Table of Contents

In the competitive arena of personal finance management, NerdWallet and Credit Karma stand as giants, offering tools that cater to the nuanced needs of modern consumers. Their platforms are not just about providing credit scores; they extend to comprehensive financial guidance, from choosing the right car loan to crafting a budget that fits one’s lifestyle.

As we navigate the complexities of the financial landscape in 2024, the functionality and features of these services become increasingly vital. Both platforms promise to empower users with the knowledge and resources to make informed financial decisions.

Introduction to Personal Finance Management Tools

Personal finance management tools are essential for individuals looking to take control of their financial futures.

The Role of Personal Finance Software in Today’s Economy

Quicken Deluxe and similar software play a pivotal role in maintaining financial health, offering insights into scores and credit reports.

Necessity of Credit Monitoring and Financial Planning

Regularly checking credit scores has become indispensable for modern financial planning and security.

Credit Karma vs NerdWallet: Core Features Compared

Both NerdWallet and Credit Karma offer robust credit score tracking, rivaled only by services like Credit Sesame.

1. Credit Score Services (Rocket Money)

These platforms not only provide credit scores but also tools to build your credit, align with Rocket Money principles, and understand credit card issuers.

Pros of NerdWallet’s Credit Score Features

NerdWallet excels in offering in-depth analyses of credit scores, which can be crucial in identifying potential areas for improvement. Their credit score feature provides a comprehensive breakdown, making it easier for users to understand the factors influencing their credit health.

Cons of NerdWallet’s Credit Score Features

However, some users may find NerdWallet’s credit scores feature slightly overwhelming due to the abundance of information, potentially confusing for those new to credit management.

Pros of Credit Karma’s Credit Score Features

Credit Karma shines with its user-friendly interface, presenting credit scores in an accessible manner. This simplicity is especially beneficial for individuals who are just starting to navigate their credit health.

Cons of Credit Karma’s Credit Score Features

On the flip side, Credit Karma’s simplification of credit scores might omit some nuanced details that could be important for users seeking a deeper understanding of their credit profile.

