Table of Contents

As someone who’s navigated the choppy waters of personal finance for decades, I understand the importance of staying on top of bill payments. The best bill reminder apps offer a robust bill manager, allowing you to track payment history, manage recurring bills, and gain valuable insights into your finances. With precise bill reminders and an advanced bill tracker, you can ensure payment reminders for recurring payments are handled efficiently, helping you meet financial goals and honor financial commitments.

Navigating the World of Bill Reminder Apps

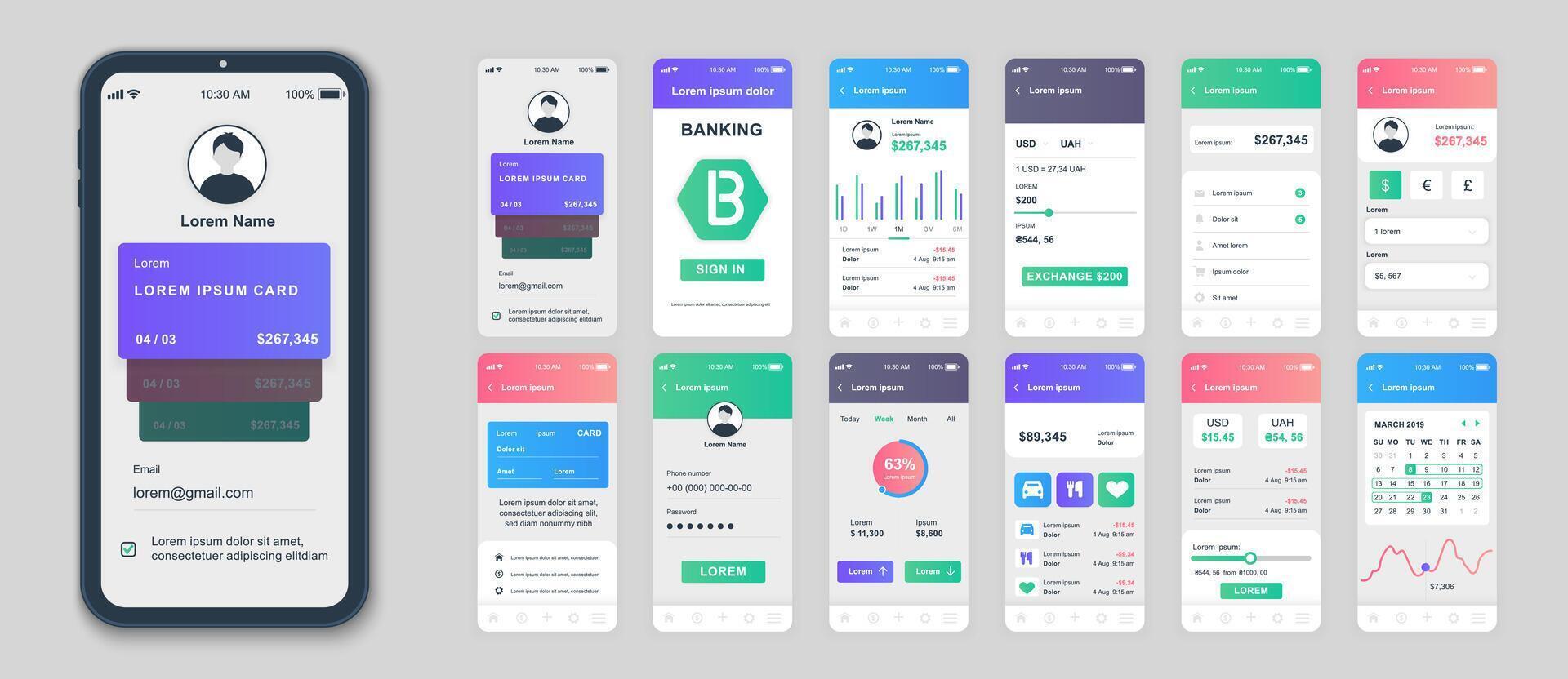

In my experience, managing bills effectively requires tools that adapt to our lives. The proper bill reminder app should offer automatic bill features for financial management, like chronicle reminders and a forecast view with intelligent estimated billing periods. It should also support multiple payment options for accounts management and help you maintain control over your financial obligations on Android and iOS platforms.

Evaluating App Features for Effective Bill Management

An app must provide a clear payment history to manage your financial commitments adeptly. This transparency allows you to identify spending patterns and adjust your budget accordingly, aligning with your broader financial vision and ensuring your path toward financial freedom remains unobstructed.

Track Your Expenses with Precision

A bill tracker that meticulously maintains a comprehensive record of your expenses furnishes you with the ability to scrutinize your financial habits. This precision in tracking and payment history helps formulate a budget that aligns with your finances, ensuring every dollar is accounted for.

