Table of Contents

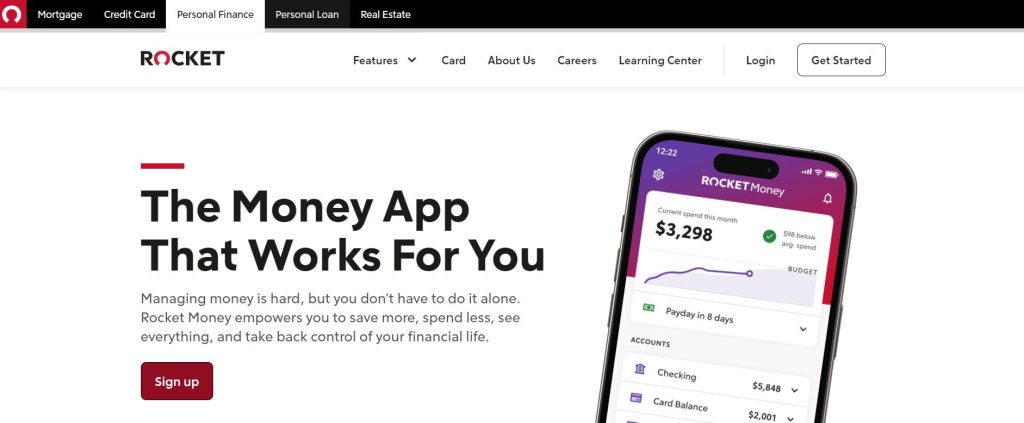

Is rocket money safe? When it comes to navigating the complexities of personal finance, the safety of the tools we use is paramount. Rocket Money, as a comprehensive management and budgeting app, understands this and has implemented security measures to protect sensitive data. With bank-level 256-bit encryption, the app safeguards information related to checking accounts, card accounts, and investment accounts. Rocket Money offers a free version and a premium subscription, both designed to assist users in managing their financial life, from tracking student loans to planning for upcoming bills.

The premium version of Rocket Money, in particular, provides enhanced features for those looking to dive deeper into their finances. A premium Rocket Money subscription grants access to advanced budgeting tools, dedicated financial advisor support, and the ability to negotiate bills directly through the app. Moreover, Rocket Money is a bill management subsidiary of Rocket Companies, which also offers the opportunity to consolidate mortgage with Rocket, thereby streamlining various aspects of one’s financial life and saving money. Rocket Money’s commitment to safety and financial security is reflected in its robust features and diligent protection of user data.

Comprehensive Rocket Money Overview

Rocket Money is an online financial service that streamlines personal finance management. Offering both a free tier and a premium subscription, it caters to a broad spectrum of financial needs. With features like automated savings, and the ability to diversify your portfolio, Rocket Money positions itself as a versatile tool for managing your monthly finances, from subscription service oversight to mastering card debt.

Weighing the Pros and Cons of Rocket Money

Weighing the pros and cons of Rocket Money is crucial for users to understand its overall efficacy in financial management. This comparison will highlight the app’s strengths and areas where it may fall short.

- The pros of Rocket Money include its user-friendly interface, which simplifies financial tracking and budgeting. Its bill negotiation feature can lead to significant savings, and the subscription management tool helps users avoid unwanted renewal charges. Additionally, the app’s ability to provide spending insights helps users make informed decisions about their finances.

- On the downside, some of Rocket Money’s best features are behind a paywall, which may limit access for users not wishing to upgrade. Additionally, the speed and performance of the app may vary, potentially affecting the user experience. Users must weigh these considerations against the benefits to decide if Rocket Money meets their personal finance management needs.

How Rocket Money Streamlines Your Finances

Rocket Money simplifies the financial landscape for users by providing a centralized platform to manage subscriptions and bills, track spending insights, and create custom categories for budgeting. Its user-friendly interface allows for quick setup, often in under 10 min, making it an accessible personal finance management tool for individuals at all stages of their financial journey. Users can easily connect their card accounts, investment accounts, and checking accounts, enabling them to get a comprehensive view of their financial profile and make informed decisions aimed at saving money and reducing recurring monthly expenses.

The Evolution of Rocket Money

Since its inception, Rocket Money has evolved to meet the changing needs of its users. Founded in 2015, the app has consistently expanded its features to provide a more holistic approach to personal finance management.

What Was Rocket Money Called Before?

Before rebranding to Rocket Money, the service was known as Truebill. Truebill established itself as a reliable app for tracking expenses and managing subscriptions. The change to Rocket Money marked a new chapter in the app’s evolution, with an enhanced focus on a wider array of financial tools and services designed to help users gain greater control over their financial life.

