Table of Contents

A credit adviser is pivotal in managing finances and steering you towards fiscal stability. They are financial consultants who advise clients on credit management, debt strategies, and building a strong financial foundation.

With expertise in various financial disciplines, these advisers provide invaluable insights and guidance to help individuals make informed decisions about their credit and debt.

Their services extend beyond simple advice; they advocate for their clients, negotiate with creditors, and often help to restructure debt. A credit adviser aims to improve your financial health, providing a pathway to a debt-free life and a solid credit standing. This article covers what to expect from credit advisers. Let’s get into it.

Defining the Credit Adviser

At the core, a credit adviser is an expert dedicated to managing your finances, particularly about credit. They offer a personalized approach to financial challenges, helping to navigate the complexities of credit, debt, and budgeting to achieve financial well-being.

A Guide to Financial Advocacy

As financial advocates, credit advisers work diligently to enhance your credit history and provide student loan counseling. They are staunch supporters in your financial corner, ensuring you make decisions that positively influence your credit score and overall financial health.

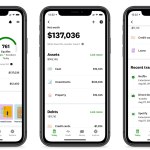

The Ultimate Money Management App: A Tool in the Adviser’s Arsenal

Today, many credit advisers incorporate financial management apps to streamline budget tracking and expense management. These digital tools enable advisers and clients to monitor finances in real-time and adjust as necessary for better financial outcomes.

The Spectrum of Credit Advising Services

Credit advising encompasses a wide range of services tailored to improve financial health.

Personalized Financial Planning and Advice

Advisers develop a personalized plan to navigate money management, including filing for bankruptcy when necessary, and foster financial literacy to build a robust financial plan.

Tailoring Strategies for Individual Needs

Debt settlement companies may offer one-size-fits-all solutions, but credit advisers work on crafting strategies that involve negotiating payments to creditors, often in a lump sum, that align with the client’s unique financial situation.

Educational Workshops on Credit and Budgeting

Structured workshops provide essential knowledge in credit and budget management.

Empowering Clients Through Knowledge

By educating clients on financial basics, advisers empower them to take control of their finances, from understanding bills and debts to interpreting credit reports and scores.

Crafting Tailored Debt Management Programs

Customized programs are designed to address credit cards and unsecured debt, negotiating with creditors on your behalf for favorable terms.

Paths to Financial Liberation

Through careful planning and student loan counseling, advisers help clean up your credit history, setting you on a path to financial liberation with sustainable habits and strategies.

Decoding the Costs of Credit Counseling

Understanding the fees involved in credit counseling is critical for financial planning.

Understanding the Investment in Your Financial Future

Investing in credit counseling is a strategic move for long-term credit history improvement and financial stability.

Comparing Fee Structures Across Credit Advisers

When considering credit advisers, comparing fee structures is important to find the best fit for your financial situation.

Credit Advising and Its Impact on Credit Scores

Credit advising can significantly impact credit scores, helping clients understand and navigate the factors that influence their creditworthiness.

The Truth About Credit Counseling and Your Credit Report

Many individuals are concerned about how engaging with a credit counseling agency will affect their credit scores. The truth is, credit counseling itself does not directly hurt credit scores.

Counselors from nonprofits like the National Foundation for Credit Counseling are trained in consumer credit, money and debt management. They can provide invaluable advice on budgeting and managing debt payments without damaging your credit.

During the initial consultation, which typically lasts around an hour, they review credit card accounts and other financial obligations, offering educational materials and workshops to help set financial goals for 2024 and beyond.

However, actions taken after counseling, like opting for a debt management plan, can temporarily impact credit scores due to changes in credit utilization.

How Debt Management Plans Affect Credit Health

Debt management plans can influence credit health in several ways. When you enter a debt management plan, a credit counselor negotiates with creditors to lower interest rates or monthly payments on credit cards and other unsecured debt.

While this does not inherently damage your credit, closing credit card accounts as part of the agreement can affect credit utilization ratios and age of credit history, which are factors in credit scoring. On the positive side, consistent, on-time payments through the plan can improve credit health.

Navigating the Selection of a Credit Adviser

Choosing the right credit adviser is crucial for effective financial guidance. It’s important to consider their expertise, experience, and the range of services they offer. An adviser who can assist with various financial challenges, from student loans to housing counseling, and who provides follow-up sessions to ensure you stay on track, can be a valuable asset in achieving long-term financial goals.

Key Considerations When Choosing an Adviser

When selecting a credit adviser, consider their qualifications, including certification and training, and whether they adhere to strict ethical standards set by organizations like the Department of Justice. It’s also vital to assess whether they offer bankruptcy counseling and credit repair services and have experience with specific financial institutions holding your accounts.

