Table of Contents

As someone who‘s navigated the complexities of personal finance for years, I understand that managing multiple credit cards can be overwhelming. The best app in today‘s market can transform this challenge into a streamlined process. With the right credit card manager app, on-time payments become second nature, and financial oversight becomes a simple task, allowing for a more organized and stress-free financial life.

Whether you are juggling bills or seeking ways to maximize rewards, a top-tier credit card manager app offers the tools necessary to monitor and manage your finances efficiently. Let‘s explore how these apps can elevate your financial strategy and lead you towards fiscal stability.

Unveiling the Power of Credit Card Manager Apps

Imagine having a personal financial assistant at your fingertips, one that consolidates all your credit card information in one place. Credit card manager apps do just that, providing a comprehensive view of your finances and empowering you to make informed decisions.

• How These Budgeting Apps Simplify Financial Management

By aggregating transactions from multiple credit cards, these apps simplify financial management. They categorize spending, track on-time payments, and provide a clear picture of where your money is going, making it easier to identify areas to cut back on expenses.

• The Role of Credit Card Manager Apps in Budgeting

When it comes to budgeting, credit card manager apps are indispensable. They help you allocate funds appropriately, ensuring that you live within your means while still making the most of the benefits offered by your various credit cards.

• Strategies for Paying Off Credit Card Debt with Management Apps

Credit card management apps are crucial for maintaining your financial health. They offer a user-friendly interface that makes it simple to monitor credit card activity, control your finances, and formulate strategies for paying down debt. With features like spending trackers and alerts, these mobile apps are essential for managing credit cards effectively.

• Data Used to Track and Enhance Credit Card Rewards

Leveraging credit card manager apps to track and optimize your reward points is a smart move, especially if you have cards like American Express or Chase Ultimate Rewards. These apps can help you ensure that every dollar spent is working towards earning you more benefits.

• Understanding the Privacy Aspects of Credit Card Manager Apps

Privacy is paramount when it comes to financial apps. Reputable credit card manager apps employ robust security measures to protect your sensitive information, providing peace of mind while you manage your finances digitally.

Top-Rated Credit Card Manager Apps of the Year

This year‘s top-rated credit card manager apps stand out for their ease of use, comprehensive features, and strong security protocols, making them the go-to choice for savvy users aiming to streamline their financial management.

1. App Spotlight: Maximizing Features and User Experience

The Chase app is notable for its compatibility with both Apple and Android devices, offering bonus points for certain transactions, tailored card recommendations, and helping users stay within their credit limit. Its robust features and seamless user experience have garnered high praise.

User Reviews and Success Stories

User testimonials highlight the Chase app‘s effectiveness, with many citing its intuitive Android device interface and the convenience of managing their accounts on both Apple and Android platforms. Stories of maximized bonus points and credit limit management abound, illustrating the app‘s impact on users‘ financial savvy.

How to Leverage Advanced App Features

To fully benefit from the Chase app, familiarize yourself with its advanced features. Set up personalized card recommendations, monitor your credit limit, and take advantage of bonus points opportunities. These tools are designed to enhance your financial experience on both Apple and Android devices.

2. The Budget-Friendly Credit Card Manager

For those mindful of their spending, budget-friendly credit card manager apps provide cost-effective solutions for managing finances without compromising on essential features.

Cost-Effective Management for Everyday Users

Everyday users can find solace in budget-friendly credit card manager apps that offer a balance between functionality and affordability. These apps assist in maintaining financial discipline without the need for hefty investments, ensuring accessibility for all users.

Tips for Getting the Most Out of Budget Apps

To maximize the benefits of budget apps, regularly review your spending patterns, set realistic budget limits, and engage with the app‘s educational resources to improve your financial literacy. These practices will help stretch every dollar further.

3. The Innovative App for Debt Reduction

The Chase app also shines as an innovative tool for debt reduction, providing users with strategies and insights to manage and overcome their credit card debt, leading to a healthier financial future.

Unique Tools for Accelerating Debt Payoff

In the landscape of credit card manager apps, unique tools such as debt snowball and avalanche calculators stand out for their ability to customize debt repayment strategies. These apps empower users to prioritize their credit card balances by interest or balance size, enabling them to make strategic payments that can reduce overall interest paid and shorten payoff times. With visual payoff simulations, users can see the potential jump in their financial freedom timeline, motivating them to stay the course.

User Feedback on Debt Reduction Capabilities

User testimonials often highlight the impact of debt reduction features within credit card manager apps. Many users have praised the intuitive design that simplifies the often overwhelming process of managing multiple credit card balances. Success stories frequently cite the clarity provided by the app‘s reporting features, which demystify the repayment process and help users navigate their way out of debt with confidence and precision.

Making Informed Choices: Selecting the Right App for You

Selecting the ideal credit card manager app is a critical decision that can shape your financial well-being. It‘s essential to weigh factors like compatibility with your spending habits, ease of setup, and the app‘s ability to adapt to your changing financial landscape. This careful consideration will ensure you choose an app that aligns with your personal finance goals and assists in achieving them effectively.