Why Did Truebill Change to Rocket Money?

The transition from Truebill to Rocket Money was driven by the desire to align more closely with the broader portfolio of services offered by Rocket Companies. This rebranding reflected an expansion of services beyond subscription management, including new features for budgeting, bill negotiation, and spending insights. The change also signified a commitment to providing a seamless and integrated financial experience for users, leveraging the expertise and resources of Rocket Companies.

Key Features of Rocket Money

Key features of Rocket Money include subscription management, bill negotiation, and powerful budgeting tools that offer users spending insights and personalized financial guidance. These core functionalities work in tandem to help users manage their financial profile more effectively.

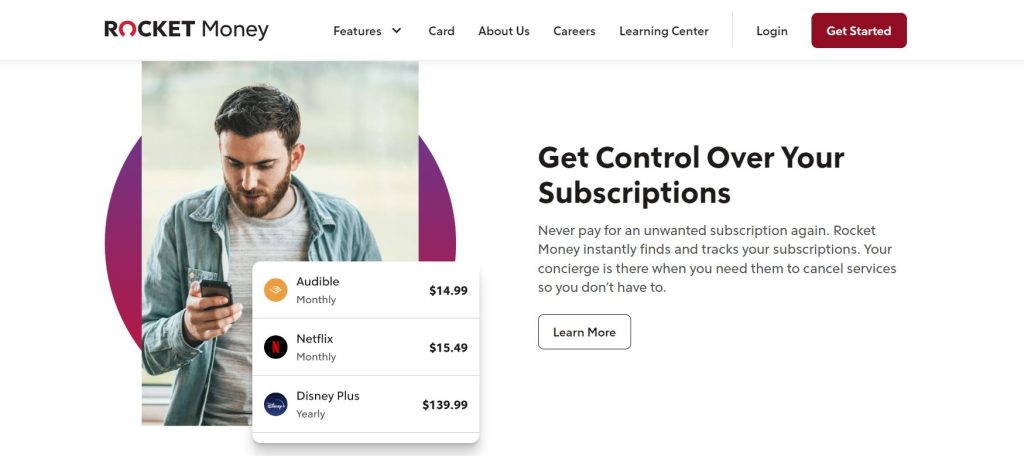

• Subscription Management

Rocket Money excels in helping users identify and cancel unwanted subscriptions. By monitoring recurring payments, the app ensures that users are only paying for services they actively use. The intuitive interface allows users to upload a copy of their bills, and Rocket Money’s customer service then takes over the process of subscription cancellation, streamlining the experience and potentially saving users significant amounts of money over time.

• Bill Negotiation

One of Rocket Money’s standout services is its bill negotiation feature. Rocket Money charges a fee only if savings are found, making it a risk-free option for users to lower their bills. The app’s customer service team conducts negotiations on the user’s behalf, and if successful, a percentage of the savings as an upfront fee, typically around 10, is charged. This performance-based pricing model ensures that the interests of Rocket Money and its users are aligned.

• Budgeting Tools and Spending Insights

Rocket Money provides personal finance app users with unlimited budgets and spending insights that rival mint alternatives. These tools are designed to give users a clear picture of their financial habits, allowing for better planning and more effective money management. The app’s budgeting tools are user-friendly and customizable, making it easy for users to set financial goals and track their progress.

Unveiling Rocket Money Premium

The premium version of Rocket Money unlocks a suite of exclusive features for users seeking an elevated financial management experience.

• What Is Rocket Money Premium?

Rocket Money Premium is a subscription service that offers advanced financial tools, such as custom categories for tracking expenses, premium chat for on-demand customer service, and personalized financial advice. For a $95 annual fee, users can access these enhanced features to take full control of their financial life, making the premium Rocket Money subscription a valuable investment for those committed to optimizing their financial well-being.

• Exclusive Premium Features

Premium Rocket Money subscription users benefit from a range of exclusive features that go beyond basic budgeting and subscription management. These include a concierge service for hands-on financial guidance and the Rocket Visa Signature Card, which offers rewards and benefits tailored to the financial needs of savvy users. These premium features are designed to add value and convenience to the financial lives of subscribers, providing a comprehensive toolkit for money management.

Investigating Whether Is Rocket Money Safe?

As financial technology evolves, so does the importance of security within these platforms. An investigation into the safety of Rocket Money reveals robust measures in place to protect user data and privacy.

Is Rocket Money Legit?