2. Budgeting and Expense Tracking

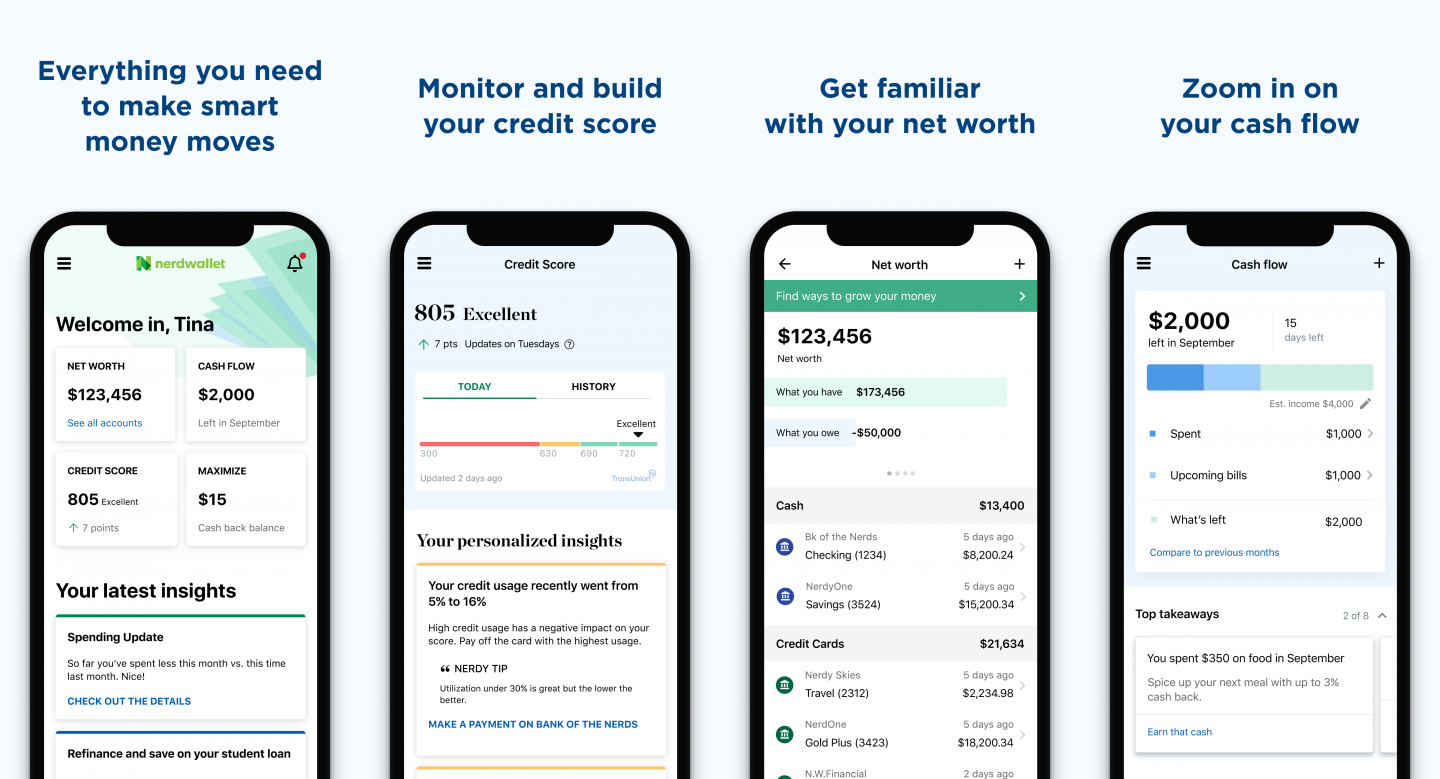

Effective budgeting hinges on balancing cash flow, monitoring income and expenses, and leveraging tools like the NerdWallet app and income and expense tracking features. These services often allow accounts to track across various platforms, including rewards cards, and help categorize your expenses for a clearer financial picture.

Pros of NerdWallet’s Budgeting Tools

NerdWallet’s budgeting app is complemented by its tax filing capabilities and educational content, offering unparalleled customer service. Their income and expense tracking tools are intuitive, aiding users in developing a clear budget plan and financial literacy.

Cons of NerdWallet’s Budgeting Tools

Despite these strengths, NerdWallet’s budgeting app could improve its tax filing integrations. Additionally, some users may desire more personalized customer service and educational content that delves into more advanced financial topics.

Pros of Credit Karma’s Budgeting Tools

Credit Karma’s budgeting tools stand out for their user-friendly design and effective income and expense tracking, making it simple for users to stay on top of their finances without feeling overwhelmed.

Cons of Credit Karma’s Budgeting Tools

However, users looking for more sophisticated features in budgeting may find Credit Karma’s tools to be too basic, lacking in-depth customization options for more complex financial scenarios.

3. Financial Advice and Resources

As a seasoned financial planner, I understand the importance of robust financial advice and resources. These tools are instrumental in managing cash flow, enhancing financial literacy, and tracking financial transactions. They’re the backbone that supports informed financial decisions and long-term economic stability.

Pros of NerdWallet’s Financial Resources

NerdWallet shines with its comprehensive customer service, offering personalized advice that caters to diverse financial needs. Their resources provide in-depth analyses and user-friendly guides that empower individuals to make well-informed financial decisions, from choosing credit cards to optimizing investments.

Cons of NerdWallet’s Financial Resources

While NerdWallet offers extensive resources, they can sometimes overwhelm novices with their complexity. The sheer volume of information may be daunting, and some users may find it challenging to locate specific guidance or advice tailored to their unique financial situations.

Pros of Credit Karma’s Financial Resources

Credit Karma excels in providing user-centric financial resources, particularly their clear and actionable insights into credit scores. Their tools are designed to demystify the elements that influence credit health, making it easier for users to improve their financial standings.

Cons of Credit Karma’s Financial Resources

However, Credit Karma’s focus on credit-related resources sometimes comes at the expense of a broader financial education. Users looking for expansive advice on topics beyond credit scores may need to seek additional resources to satisfy their comprehensive financial queries.

Safety and Security in Financial Apps

For anyone serious about their financial literacy, the security of financial transactions when using finance apps is paramount. Trusted platforms must prioritize protecting personal data to maintain user confidence and ensure the safe handling of sensitive information.

Ensuring Your Data is Protected with NerdWallet

My experience with NerdWallet has shown that they take data protection seriously, using robust encryption and security protocols to safeguard user data from unauthorized access and potential breaches.

Credit Karma’s Commitment to Security

Credit Karma’s dedication to security is evident in their vigilant monitoring systems and transparent privacy policies, which work together to protect users’ personal information and maintain trust in their service.

User Experience Showdown

In the realm of personal finance management, the user experience can make or break the effectiveness of a platform. A seamless interface is crucial for users to efficiently navigate and utilize the tools available to them.