Identifying Reputable Credit Counseling Agencies

To identify reputable credit counseling agencies, look for accreditation by recognized bodies and check their standing with the financial community. Nonprofit credit counselors often have extensive training and offer services at lower costs. They should also be transparent about their fee structures, providing a full explanation during the initial counseling session, which typically lasts about an hour.

Alternatives to Credit Counseling

While credit counseling offers a comprehensive approach to debt management, alternatives like debt consolidation loans and personal loans may suit those with a stable monthly income and personal finance savvy. Chapter 13 bankruptcy is another option for those with substantial debt, although it carries significant credit implications.

Weighing Other Debt Relief Options

Other debt relief options include working with a debt settlement company to negotiate payment plans with creditors or opting for a debt consolidation loan to streamline multiple debts into a single payment. It’s important to compare these options with the services provided by a credit counseling agency to determine the best fit for your financial health.

When to Consider Debt Settlement or Debt Consolidation

Consider debt settlement or debt consolidation when facing high-interest debts that are overwhelming to manage. If a credit counseling agency’s payment plan is not feasible, negotiating with creditors through a debt settlement company may provide relief. However, when choosing these options, be mindful of potential legal issues and the impact on financial health.

When to Seek Help From a Credit Adviser

If you’re struggling with financial obligations like medical bills or feeling overwhelmed by debt, it might be time to seek help from a credit adviser. They can offer guidance through the Trustee Program and help manage your finances more effectively.

Recognizing the Signs You Need Financial Guidance

Recognizing when you need financial guidance is key to avoiding a crisis. Suppose you find yourself juggling multiple debt payments, missing due dates, or receiving calls from debt collectors. In that case, these are clear signs it’s time to seek professional advice from a credit counseling agency.

Proactive Counseling vs. Crisis Management

Proactive counseling involves seeking financial advice before a crisis occurs, while crisis management is responding to an immediate financial problem. Credit counseling agencies can help with both, but proactive counseling can prevent the need for more drastic measures like bankruptcy or debt settlement.

Steps to Engage With a Credit Adviser

Engaging with a credit adviser involves researching accredited agencies, scheduling an initial consultation, and preparing personal financial information. This proactive step can improve financial stability and peace of mind.

Preparing for Your First Credit Counseling Session

Before your first credit counseling session, gather all relevant financial documents, including income statements, debt summaries, and living expenses. This will help the counselor provide accurate and tailored advice for your situation.

Establishing Goals With Your Credit Adviser

Establishing goals with your credit adviser is a collaborative process. During follow-up sessions, you’ll work together to set realistic financial targets, such as reducing debt, improving credit scores, or saving for a down payment on a home.

The Debate: Nonprofit Versus For-Profit Credit Advising

The debate between nonprofit and for-profit credit advising centers around cost, quality of service, and motives. Nonprofit organizations often have lower fees and receive endorsements from entities like the Federal Trade Commission, ensuring consumer protection in the United States. However, some for-profits might offer specialized services that suit individual financial needs.

Benefits and Drawbacks of Each Model

Nonprofit credit advisers often consolidate credit cards into a single monthly payment, making finances more manageable. While for-profit agencies may provide similar services, they might focus more on revenue through higher fees. Each model has its strengths, with nonprofits focusing on client education and for-profits possibly offering more innovative solutions.

Ethical Considerations and Consumer Protection

When engaging with credit counseling services, evaluating their ethical practices is crucial. Reputable agencies disclose all upfront fees, such as a monthly or setup fee. This transparency ensures consumers trust the counseling process and safeguard their financial health without encountering hidden costs.

The Adviser-Client Relationship: A Partnership for Prosperity

The relationship between a credit adviser and their client is foundational to successful financial recovery. It’s a partnership built on trust, with the adviser providing guidance and the client taking proactive steps toward achieving their financial goals.

The Verdict on Credit Advising

Credit advising has proven to be essential for many seeking to navigate financial difficulties. The value it adds in terms of personalized advice and support in managing debt is immeasurable for those looking to rebuild their credit and financial health.

Evaluating the Effectiveness of Credit Counseling Services

The effectiveness of credit counseling hinges on personalized advice and the strategic management of debt. Services that maintain nonprofit status often prioritize client education and debt management without the pressure of generating profits, aligning closely with consumer interests.

Achieving Long-Term Financial Stability with Expert Guidance

Expert guidance from a credit adviser can be pivotal in achieving long-term financial stability. Their knowledge and support provide the foundation for making informed decisions and maintaining financial discipline over time.

Conclusion: Is a Credit Adviser Right for You?

If you’re struggling with credit card debt, a credit adviser can help formulate a financial plan tailored to your situation. These professionals offer a blend of credit and financial education, budgeting strategies, and debt management plans designed to facilitate debt reduction and foster financial literacy.

Selecting a credit adviser should involve diligent research, including checking their standing with the business bureau and reviewing client testimonials. Your choice will significantly influence your financial recovery journey and your ability to achieve long-term financial health.