Rocket Money’s legitimacy is established through its transparent business model, strong user reviews, and affiliation with Rocket Companies, a reputable name in the financial industry. The service’s commitment to user privacy and data security is further exemplified by its adherence to industry-standard encryption protocols and privacy policies. With a B rating and positive feedback from users, Rocket Money is recognized as a legitimate tool for personal finance management.

Protecting Your Personal Data with Rocket Money

Rocket Money understands that safeguarding your financial details is paramount. They employ robust security measures to ensure that your personal information remains secure. Users can rest easy knowing their data is handled with the utmost care, shielded from unauthorized access.

Encryption Standards and Data Protection

Rocket Money utilizes industry-standard encryption to protect user data. Their servers implement advanced security protocols to thwart potential breaches, ensuring that sensitive information such as bank account numbers and transaction histories are securely encrypted both in transit and at rest. This level of data protection is designed to provide users with peace of mind when managing their finances.

User Privacy Policies of Rocket Money

The privacy policies of Rocket Money are crafted with user confidentiality in mind. They are transparent about the data they collect and how it is used, never sharing personal information without consent. Their policies are in strict compliance with privacy laws, reflecting their commitment to user privacy and establishing a trustworthy environment for managing one’s financial landscape.

Utilizing Rocket Money Effectively

Effectively using Rocket Money can transform the way you handle your finances. From budgeting to bill negotiation, it offers a plethora of tools to streamline your financial life. Learning to leverage these features can lead to substantial savings and financial empowerment.

• Lowering Your Bills with Rocket Money

With Rocket Money, users can lower their bills, including car insurance payments, through strategic bill negotiation and subscription management. This empowers consumers to save money without compromising on the services they enjoy.

The Step-by-Step Process to Reduce Expenses

The Rocket Money app simplifies expense reduction with a user-friendly interface. It begins with an analysis of your spending, followed by identifying unnecessary subscriptions. The app then assists in canceling them or negotiating lower rates, effectively trimming down your monthly outlays and freeing up more money for saving or investing.

Seeking Refunds for Fees and Outages

Rocket Money aids in seeking refunds for various fees and service outages. If you experience issues with your phone service or both internet and phone services, the app can negotiate on your behalf to secure refunds or credits, ensuring you only pay for the services you actually receive.

• Mastering Subscriptions with Rocket Money

Mastering your subscriptions becomes effortless with Rocket Money. It provides an organized view of all your subscriptions, alerts before renewals, and helps cancel those you no longer use, ensuring you maintain control over your recurring expenses.

• The Cost of Rocket Money

The services offered by Rocket Money come at various price points, catering to different user needs. Whether opting for the free version or the premium, users can select the service tier that aligns with their financial management requirements.

Free vs Premium: Understanding the Differences

Rocket Money provides a free tier with essential features and a premium subscription that unlocks advanced tools. While the free version offers basic budgeting and subscription tracking, the premium tier includes Rocket Money charges for services like bill negotiation and subscription cancellation, providing a more comprehensive financial management experience.

Pay-What-You-Want Model for Users

Rocket Money’s pay-what-you-want model allows users to decide how much they value the service. This unique approach respects the privacy and financial data of users, giving them the autonomy to contribute an amount they feel reflects the utility and benefits they derive from using the app.

Assessing Rocket Money’s Benefits and Limitations

Assessing the benefits and limitations of Rocket Money requires a balanced view of its impact on managing financial accounts. We will explore the advantages and drawbacks to provide a comprehensive understanding.

Unique Selling Points of Rocket Money

Rocket Money shines with unique features that distinguish it from the sea of financial apps. Its intuitive platform helps users effortlessly manage their finances, while innovative tools work behind the scenes to save users money. With a focus on simplicity and effectiveness, Rocket Money offers a compelling suite of services that cater to the needs of modern consumers looking to optimize their financial health.

Money-Saving Features

One of the standout offerings of Rocket Money is its negotiation service, designed to lower bills by haggling with service providers on your behalf. This feature has helped numerous users reduce their monthly expenses without the hassle of personally dealing with customer service departments. By leveraging industry knowledge and negotiation tactics, Rocket Money’s service can lead to significant savings on recurring bills.

User-Friendly Interface and Technology

The app’s user-friendly interface allows for easy navigation and management of financial data, making it accessible for users of all tech proficiencies. With a clean design and simple layout, Rocket Money ensures that users can quickly find the features they need without becoming overwhelmed by complexity. The technology underpinning the app prioritizes user experience, ensuring that financial management is a smooth and hassle-free process.

Areas for Improvement in Rocket Money

While Rocket Money excels in many areas, there is room for growth. Feedback suggests that some of the most effective tools are only available behind a premium paywall, which could limit accessibility for users not willing to pay for the advanced services.