Navigating NerdWallet’s Interface

Navigating NerdWallet’s interface has been a breeze in my experience, with its intuitive design and clear categorization of features enabling users to find the information they need with minimal effort.

The Usability of Credit Karma’s Platform

Credit Karma’s platform stands out for its usability, with a straightforward layout that simplifies the process of monitoring credit scores and finding tailored financial products.

Side-by-Side Comparison of Additional Features

When comparing NerdWallet and Credit Karma, it’s essential to look beyond the basics and examine the additional features that each provides to enrich the user’s financial journey.

Monitoring Investments with NerdWallet

Monitoring investments with NerdWallet has been a highlight for many users, as it offers detailed insights and performance tracking that cater to both new and experienced investors alike.

Tax Services Offered by Credit Karma

Credit Karma’s tax services have been widely appreciated for their ease of use and cost-effectiveness, simplifying the tax filing process for individuals across various financial situations.

Loan and Credit Card Comparisons

Both NerdWallet and Credit Karma provide comprehensive loan and credit card comparisons, helping users to make informed decisions by evaluating terms, rates, and rewards across multiple financial products.

In-Depth Analysis: Who Should Use NerdWallet?

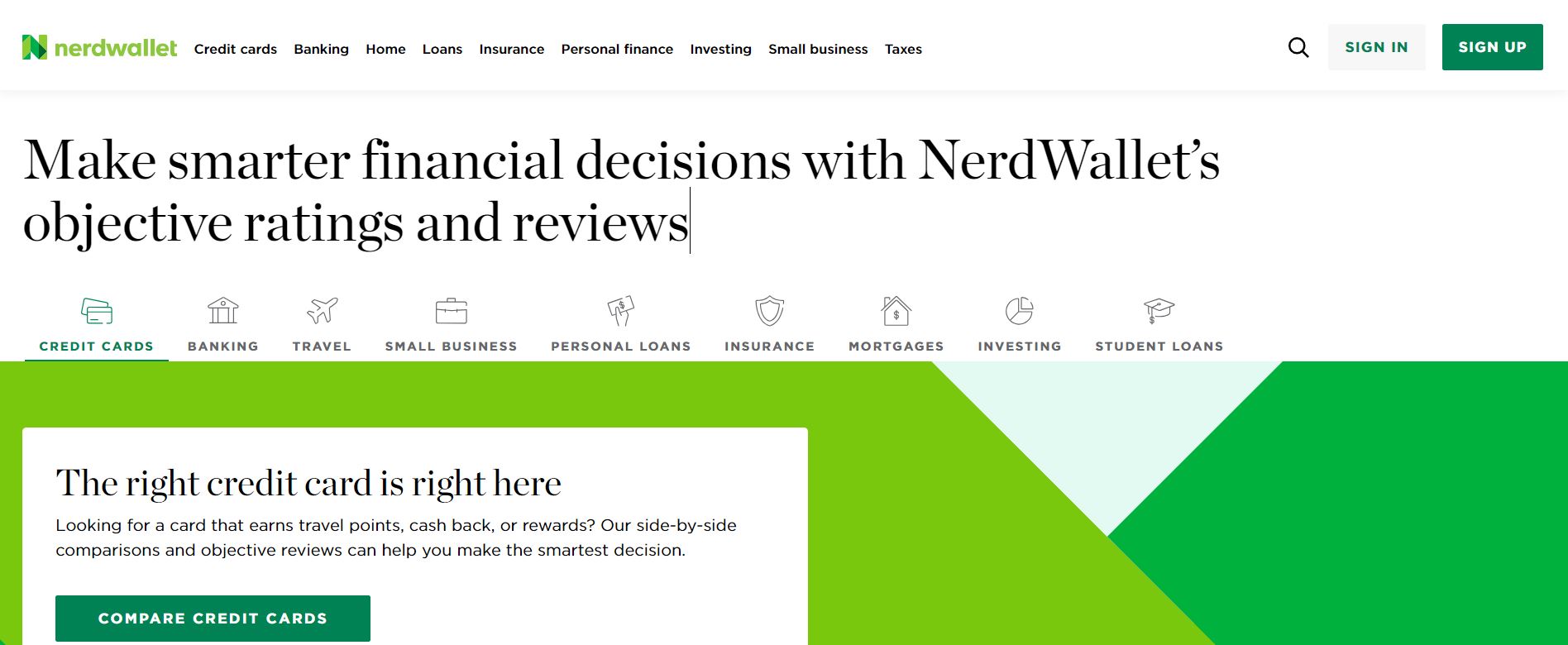

Individuals seeking comprehensive financial management should consider NerdWallet. It’s ideal for those who prefer a blend of hands-on tools and expert insights for making informed decisions about their financial life. Whether you’re crafting a financial plan, comparing financial institutions, or seeking personalized advice, NerdWallet provides a robust platform that caters to a variety of financial needs and goals.

