Table of Contents

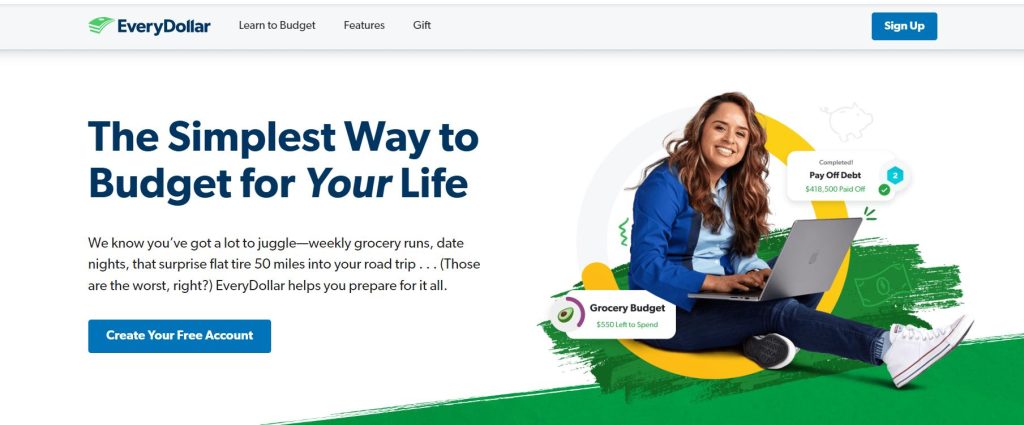

The EveryDollar app stands as a beacon of hope, guided by the principles of Dave Ramsey embarking on the journey to financial freedom. This budgeting app helps users allocate every dollar with intention, ensuring that each cent contributes to their financial goals. Whether you’re a seasoned budgeter or new to personal finance, EveryDollar simplifies the process, making it accessible for all to master their budget with ease.

Understanding the EveryDollar Budgeting App

At its core, the EveryDollar app, inspired by Dave Ramsey’s philosophy, encourages proactive finance management. It’s more than just one of the many budgeting apps; it’s a tool that empowers users to give every single dollar a purpose. Its streamlined interface allows users to connect to their financial lives and plan for the future with clarity and confidence.

The Philosophy Behind EveryDollar’s Budgeting Approach

The EveryDollar app is rooted in the zero-based budgeting method, ensuring that every dollar earned is assigned a role, whether it’s for expenses, savings, or investments. This philosophy aligns with the belief that planning leads to better financial outcomes and personal empowerment.

Comparing Zero-Based Budgeting to the 50/30/20 Strategy

Zero-based budgeting, embraced by EveryDollar, differs from the 50/30/20 strategy by requiring meticulous allocation of monthly spending. Unlike dividing expenses and savings, it demands specific attention to debt payments, ensuring minimum payments are met, and aligning money goals with actual financial activity.

Setting Up Your EveryDollar Budget

To harness the power of EveryDollar, setting up a personalized budget is the first step. This process involves defining financial priorities and preparing a plan that reflects one’s unique financial landscape, paving the way for a secure financial future.

1. Inputting Your Monthly Income

When inputting your monthly income, EveryDollar prompts you to lay the groundwork for your financial plan. This crucial step allows you to visualize your financial capacity and strategize how to plan for your money effectively each month.

2. Customizing Your Budget Categories

Flexibility within EveryDollar is evident as users can customize budget categories to match their monthly income and spending habits. This ensures every category is tailored to their life, making budgeting more relevant and effective.

3. Allocating Funds to Your Four Walls First

With EveryDollar, a fundamental step is prioritizing essential expenses. Allocating funds to ‘your four walls’, such as rent or mortgage, ensure stability and peace of mind, setting the stage for a budget that supports your basic needs.

4. Identifying and Adding Month-Specific Expenses

EveryDollar also caters to the fluid nature of life by allowing for the inclusion of month-specific expenses. This ensures that seasonal costs or unexpected events are accounted for, maintaining the accuracy and reliability of your budget.

Managing Expenses with EveryDollar

Effective management of expenses is central to budgeting with EveryDollar. The app’s design supports users in tracking and adjusting their spending, making it possible to stay on top of their financial game every month.

