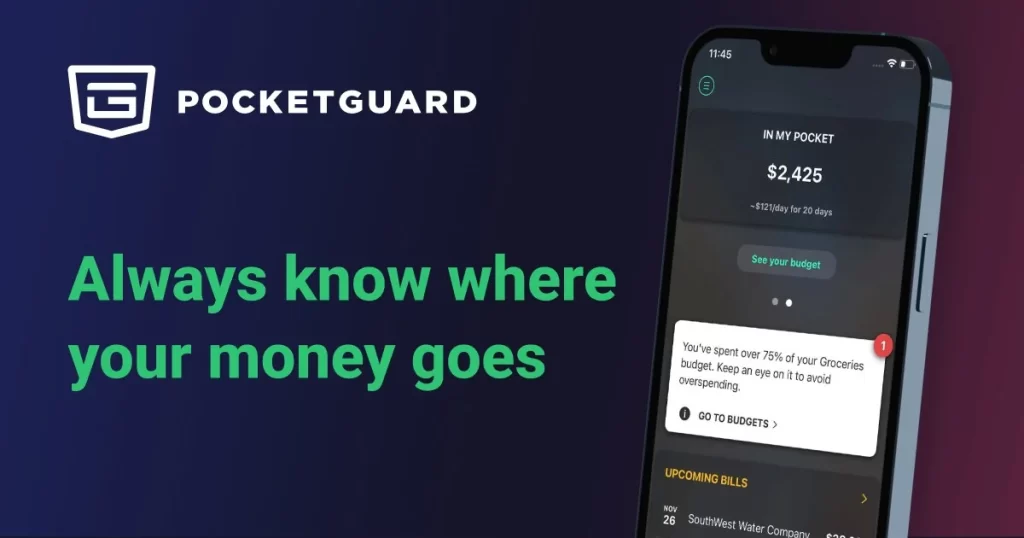

PocketGuard: An Overview

PocketGuard is a budgeting app that has gained popularity for its simplicity and effectiveness in helping users manage their finances. The app’s intuitive design makes it easy for anyone to get a clear picture of their financial situation. Even for those new to budgeting, PocketGuard provides a straightforward approach to tracking expenses and income, leading to more informed financial decisions.

With a focus on helping users identify how much money they have in their pocket for day-to-day spending, PocketGuard demystifies the budgeting process. The app appeals to a broad audience, including those looking for a tool to help them navigate their financial journey without unnecessary complexity. Its paid version offers additional features that cater to more advanced budgeting needs.

Core Features of PocketGuard

PocketGuard’s core features make managing money hassle-free. The app categorizes your expenses into spending categories, making it easier to identify patterns and adjust budgets as needed. It also helps users set and track financial goals, providing motivation and a clear path to achieving them. The app’s unique in-my-pocket feature simplifies the complex task of figuring out how much money is available for discretionary spending after accounting for bills and savings goals.

The simplicity of PocketGuard’s offerings is particularly appealing to those who prefer a straightforward budgeting experience. By focusing on essential budgeting functionalities, the app ensures that users are not overwhelmed by too many options, making it easier to stay committed to their financial objectives. PocketGuard’s approach to budgeting is all about clarity, control, and convenience.

Subscription Tiers and Pricing

PocketGuard offers both free and paid versions to cater to different user needs. The paid version unlocks advanced features such as splitting transactions into separate categories, providing a more granular view of spending habits. This ability to split transactions is helpful, particularly for users who want to fine-tune their budgeting strategy and gain a deeper understanding of their financial patterns.

For those seeking a lifetime of budgeting support, PocketGuard offers a one-time payment option of $99 for a lifetime subscription. This investment in your financial future grants access to a suite of features designed to optimize personal finances over the long term. With the paid version, users enjoy an enhanced budgeting experience that can adapt to their evolving financial needs.

- One of the main advantages of PocketGuard is its ability to create a budget that’s tailored to your financial goals. By inputting your monthly income and expenses, the app calculates the “In My Pocket” feature, which tells you how much money you have left to spend after accounting for bills and savings. This proactive feature helps prevent overspending.

- Another pro is PocketGuard’s ability to pinpoint money-saving opportunities. It identifies high-yield savings accounts and negotiates bills on your behalf, potentially increasing your savings rate and lowering monthly expenses. This feature is particularly beneficial for those who may not have the time or expertise to hunt for better deals themselves.

- However, no app is without its limitations. Some users may find PocketGuard’s automated categorization of expenses not always accurate, necessitating manual corrections. This can be a drawback for users seeking a completely hands-off budgeting tool.