Avoid Late Payment Fees and Keep a Clean Financial Slate

One of the most valuable insights from using payment reminders is avoiding late fees. By setting shared bill reminders at least seven days in advance, you can ensure timely payments, maintain a clean financial slate, and edge closer to your financial goals with each on-time payment.

Live a Debt-Free Life by Staying on Top of Bills

Staying vigilant with bill reminders is a crucial step in averting debt accumulation. An app that efficiently manages shared bills can help you avoid the pitfalls of late payments, ensuring that you remain on a steadfast course toward a debt-free existence.

Top Picks for Reliable Bill Reminder Apps

Choosing the right tool from the best bill reminder apps can be daunting. However, the essence lies in selecting an app that resonates with your personal finance management style and helps you organize bills efficiently, ensuring no upcoming payment slips through the cracks.

1. BillOut – Simplifying Your Monthly Bill Payments

BillOut stands out as an organizer app designed to streamline monthly bill payments. It caters to the need for simplicity in personal finance, helping users manage money more effectively by providing a comprehensive overview of their financial responsibilities.

2. Chronicle – Your Partner in Personal Finance Management

Chronicle is your ally, offering a suite of tools that encompass a detailed view of your finances. The app excels in chronicling your spending and ensuring that each financial commitment is met with diligence and foresight.

3. TimelyBills – Empowering You to Manage Money Smartly

TimelyBills is an app that lives up to its name, empowering you to make smart decisions with your money. It keeps you informed of upcoming bills and aids in establishing a routine for managing your finances proactively.

4. Cushion – The Financial Cushion You Need

The cushion provides a safety net, offering a buffer against financial surprises. It helps you to absorb the impact of irregular bills and unexpected financial hiccups, ensuring your path toward financial stability remains steady.

5. Bill Tracker Pro – Ultimate Control Over Your Bills

Bill Tracker Pro emerges as an apt bill organizer for those seeking comprehensive control. It provides an in-depth look at your bills and payments, affording you the oversight needed to make informed financial decisions.

Security and Privacy Concerns

Security is paramount when it comes to financial apps. A credible bill reminder app must prioritize your data’s protection, ensuring that your sensitive financial information is guarded against unauthorized access.

100% Secure Money Management

In money manager apps, a promise of 100% security is non-negotiable. The best apps employ stringent security measures to safeguard your financial data, giving you peace of mind as you navigate your monetary affairs.

Data Not Linked to Personal Identifiable Information

The bill reminder apps you use mustn’t link your financial data to personally identifiable information. This separation is a critical component of data protection, ensuring your privacy is upheld while you manage your finances.

Accessibility and Compatibility

Everyone must have access to the tools necessary for managing their finances, including reminders for regular bills like car payments. That’s why ensuring bill reminder apps are accessible to all users, regardless of their device or technical know-how, is a top priority.

Ensuring App Availability for All Users

An app’s value is tied to its availability. Whether you’re juggling a car payment or multiple subscriptions, the app must be within reach, ready to serve users from various demographics and with different needs.

Age Rating and Category Considerations

When choosing a bill reminder app, it’s crucial to consider the age rating to ensure it’s appropriate for all members of the household who might need to manage a payment, especially for shared expenses like car payments.

App Size and Device Compatibility

The effectiveness of a bill reminder app is also measured by its compatibility with various devices and its size, ensuring it doesn’t impede the device’s performance while managing critical payments.

Making the Most of Your Bill Reminder App

I’ve discovered that the key to financial health is utilizing every feature offered by your bill reminder app, especially when sending timely reminders for obligations such as car payments.

Key Features that Set Apart the Best Apps

The best apps stand out by how they aid in financial management; this includes not just tracking bills but also providing insightful analytics and reminders for upcoming car payments and more.

50+ Features to Improve Your Financial Health

Imagine an app that reminds you of your car payment and offers over 50 features designed to bolster your financial well-being, from budgeting to expense tracking.

The Verdict on the Best App for Bill Reminders

After diligent research and analysis, I’ve concluded that the best bill reminder app is one that excels in sending timely reminders and functions seamlessly as a mobile application, catering to all your financial tracking needs.

Why User Ratings and Reviews Matter

User ratings and reviews provide invaluable insights into how a mobile application performs in real-world scenarios, including its reliability in sending timely reminders for crucial payments.

Deciding on the Best App Based on Community Feedback

Community feedback is a powerful indicator of an app’s effectiveness, particularly in how well it assists users in managing their finances and sending timely reminders for their car payments and other bills.

Embrace Financial Freedom with the Best Bill Reminder Tool

Financial freedom starts with mastering the basics, and a top-tier bills reminder app is your ally in this journey. It’s crucial to track your income and ensure that reminders for upcoming bills are in place, so you never miss a payment again. With the right iOS app, users of iOS devices can enjoy secure access to their financial schedules, confidently managing unpaid bills with ease. Embrace the peace of mind that comes from knowing every due date is accounted for, and take the first step towards a life unencumbered by financial stress.