Best Features Behind Paywall

Features such as the subscription cancellation concierge, which aids in terminating unwanted subscriptions, and automatic savings plans, are part of Rocket Money’s premium offerings. Although these services are highly valued, some users feel that a sliding scale for pricing could make these premium features more accessible. Balancing the need for revenue with user inclusivity is an area where Rocket Money could refine its approach.

Speed and Performance of the App

Speed and app performance are crucial for a seamless user experience. While Rocket Money typically runs smoothly, there are occasional reports of lag or delays, especially during peak usage times. Enhancing the app’s performance to ensure consistent speed and reliability remains an important area for improvement, ensuring that users can manage their finances without interruption.

Comparing Rocket Money with Other Financial Tools

Understanding how Rocket Money stacks up against its competitors is key to evaluating its place in the financial app landscape. Comparisons with other tools reveal its strengths and weaknesses, helping users decide if it’s the right fit for their needs.

Rocket Money vs Competitors

When placed side by side with similar apps, Rocket Money’s features and user experience are scrutinized to pinpoint what sets it apart from the rest. This comparison is crucial for users to make an informed choice about their financial management tools.

• Rocket Money vs Mint

Mint is another popular financial tool, known for its budgeting prowess and expense tracking. While Mint offers comprehensive financial oversight, Rocket Money’s proactive money-saving features, such as bill negotiation, give it an edge for those looking to actively reduce their expenses. The choice between the two may come down to whether a user prioritizes tracking or saving.

• Rocket Money vs Monarch Money

Monarch Money is a relative newcomer that emphasizes investment tracking and net worth calculation. Rocket Money, on the other hand, focuses more on day-to-day financial management and saving on bills. Users looking for a tool to help with saving on regular expenses may prefer Rocket Money, while those interested in a broader investment perspective might lean towards Monarch Money.

Alternatives to Rocket Money

For those considering their options, there are several alternatives to Rocket Money, each with its own set of features and benefits. The choice often depends on individual financial needs and preferences.

• Rocket Money vs YNAB

You Need A Budget (YNAB) is renowned for its detailed budgeting system and educational resources. YNAB’s methodical approach to budgeting is ideal for users who want to be intimately involved with their finances. In contrast, Rocket Money provides a more hands-off experience, with features like automatic savings and subscription management that can appeal to users seeking convenience.

• Rocket Money vs Empower

Empower offers a suite of financial tools including budgeting, savings, and investment tracking. While Empower aims to be an all-in-one financial platform, Rocket Money’s niche is in finding and achieving savings for users. Those looking for a focused tool to lower bills might prefer Rocket Money’s specialized services.

Delving into Customer Experiences

Exploring real-life user experiences with Rocket Money provides valuable insights into the app’s effectiveness and customer satisfaction. These experiences are a testament to the app’s impact on users’ financial lives.

User Reviews: Real Feedback on Rocket Money

Customer reviews often highlight Rocket Money’s ability to save on auto insurance and praise the convenience of linking their cash app accounts for streamlined financial oversight. With many users rating the app at 5 stars, the positive feedback underscores the value that Rocket Money provides in simplifying and reducing financial burdens.

Customer Service Quality of Rocket Money

Rocket Money’s customer service has garnered attention for its efforts in assisting users with various financial concerns. While not directly linked to Rocket Loans, they share a commitment to user satisfaction. The support team works diligently to resolve issues, ensuring a positive experience for those utilizing their financial tools.

Accessibility of Live Support

The availability of live customer service support is crucial for users needing immediate assistance with their financial accounts. Rocket Money recognizes this need and provides various channels for users to reach out, including chat, email, and phone support. Their team is trained to handle a wide range of inquiries, making the user experience smoother and more reliable.

Evaluating Rocket Money’s Company Profile

Rocket Money operates with a clear focus on helping users manage their finances effectively. They work with users’ financial accounts to provide a comprehensive view of their fiscal health, empowering users to make informed decisions and achieve financial stability.

Behind the Scenes: Who Owns Rocket Money?

Ownership details of Rocket Money are a point of interest for many. As a private entity, the company is backed by investors who believe in its mission to simplify personal finance. The team behind Rocket Money is composed of industry experts who continuously innovate to improve financial management for users.

Rocket Money’s Business Model

Rocket Money’s business model hinges on providing value through its app, which offers users tools to manage their cell phone bills and other expenses. Their rating of 3 stars underscores their commitment to enhancing the financial well-being of their users.

How Does Rocket Money Make Money?