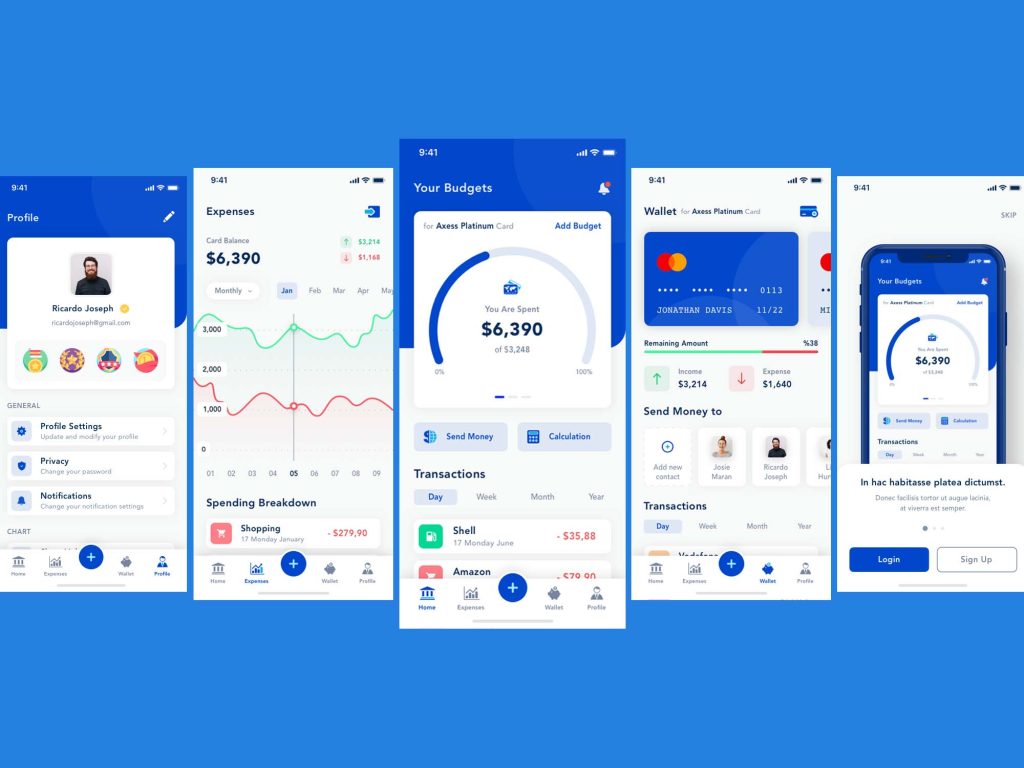

Comparing App Functionality and User Interface

When evaluating credit card manager apps, the functionality and user interface are paramount. An app that seamlessly integrates expense tracking with detailed analytics provides a robust overview of your finances. I recommend looking for intuitive navigation, clear categorization of expenses, and customizable alerts, as these features can significantly enhance your financial management experience and help you stay on top of your credit game.

Evaluating Security Measures in Credit Card Manager Apps

Security is non-negotiable when it comes to managing sensitive financial data. I advise assessing encryption standards, two-factor authentication, and data breach protocols of credit card manager apps. Ensure that the app you choose is committed to safeguarding your information with the latest security measures, providing peace of mind as you manage your credit card balances with confidence.

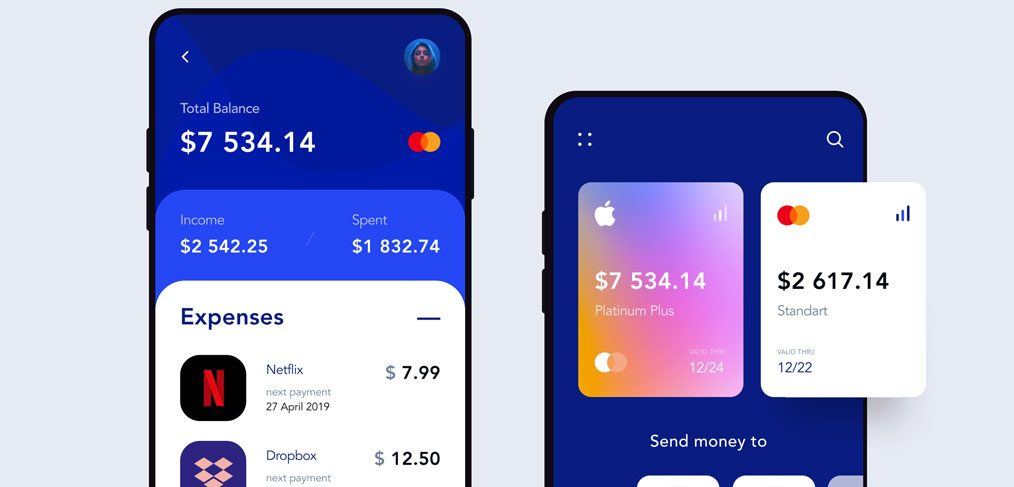

Integrations with Other Financial Tools

For a seamless financial management experience, integration with other financial tools is essential. The right credit card manager app should be able to connect with your bank accounts, investment portfolios, and even loan servicers, providing a holistic view of your finances and enabling efficient money management across platforms.