- Additionally, while PocketGuard helps track spending, it lacks more advanced financial planning features that some users might need. For those looking to delve deeper into investment tracking or long-term financial planning, PocketGuard might seem too focused on day-to-day budgeting.

Empower: An Overview

Empower stands out in the budgeting app space with its focus on tracking spending and enhancing cash flow management. The app’s empowered personal dashboard is central to its design, offering users a comprehensive view of their finances, and enabling more informed decision-making. Empower caters to those seeking an all-in-one financial planning solution that goes beyond simple budgeting.

The app’s ability to provide insights into cash flow helps users understand their financial habits on a deeper level, guiding them to make changes that can significantly improve their financial health. With Empower, users gain access to diverse tools and analytics that support a proactive approach to managing money.

Empower’s Unique Offerings

Empower differentiates itself with its Empower personal dashboard, which provides a holistic overview of a user’s finances. This dashboard is a hub of financial insights, allowing users to track spending, monitor savings, and even get recommendations on optimizing their cash flow. Empower’s focus on empowering users with knowledge and tools reflects its commitment to financial education and long-term financial health.

With a suite of features tailored to various financial planning needs, Empower’s dashboard is a testament to the app’s versatility. Whether it is setting up savings goals, managing debt, or investing, Empower provides comprehensive support that can adapt to the user’s evolving financial landscape. It is an app designed to empower users to take charge of their finances and make smarter financial choices.

Subscription Tiers and Pricing

Empower offers a tiered subscription model that includes both free and paid versions. The paid version provides access to enhanced features such as advanced cash flow analysis and personalized recommendations. For users looking for a more robust financial planning tool, the paid tier offers a broader range of capabilities designed to facilitate a deeper understanding of personal finances.

Empower also presents a $99 for a lifetime subscription option, providing a cost-effective solution for long-term financial management. This option is attractive, especially for those who appreciate the convenience of a one-time payment for continuous access to Empower’s full range of services. The ability to split transactions and categorize them into different categories is a feature that is particularly valuable for users who need a detailed and flexible approach to budgeting.

- One of the strengths of Empower is its ability to offer personalized recommendations for financial products. By analyzing your financial habits, Empower can suggest credit cards, loans, and insurance plans that may fit your needs, potentially leading to better financial outcomes.

- Empower’s proactive alerts are also a notable feature. The app notifies you of upcoming bills and bank fees, allowing you to address them before they become issues. This real-time monitoring can be instrumental in avoiding unnecessary expenses and staying on track with your financial goals.

- On the flip side, Empower’s vast array of features may be overwhelming for those new to budgeting or who prefer simplicity. The myriad of options and data points could detract from the core goal of budgeting for some users.

- Moreover, Empower’s emphasis on financial planning tools may come at a higher cost compared to more basic budgeting apps. Users looking for a simple tool to track monthly expenses might find the additional features unnecessary and not worth the extra expense.

User Experience and Accessibility

User experience and accessibility are crucial components of any budgeting app. An app’s design and ease of use can significantly influence its effectiveness in helping users manage their finances. A user-friendly interface can encourage consistent interaction with the app, leading to better financial habits and, ultimately, a powerful impact on your monetary health.

Navigating the PocketGuard Interface

Navigating the PocketGuard interface is a breeze, thanks to its clean design and straightforward navigation. The app intuitively organizes financial information, making it easy for users to track their spending, view their budgets, and understand their financial standing at a glance. PocketGuard’s emphasis on simplicity ensures that users can focus on what is important: their financial goals.

The app’s layout is designed with the user in mind, providing quick access to key features and allowing for seamless management of personal finances. Whether you are checking account balances or setting up new budget categories, PocketGuard ensures that every step is straightforward and user-friendly, making the app an excellent choice for those who value ease of use in their budgeting tool.

Empower’s User-Friendly Approach

Empower’s user-friendly approach to budgeting is evident in its empower personal dashboard, which brings all of a user’s financial information into one accessible and easy-to-navigate space. The dashboard simplifies the process of financial planning by presenting data in a clear and actionable way, allowing users to make quick, informed decisions about their finances. Empower’s design philosophy revolves around empowering users with the tools they need, presented in a way that is both intuitive and effective.

The app also prioritizes user engagement by offering personalized insights and recommendations, making the financial planning process more interactive and responsive to individual needs. With Empower, users find that managing their finances becomes less of a chore and more of an empowering experience, thanks to the app’s focus on user experience and accessibility.

Security Measures and Privacy Protections

Security measures and privacy protections are paramount when dealing with sensitive financial information. In a digital world where data breaches are a common concern, budgeting apps must employ robust security protocols to protect users’ financial data. This includes utilizing encryption, secure connections to financial institutions, and other industry-standard measures to ensure that users’ information remains confidential and safe from unauthorized access.