Rocket Money’s revenue is primarily derived from its premium services, which include advanced financial tools and personalized support. Users can opt for a subscription that aligns with their needs, enabling Rocket Money to cater to a range of financial management requirements while sustaining its business operations.

How Does Rocket Money Lower Bills?

Rocket Money employs a negotiation service that works on a sliding scale fee structure to help users reduce their monthly subscriptions and other bills. This concierge service leverages industry expertise and negotiation tactics to secure the best possible rates, translating to savings for the user.

Practical Insights and User Guides

For those looking to optimize their finances, practical guidance on tools like Rocket Money can be invaluable. The app’s compatibility with various accounts, including Roth IRAs, demonstrates its versatility in managing a diverse range of financial assets.

Getting Started with Rocket Money

Embarking on the journey with Rocket Money begins with a straightforward setup process, designed to integrate seamlessly with users’ financial lives.

How to Add Your Apple Card to Rocket Money

Addition of the Apple Card to Rocket Money is a simple process that users can complete on their iOS or Android devices. By following a few easy steps, users can link their Apple Card to the app, allowing for a consolidated view of their spending and better financial management.

How to Cancel Rocket Money Subscription

Cancelling a Rocket Money subscription requires users to navigate through the app’s settings. The process is designed to be user-friendly, with step-by-step instructions ensuring that users can discontinue their subscription without unnecessary complications.

Keeping Informed: Rocket Money FAQs

Staying informed about the features and functionalities of the Rocket Money app can greatly enhance user experience. The app’s FAQ section is a valuable resource for addressing common questions and concerns.

The Rocket Money app’s FAQs provide quick answers to common questions, helping users to navigate the app more effectively and make the most of its features.

Subscription Management Queries

Managing unwanted subscriptions and recurring payments is a frequent concern among users. Rocket Money offers a solution by allowing users to upload a copy of their bills, which the app then analyzes to identify potential savings and cancel unnecessary subscriptions efficiently.

Billing and Premium Features Inquiries

Questions about basic budgeting and subscription management are common among Rocket Money users. The app’s concierge service offers personalized support for these queries, and with the Rocket Visa Signature Card, users can enjoy additional benefits tailored to their financial needs.

Final Verdict on the Safety of Rocket Money

After careful consideration, it is clear that Rocket Money prioritizes user security. With robust encryption standards and a commitment to protecting personal information, Rocket Money demonstrates a strong security posture. While no platform can guarantee absolute safety, Rocket Money’s measures align with industry best practices, offering peace of mind to its users.

Bottom Line: The Trustworthiness of Rocket Money

Rocket Money stands out as a trustworthy financial tool, balancing powerful features with stringent security protocols to protect its users’ financial data.

Rocket Money: A Reliable Financial Companion?

Considering its comprehensive approach to security, Rocket Money can be seen as a reliable partner in managing personal finances. Its dedication to safekeeping user data, alongside features like subscription management and bill negotiation, make it a strong contender in the personal finance space.

Continuing Your Financial Education

As the financial landscape evolves, so should one’s financial literacy. Staying informed about the latest tools and resources, such as Rocket Money, is crucial. By embracing continuous learning and leveraging modern financial applications, individuals can make more informed decisions and achieve their financial goals more effectively.

Best Investing Apps of 2024

The current year has brought forward a variety of investing apps, each offering unique features for different investment styles. Among these, online brokers have been particularly innovative, providing users with intuitive platforms to diversify their portfolios and access to expert advice, making investment more accessible to the masses.

Improving Credit Scores: Tips and Tricks

Building a strong credit score is essential for financial health. Timely payments, maintaining low credit utilization, and regularly checking credit reports for errors are just a few strategies. Additionally, using budgeting tools like Rocket Money can help manage debts and expenses, contributing to a better credit score over time.

The Last Word: Is Rocket Money the Right Choice for You?

Deciding if Rocket Money is the right choice depends on individual financial situations and needs. It’s important to assess whether its features align with your financial goals, and if the convenience and potential savings justify choosing Rocket Money over other financial management tools.

Making an Informed Decision on Rocket Money

Choosing Rocket Money requires weighing its benefits against personal financial requirements and preferences.

Considering Your Financial Needs and Goals

When evaluating Rocket Money, it’s crucial to consider how it aligns with your financial goals. Does it offer the tools and features you need to manage your finances effectively? Understanding the impact it can have on achieving your goals is key to making an informed decision.

Weighing the Value of Rocket Money’s Services

Rocket Money’s value lies in its ability to simplify financial management. With features like bill negotiation and spending insights, it can potentially save users money and time. However, it’s important to consider the cost of its premium services and determine if the benefits outweigh the expense for your specific financial situation.