Listing All Monthly Outgoings

EveryDollar encourages a complete overview of outgoings, enabling users to list all monthly expenses. This comprehensive view is essential to plan for your money effectively and avoid financial surprises.

• Fixed Expenses

Tracking fixed expenses is straightforward with EveryDollar. Money coming in is easily matched with regular payments set aside, such as for an emergency fund, ensuring that your financial commitments are always met.

• Variable Expenses

For variable expenses, EveryDollar’s flexibility shines. It allows users to adjust their budget as money coming in fluctuates. Users can set aside money for an emergency fund or other priorities, adapting to changes in their spending patterns.

• Periodic or Semiannual Costs

EveryDollar also caters to the planning of periodic or semiannual costs, ensuring these are integrated into the budget. This foresight prevents financial strain during months when these expenses are due and supports a balanced financial plan year-round.

The Role of a Monthly Expenses Checklist

A monthly expense checklist is a component that is crucial in budgeting with EveryDollar, ensuring that all financial obligations are accounted for and prioritized. Users can prevent oversights and maintain a comprehensive overview of their financial commitments by systematically listing anticipated monthly expenses. This checklist enables effective expense tracking and facilitates adjustments to spending in real time, aligning with the app’s goal of empowering users to achieve their financial objectives.

Navigating EveryDollar’s Features

The EveryDollar app offers a suite of features designed to streamline budget management. From creating customizable budget categories to tracking spending trends, the app provides users with tools to tailor their financial plans to their unique needs. Users can easily navigate these features, thanks to a user-friendly interface that simplifies the complex budgeting process into manageable steps, making financial control more accessible to everyone.

1. Simplifying Expense Tracking Through Bank Connectivity

The premium version of EveryDollar enhances the experience of managing personal finances by offering bank connectivity. This feature simplifies expense tracking by automatically importing transactions, which syncs with paycheck planning strategies. Users can benefit from the convenience of having their expenses tracked in near real-time, allowing for more accurate budgeting and a clearer picture of their financial health.

2. Adjusting Your Budget as Needs Change

Flexibility is at the heart of EveryDollar’s design, acknowledging that financial situations are dynamic. Users can easily adjust their budgets as their needs change, whether due to unexpected expenses or changes in income. This adaptability ensures that users can stay on top of their finances and make informed decisions, keeping their budget relevant and effective over time.

3. Using EveryDollar Across Devices: Android and iOS Accessibility

EveryDollar’s cross-platform compatibility ensures that budgeting apps like it are widely accessible. Whether on Android or iOS devices, users can access their budgets, track spending, and make adjustments on the go. This accessibility underscores the principles of Dave Ramsey’s approach to personal finance, empowering users to maintain financial discipline regardless of the device they use.

Maintaining Your Budget Throughout the Month

Maintaining a budget requires diligence and consistent oversight. EveryDollar equips users with the tools to manage their finances effectively, enabling them to track progress towards paying off debt and ensuring that income minus expenses results in a sustainable financial plan. Regular monitoring and adjustments ensure that users can stay on track with their financial goals throughout the month.

Monitoring Your Spending by Tracking Transactions

EveryDollar fosters control of your finances by enabling users to track expenses diligently. The version of EveryDollar with bank connectivity offers a seamless way to monitor transactions, but users can also enter each transaction manually for greater oversight. By recording each expenditure, users can identify spending patterns and make informed decisions to optimize their budget.

Automatic Transaction Imports

For users of the premium version of EveryDollar, automatic transaction imports offer a hassle-free method of keeping track of expenses. This feature captures and categorizes bank transactions, reducing the time spent on manual entries and ensuring that all expenses are accounted for. It’s an efficient way to maintain budgeting accuracy and to stay informed about where money is going.

Manual Entry for Greater Control

For users who prefer hands-on budget management, EveryDollar provides the option for manual entry of transactions. This method gives users complete control over the categorization and recording of their spending, enabling a more personalized and detailed understanding of their financial habits. Manual entry can be particularly beneficial for those who wish to engage more deeply with their budgeting process.