How PocketGuard Safeguards Your Information

As someone who has been guiding young adults in financial planning, I understand the importance of security, especially when it comes to sensitive financial information. PocketGuard employs bank-level security measures to ensure your data is encrypted and protected. They use industry-standard protocols, including 256-bit SSL encryption, to safeguard your personal information from unauthorized access.

Moreover, PocketGuard does not store your bank login details on their servers. The app uses third-party services to handle the connection with financial institutions, maintaining a secure environment for your credentials. This multi-layered approach to security instills confidence that your sensitive financial information remains private and protected while using PocketGuard.

Empower’s Commitment to Security

In my experience, a trusted budgeting tool must also be a bastion of security. Empower recognizes this imperative and commits to protecting sensitive financial data with robust security protocols. They utilize AES 256-bit encryption to secure user data, in transit and at rest, ensuring your details are not compromised.

Additionally, Empower requires multi-factor authentication for added security, which helps prevent unauthorized access to your account. They perform regular security audits and tests to stay ahead of potential vulnerabilities. Their partnership with reputable financial institutions further supports a secure ecosystem for managing your finances.

Budgeting Features and Financial Planning

Effective management of monthly income and expenses is the bedrock of any sound budgeting system. By categorizing your spending, budgeting apps like PocketGuard and Empower help you identify where your money is going and how you can optimize it. This insight into monthly expenses and spending categories enables users to make informed decisions to achieve financial stability and growth.

PocketGuard’s Budgeting Capabilities

My advice to those starting their financial journey is to find an app that simplifies the budgeting process. PocketGuard allows users to connect their bank accounts directly, which streamlines tracking your spending against your budget. This connectivity ensures all transactions are considered, providing an up-to-date picture of your finances.

Once you connect your bank accounts, PocketGuard categorizes transactions automatically, making it easier to see where you might be overspending. Their algorithms analyze your spending patterns, offering insights that can help tweak your budget for better financial outcomes.

Empower’s Financial Planning Tools

Empower offers a suite of tools that cater to the needs of individuals looking to take a more hands-on approach to their financial planning. With Empower, you can set up custom spending categories that align with your budgeting system, ensuring that every dollar is allocated according to your financial plan.

For those who prefer a comprehensive overview of their finances, Empower’s integration with Monarch Money provides an expansive view of your financial landscape. This partnership allows a holistic approach to managing your money, combining budgeting, investments, and financial planning in one platform.

Comparing Costs and Value for Money

When evaluating budgeting apps, it’s crucial to consider the value you get in return for the cost. For college students or anyone on a tight budget, the appeal of a 34-day free trial can be significant. It provides an opportunity to test the waters without financial commitment. PocketGuard and Empower both cater to recurring expenses and monthly bills, but their pricing and value proposition should align with your financial situation and goals.

PocketGuard Pricing: Is It Worth It?

PocketGuard’s pricing structure is designed to be flexible, offering a free version for basic budgeting needs and a paid option for more advanced features. The premium version provides additional tools to help you reach financial goals, like the ability to track cash transactions and monitor high-yield savings accounts. This can be particularly valuable for those aiming to maximize their savings potential.

The question of value for money depends on your individual needs. If you’re looking to fine-tune your budget to increase savings and manage money more effectively, the additional features of the paid version could be worth the investment. However, for users seeking only basic tracking, the free version may suffice.

Analyzing Empower’s Cost-to-Value Ratio

Empower operates on a subscription-based model, which might seem off-putting at first glance. However, the app’s comprehensive financial planning tools offer significant value for those who are looking to take a more active role in managing their wealth. If you make full use of its capabilities, from budgeting to investment tracking, the subscription can be a worthwhile expense.

It’s essential to weigh the benefits against the cost. For individuals who require only minimal assistance with budgeting and expense tracking, the subscription cost may not provide the best value. But for those who benefit from its wide-ranging financial planning tools, Empower could be a game-changer in their financial journey.

Synchronization with Financial Institutions

In my years of helping people with their finances, I’ve seen how crucial it is to have a budgeting tool that syncs seamlessly with financial institutions. Apps typically offer this feature to provide a comprehensive view of spending habits and help with zero-based budgeting. This synchronization ensures all transactions are captured, giving you a real-time overview of your financial health.

How PocketGuard Connects with Your Accounts

PocketGuard’s approach to managing your finances starts with the ability to connect seamlessly with your financial institutions. This connection is the cornerstone of their zero-based budgeting system, which is designed to give every dollar a job. By having a direct link to your accounts, PocketGuard ensures that your spending habits are tracked accurately, providing you with a complete financial picture.