Beyond the App: Enhancing Credit Management

While credit card manager apps offer a solid foundation for handling credit, true mastery comes from leveraging additional resources. This includes understanding credit reports, recognizing factors that affect credit scores, and staying informed about best practices in credit utilization and management.

Expert Tips for Credit Optimization

Expert advice can be a game-changer in optimizing your credit. Key tips include keeping credit utilization low, paying bills on time, and avoiding opening too many accounts at once. These practices can not only boost your credit score but also enhance your overall financial stability.

Utilizing Apps to Monitor Credit Health

Monitoring your credit health is vital, and credit card manager apps can play a significant role. Use these apps to track your credit score, identify potential errors on your credit report, and understand the factors influencing your credit. Regular monitoring can help you make informed decisions that contribute to a stronger financial profile.

Leveraging Technology to Combat Credit Card Fraud

Technology is a powerful ally against credit card fraud in the digital age. Modern credit card manager apps come equipped with real-time alerts and transaction monitoring to flag unauthorized activity. By using these technological advancements, you can act swiftly to secure your accounts and protect your financial integrity.

Journey to Financial Freedom

Achieving financial freedom is a journey that requires dedication, strategy, and the right tools. Credit card manager apps can be a valuable companion, helping you to navigate the path from debt to financial independence with detailed planning, consistent tracking, and actionable insights.

Success Stories: From Debt to Financial Independence

Many have transformed their financial lives using credit card manager apps, moving from burdensome debt to monetary independence. Their stories often reflect disciplined budgeting, strategic debt repayment, and the use of app features that provide clarity and motivation throughout their journey.

Personalized Plans within Credit Card Manager Apps

Customization is crucial in credit card management. The best apps offer personalized plans that cater to individual financial situations, allowing users to set realistic goals and timelines. These tailored plans help users to focus on what‘s most important, adapting as their financial landscape evolves.

Staying Motivated with Progress Tracking and Milestones

Long-term financial goals require sustained effort, and credit card manager apps aid in maintaining motivation through progress tracking and milestone celebrations. Visual representations of debt reduction and notifications of achieved goals can provide the encouragement needed to continue striving toward financial freedom.

The Future of Credit Card Management Apps

The future of credit card management is bright, with advancements in app technology promising even more personalized and efficient financial planning. Expect to see a greater emphasis on user engagement, artificial intelligence, and predictive analytics that anticipate user needs and offer proactive guidance toward optimal financial health.

Predicting Trends in App Development and User Engagement

As we look ahead, I anticipate a surge in user engagement facilitated by credit card manager apps that harness the power of machine learning to provide more intuitive experiences. The future is bright for banking apps, which will likely evolve to offer more personalized money management insights, helping users achieve their financial goals with greater ease. The interactivity of mobile banking will advance, with apps creating more responsive financial ecosystems that learn from everyday spending habits, leading to more user-centric features and services.

The Role of AI in Personal Finance Apps

Artificial Intelligence (AI) is revolutionizing the way we handle our finances. In personal finance apps, AI‘s role is becoming increasingly significant, offering smart insights into spending patterns and suggesting ways to maximize your credit card rewards. AI-driven financial tools can analyze credit history, suggesting the best balance transfer credit cards or secured credit options tailored to individual user profiles. This results in more sophisticated credit card manager apps that advise and adapt to our financial behaviors.

Anticipating Next-Gen Features in Credit Card Manager Apps

Looking forward, we can expect credit card manager apps to integrate features that go beyond traditional budgeting. The Mint app, for instance, could incorporate predictive analytics to forecast future spending and savings scenarios, enabling users to adjust their habits proactively. Features that offer real-time FICO credit score updates and personalized alerts for unusual activity will likely become standard, enhancing security and giving users more control over their financial institution interactions to better manage their personalized money strategies.

Wrapping Up Your Search for the Best Credit Card Manager App

In my years of guiding young adults in financial matters, I‘ve seen the profound impact that the right tools can have on managing credit card accounts and overall monetary health. A robust credit card manager app can assist you in making informed decisions, enabling you to track your spending across different spending categories, and even help you to consolidate credit card debt. Whether you‘re grappling with student loans, personal loans, or aiming for retirement planning, these apps serve as a critical component of money management on your mobile device.

As you conclude your search, remember to consider apps that offer comprehensive features such as two-factor authentication to protect against credit card fraud and those that are compatible with the app landscape across devices, including an app for Android users. Look for budgeting apps that allow you to categorize transactions, monitor credit and debit cards, and manage monthly payments efficiently. An ideal app might even offer financial planning tips, like how to avoid missed payments or strategize credit card payments to optimize interest savings. Ultimately, the best app for you is one that fits seamlessly into your financial landscape, empowering you to take charge of your fiscal future.