Preparing for the Next Month with EveryDollar

EveryDollar encourages users to be proactive, allowing them to prepare for upcoming months with ease. As the current month winds down, individuals can review their budgets, adjust for anticipated changes, and set clear financial targets for the days ahead. This foresight facilitates smoother transitions into new budgetary periods, ensuring users are never caught off guard by recurring expenses or irregular income patterns.

Evaluating EveryDollar’s Service Options

Darryl helps his audience understand that choosing the right service level is crucial for an optimal budgeting experience. EveryDollar offers distinct options tailored to users’ varying needs, from the basics of budgeting to more advanced features. Evaluating these service options requires careful consideration of personal financial goals and the tools necessary to achieve them.

Comparing Free and Premium Versions

The EveryDollar app provides free and premium versions, each with unique benefits. The free version is a robust starting point for beginners, while the premium version, EveryDollar Plus, includes additional features like bank connectivity. Users can start with a 14-day free trial to experience the premium benefits before committing financially.

Assessing the Value of EveryDollar Subscription Costs

When assessing EveryDollar’s subscription costs, Darryl emphasizes the importance of weighing the app’s advanced budgeting capabilities against its price. The premium version’s tools, such as automated transaction tracking and personalized reports, can be invaluable for those dedicated to achieving their financial objectives and may justify the investment.

Pros and Cons of Using EveryDollar

Every dollar, like any budgeting tool, has advantages and limitations. Users must consider these carefully to determine if the app aligns with their personal finance strategies and can genuinely aid in achieving money goals.

Pros

The EveryDollar app is praised for its strengths, which contribute significantly to the positive experiences reported by many users. These advantages include a user-friendly interface and effective integration with proven financial principles.

• User-Friendly Interface

Users often highlight EveryDollar’s user-friendly interface, noting its simplicity and ease of navigation. Even those new to budgeting find the app’s design intuitive, which enhances their financial management experience and helps maintain their budgeting momentum month after month.

• Integration with Ramsey Solutions’ Financial Principles

EveryDollar stands out for its seamless integration with Ramsey Solutions’ financial principles. This includes guidance on debt payments and lessons from Financial Peace University, offering users a comprehensive approach to achieving and sustaining financial peace.

Cons

Despite its numerous benefits, EveryDollar has aspects that may not work for everyone, which is essential for potential users to acknowledge when considering the app.

• Potential Connectivity Issues with Accounts

Some users of the premium version have experienced connectivity issues with their financial accounts, which can affect the efficiency of paycheck planning. These intermittent technical glitches are essential to consider if continuous, automated budget tracking is a priority.

• Limitations in Financial Goal Customization

While EveryDollar assists in setting up a budget, certain users may find limitations in financial goal customization. Personalized money goals and teachings from Financial Peace University may not be as deeply incorporated as some users would prefer, presenting a potential hurdle for complex financial planning.

Making an Informed Decision About EveryDollar

Deciding whether EveryDollar suits one’s financial needs involves an assessment of personal budgeting habits, desired features, and the value placed on the app’s educational resources. Darryl’s guidance can help users make informed decisions that align with their financial aspirations.

Is EveryDollar the Right Choice for Your Financial Needs?

Darryl helps his readers understand that the right choice in a budgeting app is subjective and must align with individual financial needs. EveryDollar may be the perfect tool for those who value structured budgeting methods and the philosophies of Ramsey Solutions.

Incorporating Feedback and Sharing Your Experience

Sharing experiences and incorporating feedback are integral parts of the EveryDollar community. Users can gain insights from others’ experiences, which can help refine their budgeting practices and contribute to the app’s continuous improvement and user satisfaction.

Community Insight: Is Every Beneficial for Users?

The community’s insight reveals a consensus that EveryDollar has been beneficial for many users. The app’s ability to simplify budgeting and enforce financial discipline is frequently lauded, though individual experiences vary based on personal finance complexity and user engagement.

Finishing Thoughts: How to Use EveryDollar App

As users reach the end of their journey with EveryDollar, it becomes clear that the app provides a structured and proactive approach to personal finance. With a user-friendly interface and a strong emphasis on zero-based budgeting, EveryDollar stands out as a powerful tool for individuals looking to take control of their money. It’s more than just an app; it’s a financial planning partner that encourages users to allocate every dollar purposefully, ensuring not a single cent goes unaccounted for.