Ideal User Profiles for NerdWallet

NerdWallet suits users who are serious about financial planning and prefer data-driven decisions. If you’re a detail-oriented individual who values in-depth analyses and comparisons of accounts and credit cards, NerdWallet’s detailed approach to personal finance apps can elevate your financial strategy. The platform offers a wealth of information for those who want to dive deep into their financial health.

When NerdWallet Might Be the Better Choice

NerdWallet shines for users who prioritize extensive financial resources and educational content. If you’re navigating complex financial decisions or want to connect to your financial accounts with an emphasis on security protocols, NerdWallet’s platform stands out. Its features cater to users who want to actively manage and improve their financial data in a secure environment.

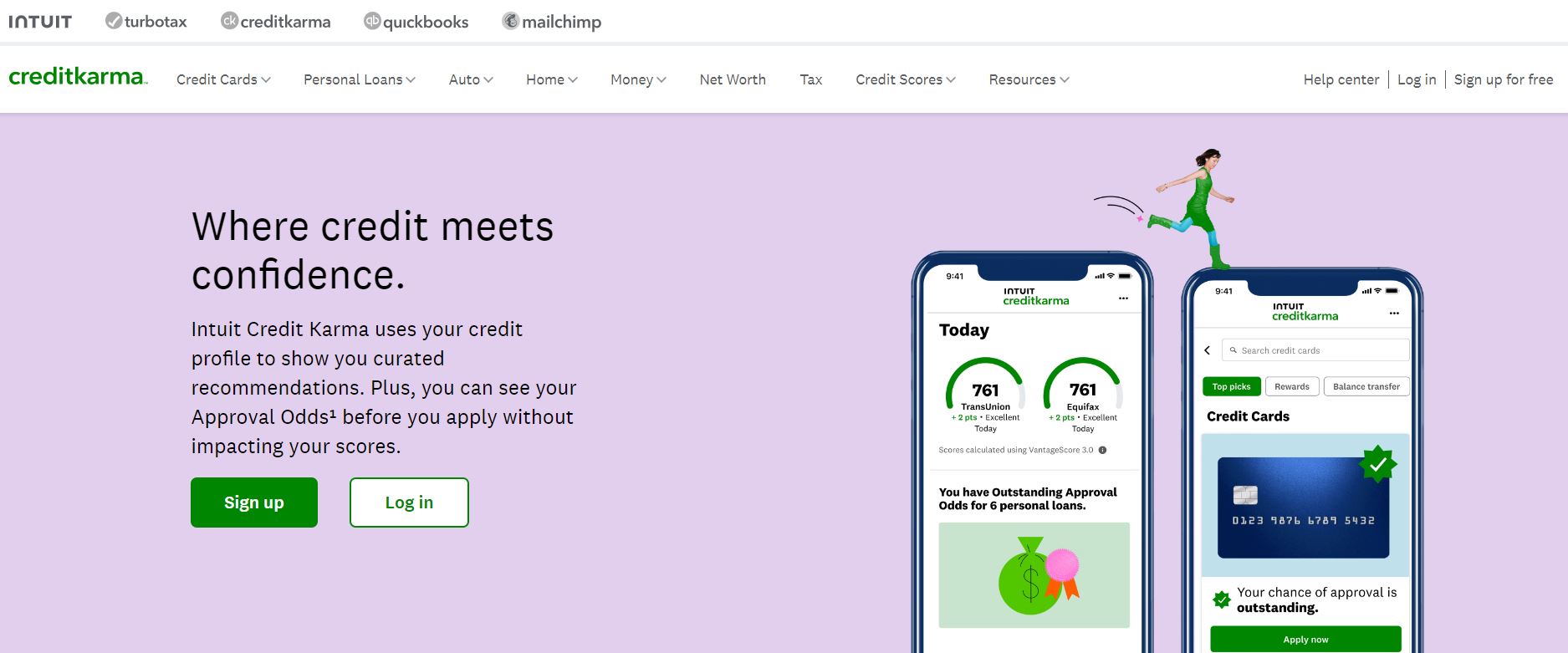

In-Depth Analysis: Who Should Use Credit Karma?