Furthermore, PocketGuard utilizes algorithms to analyze your transactions and suggest ways to improve your financial health. This might include identifying recurring subscriptions you could do without or negotiating better rates on monthly bills. Such features make PocketGuard an ally in achieving a balanced budget.

Empower’s Connectivity and Account Aggregation

Empower also excels in its ability to aggregate accounts from various financial institutions. This aggregation is crucial to understanding your overall monetary landscape and adapting your spending habits accordingly. By having all your financial information in one place, Empower can help you implement zero-based budgeting effectively, ensuring that every expense is accounted for in your plan.

The app’s real-time updates on your finances are a significant advantage. As your spending habits evolve, Empower adjusts its analysis and recommendations, providing you with the insights needed to make informed decisions. This level of connectivity and aggregation is a testament to Empower’s commitment to helping you take control of your financial future.

Customer Support and Educational Resources

Embarking on a journey of money management requires more than just an intuitive app; it necessitates robust customer support and comprehensive educational resources. A well-informed user is empowered to make smarter financial decisions, and both PocketGuard and Empower strive to provide avenues for learning and assistance.

Support Services Provided by PocketGuard

PocketGuard prides itself on a customer support system that’s designed to address user inquiries with efficiency. Whether you’re experiencing technical difficulties or seeking advice on feature utilization, their team is accessible through multiple channels. This commitment to user support underscores the app’s dedication to a seamless budgeting experience.

Moreover, PocketGuard offers a wealth of resources aimed at educating users on various aspects of personal finance. From blog posts to tutorials, these materials are crafted to help users not only navigate the app but also to enhance their overall financial literacy.

Empower’s Resources for Financial Education

Empower stands out by offering a personalized financial coaching experience. The app provides users with tailored advice, aiming to transform their financial picture into one of clarity and confidence. Empower’s approach to financial education is proactive, engaging users with actionable insights based on their data.

Furthermore, Empower’s educational content extends beyond the app itself, featuring articles, webinars, and interactive tools. These resources are designed to equip users with the knowledge needed to make informed decisions, reflecting Empower’s holistic approach to personal finance.

Real-World Reviews and Ratings

User testimonials play a crucial role in evaluating the effectiveness of budgeting apps. Real-world experiences reveal how apps like PocketGuard and Empower perform outside of controlled scenarios, providing insights into their practicality and impact on daily financial management.

What Users Are Saying About PocketGuard

PocketGuard’s users often highlight the app’s simplicity and ease of use when discussing their experiences. The ability to quickly ascertain how much money is available for spending after scheduled bills and savings contributions is frequently praised. Users appreciate the app’s role in helping them avoid overspending and stay on track with their financial goals.

However, some users express a desire for more advanced features or customization options. While the core functionalities are well-received, the feedback suggests an opportunity for PocketGuard to enhance its offering to satisfy a broader range of user preferences.

Empower Appraisals from Actual Customers

Empower users commonly commend the app for its comprehensive financial planning tools. The integration of personalized coaching and automatic savings features receives particular acclaim, as customers value the support in achieving their financial objectives. The app’s user-friendly interface also contributes to its high ratings.

Nonetheless, certain users note that the cost of the subscription can be a hurdle, especially for those who are looking to minimize expenses. While the tools and services are extensive, the price point is an important consideration for potential Empower customers when evaluating the app’s overall value.

The Verdict on PocketGuard vs Empower

In the clash of budgeting titans, PocketGuard and Empower each exhibit strengths that cater to different user needs. While both apps offer robust features to aid in financial management, the decision often hinges on personal preference and specific financial situations.

Situations Where PocketGuard Shines

PocketGuard excels for individuals seeking a straightforward and automated approach to budgeting. With its ability to analyze transaction data and identify recurring bills, the app shines in helping users keep track of their finances with minimal manual input. Its prowess in simplifying complex financial information makes it a strong contender for those new to budgeting.

Additionally, for those wanting to download the app on various platforms, PocketGuard offers compatibility with both iOS and Android devices, ensuring a broad reach. Its focus on simplicity and accessibility makes it a go-to choice for users who prefer an uncomplicated financial tool.

When to Choose Empower Over PocketGuard

Empower is the preferred choice for users who require a more comprehensive suite of financial features. The app’s ability to aggregate data manually from different cash accounts and provide personalized financial advice sets it apart for those seeking a more hands-on approach to budgeting and money management.