For individuals focused on credit monitoring and improvement, Credit Karma is a strong contender. It’s designed for users who appreciate real-time updates and actionable insights into their credit status. With a user-friendly interface and free services, Credit Karma is approachable for beginners and those keen on protecting themselves from identity theft without extra cost.

Ideal User Profiles for Credit Karma

Credit Karma is best suited for those new to managing their finances or who are primarily concerned with credit health. Its intuitive platform is perfect for users seeking simplicity and clarity in their credit reports and scores. Additionally, individuals interested in a password manager for their financial accounts may find Credit Karma’s offerings particularly appealing.

Situations Where Credit Karma Excels

Credit Karma excels in scenarios where users need regular credit score updates and personalized recommendations. Those looking to apply for loans or credit cards will benefit from Credit Karma’s suggestions based on their credit profile. Its strength lies in its user-friendly credit tools and the ability to alert users to potential identity theft promptly.

The Verdict on Account Linking and Aggregation

When it comes to account linking and aggregation, both NerdWallet and Credit Karma offer robust solutions. They enable users to view their financial data from various financial institutions in one place, simplifying the management of their financial lives. Each platform employs strict security protocols to ensure data protection and user trust.

How NerdWallet Handles Linking Your Accounts

NerdWallet provides a secure method to link multiple accounts and credit cards, offering a comprehensive view of your finances. The platform utilizes advanced security measures to protect user information, ensuring peace of mind for those who value their financial data’s safety. This aggregation of accounts enables better financial planning and monitoring.

The Integration Strengths of Credit Karma

Credit Karma’s integration capabilities stand out, making it effortless for users to connect to their financial accounts across different institutions. The platform’s seamless connection process, combined with its vigilant security practices, ensures that users’ financial data remains safe while they take advantage of Credit Karma’s credit monitoring and financial planning tools.

Accessibility: Mobile and Desktop Platforms

Both NerdWallet and Credit Karma understand the importance of accessibility, offering their services on multiple platforms. Whether users prefer the convenience of mobile apps or the full experience available on desktop platforms, these personal finance apps provide options to manage finances effectively from anywhere, at any time.

NerdWallet’s Mobile App vs Desktop Experience

NerdWallet’s mobile apps provide users with on-the-go access to financial tools and insights, maintaining feature parity with its desktop counterpart. The user interface is designed for easy navigation, ensuring a seamless transition between platforms. This consistency in user experience ensures that financial management is convenient and adaptable to each user’s lifestyle.

Credit Karma’s Mobile App vs Desktop Experience

Credit Karma offers a harmonious experience across its mobile apps and desktop platforms. Users can expect the same quality of credit information and financial tools, whether checking scores on their phones or planning budgets on their computers. The platform’s design focuses on simplicity, ensuring users can easily manage their financial tasks without hassle.

Beyond Budgeting: Planning for the Future

Forward-thinking users will appreciate the advanced features for retirement planning and long-term goal setting offered by both NerdWallet and Credit Karma. These tools go beyond daily budgeting, providing strategies and simulations to help users prepare for a secure financial future, tailored to their unique situations and objectives.

Retirement Planning with NerdWallet

NerdWallet takes retirement planning seriously, offering users tools to create a robust financial plan. With personalized advice and calculators, users can project their retirement savings and adjust their strategies accordingly. NerdWallet’s platform is designed to assist with retirement planning, helping users to confidently navigate their future financial needs and goals.

Credit Karma’s Tools for Long-term Goals

Credit Karma supports users in reaching their long-term financial objectives through targeted tools and resources. The platform focuses on helping users understand the implications of their financial decisions on their future wealth, with a particular emphasis on improving credit scores to secure better terms for major purchases and investments.

NerdWallet vs Credit Karma: Choosing the Right Tool for Financial Empowerment

In the quest to bolster financial literacy and navigate the myriad of financial transactions we face daily, selecting the right personal finance tools becomes crucial. Whether it’s for managing credit card debt, keeping a watchful eye on an emergency fund, or employing budgeting tools to steward resources wisely, both NerdWallet and Credit Karma equip consumers and small businesses with the tools necessary for sound money management. NerdWallet shines with robust investment tracking and content on mobile apps, while Credit Karma offers valuable insights into auto insurance and debit card usage. The track record of both platforms in aiding users to make informed financial decisions speaks volumes. Ultimately, the choice hinges on your unique financial goals and which platform’s features align best with your needs—be it for personal use or guiding your business towards fiscal prudence. As I always say, the power to shape your financial future is in your hands; these tools are just the compass to guide your journey.