Moreover, if you’re looking for an app for Android or iOS that offers a blend of automated savings alongside budgeting tools, Empower may be the superior option. Its commitment to a complete financial package makes it ideal for users who want an all-in-one solution to their financial planning needs.

Additional Budgeting App Alternatives

While PocketGuard and Empower stand out in the budgeting app market, other alternatives might better align with specific user requirements. Apps like Rocket Money offer distinct features that cater to a variety of money management preferences.

When to Consider Other Budgeting Apps

When assessing budgeting apps, security is paramount. Apps that offer multi-factor authentication provide an additional layer of protection, ensuring your financial information remains secure. Users who prioritize security may find such features a deciding factor in their choice of a budgeting tool.

Close Contenders Like Mint and YNAB

Mint users often laud the app for its comprehensive overview of their financial picture, including investments and credit score monitoring. Meanwhile, YNAB (You Need A Budget) is praised for its proactive budgeting philosophy and detailed tracking system, making these apps close contenders in the budgeting space.

Up-and-Coming Apps: Simplifi and Goodbudget

Simplify and Goodbudget represents the innovation in the budgeting app market. Simplify offers a modern approach to money management, while Goodbudget adopts the envelope system with digital envelopes, allowing for up to 20 total envelopes. These apps cater to users who appreciate a more visual and hands-on budgeting method.

Making the Decision: Which App Suits Your Needs?

The quest for the perfect budgeting app is a personal one, with no one-size-fits-all solution. Your financial goals, habits, and preferences will guide your decision, and the right app can become a pivotal tool in your journey toward monetary stability.

Factors to Consider Before Making a Choice

Before settling on a budgeting app, consider factors such as the complexity of your financial situation, the level of guidance you require, and the importance of features like real-time tracking and forecasting. These elements will influence which app aligns best with your unique financial landscape.

Customizing Your Budgeting Experience

Personalizing your approach to managing personal finances is crucial for successful budgeting. Many apps allow users to set financial goals, but it is essential to find one that offers the flexibility to create unlimited savings goals that align with your unique financial situation. Whether you prefer the envelope method or another strategy, ensure the app you choose can help indicate when and where your money is coming from and going.

Frequently Asked Questions (FAQs) About Budgeting Apps

Common inquiries often revolve around the budgeting apps effectiveness, their ability to boost savings, and potential concerns users might have. These questions are vital as they address core functions and reliability of such apps in everyday financial management. By exploring these FAQs, one can better understand the integration of budgeting apps into their financial routines.

1. Are budgeting apps generally effective?

2. Can budgeting apps truly enhance savings?

3. What are the common concerns with budgeting apps?

Empowering Your Financial Future

Adopting a strategic approach like zero-based budgeting, where every dollar is allocated a role, can empower your financial future. This method ensures intentionality with your spending and can help to prevent waste. By embracing such strategies through the use of budgeting apps, you’re taking proactive steps to secure a more stable and prosperous financial outlook.

Long-Term Benefits of Consistent Budgeting

Consistent budgeting lays the foundation for long-term financial stability. It instills discipline, reduces the likelihood of impulsive spending, and helps you build a buffer for unforeseen expenses. Over time, the habit of tracking and managing your finances can lead to substantial wealth accumulation and a reduced stress life regarding financial matters.

The Path to Financial Freedom with the Right App

Finding the right app to manage your finances is a step towards financial freedom. The ideal app should align with your financial goals, offer practical tools for tracking spending, and provide insights to make informed financial decisions. With the right app, you can effectively navigate your financial journey, from eliminating debt to growing your wealth.

Conclusion: PocketGuard vs Empower

After carefully considering the various features that PocketGuard and Empower offer, from tracking your transaction history and monthly spending to offering investment tracking and spending alerts, the decision comes down to the app that best aligns with your financial goals. Personal finance software is a powerful ally in managing your finances, whether you’re fine-tuning your spending limits, optimizing your checking and savings, or focusing on paycheck planning. PocketGuard’s basic version might appeal to you for its simplicity in automatically categorizing transactions and setting spending limits, while Empower could be the better choice if you’re looking for robust features like Roth IRA and CD rates analysis or comprehensive investment tracking.

Ultimately, the best budgeting app for you is the one that meets your unique needs, giving users a sense of control over their income and expenses. Whether you want to keep an eye on student loans, manage card accounts, or receive timely spending alerts, the right app should enhance your financial data’s visibility and utility. With options to create custom categories and tools for analyzing spending and saving patterns, these apps can aid in the journey toward financial stability. Remember, the convenience of monitoring your financial health from devices like the Apple Watch is a bonus to the diligent management of your financial future.