Table of Contents

As someone who has navigated the tricky waters of personal finance for years, I am always looking for tools that simplify managing money. PocketGuard is one such app that has caught my attention. Designed to help users take control of their finances, it offers a range of features aimed at budgeting, tracking expenses, and optimizing savings. In my quest to find the best financial tools, I have taken a deep dive into PocketGuard’s offerings to see if it delivers on its promise of monetary ease.

With the myriad of budgeting apps available, determining which one suits your needs could be complex. PocketGuard stands out with its user-friendly interface and practical financial management tools. Whether you are searching to reign in your spending or boost your savings, this app claims to be your ally. Let us explore its capabilities to understand how it can make a difference in your financial journey.

Introduction to PocketGuard’s Capabilities

The PocketGuard app is a comprehensive financial tool designed to ease the stress of managing monthly bills and everyday spending. It connects with various financial accounts, from savings accounts to high-yield savings options, offering a detailed view of your financial landscape. This connection provides real-time insights into spending patterns and potential savings opportunities, making it easier to achieve your financial goals.

Synthesizing PocketGuard’s Core Functions

At its core, the PocketGuard app simplifies the complexity of personal finance. It effortlessly tracks monthly bills and categorizes everyday spending, providing you with a clear picture of your financial health. By linking to your savings accounts, the app also encourages the pursuit of high-yield savings as part of your financial strategy. The app connects to your financial institutions, ensuring all your financial information is accessible in one place.

Understanding the User Experience

When it comes to user experience, PocketGuard’s interface is simple. Navigating the app is intuitive, allowing quick access to essential features like budgeting and spending analysis. The focus on everyday spending helps users stay on top of their finances without feeling overwhelmed, making the app suitable for both novices and experienced budgeters.

PocketGuard’s Unique Features Unveiled

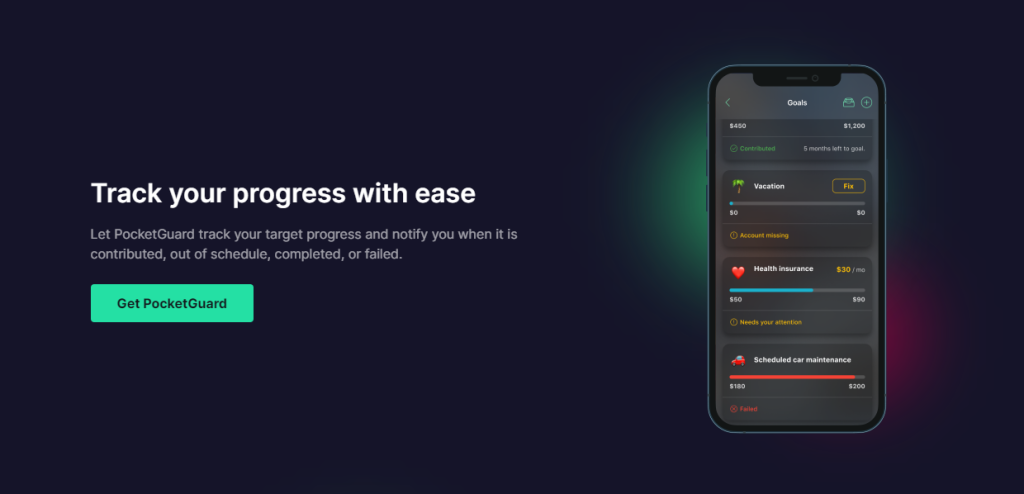

PocketGuard sets itself apart with unique features that address the practicalities of managing money. The app tracks everyday spending and introduces clever tools for setting goals and analyzing financial habits. These features are integrated thoughtfully to provide a seamless financial management experience, tailored to the modern user’s needs.

Budget Creation and Management

The paid version of PocketGuard includes robust budget creation and management tools. With 256-bit SSL encryption, users can securely link their debit cards and export transactions. The app categorizes transactions into different categories, allowing for a granular look at spending. For those seeking even more control, the premium membership offers additional features like spending limits, and for a one-time payment of $99, there is an option for a lifetime membership, ensuring long-term budgeting support.

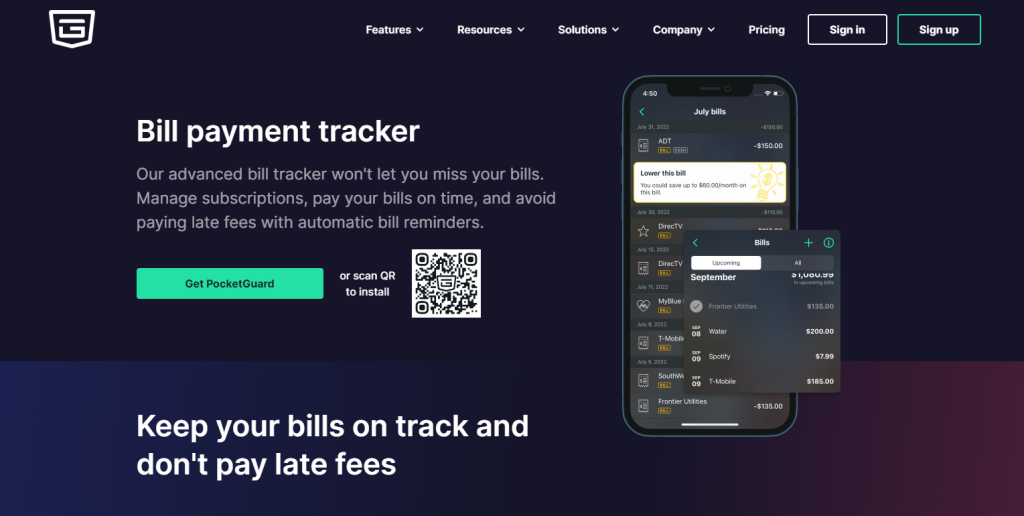

In My Pocket- A Real-Time Spending Guide

In My Pocket is PocketGuard’s innovative solution to managing spending money. The feature considers your recurring expenses and anticipated income to calculate how much money you have left to spend. This real-time guide empowers users to make informed decisions about their purchases, ensuring they stay within their financial means and avoid overspending.

Visual Spending Reports and Insights

PocketGuard provides users with visual spending reports that can easily identify spending habits and unwanted subscriptions. The app employs pie charts to depict how money is distributed across different spending categories, offering a clear and engaging way to understand where your funds are going. This visual approach to financial tracking is helpful in pinpointing areas where you can cut back and save more.

Compatibility and Accessibility

In today’s digital age, accessibility is key, and PocketGuard ensures that users can manage their finances on the go. The app’s compatibility with multiple platforms allows for a seamless transition between devices, ensuring your financial picture is always within reach, be it on a smartphone, tablet, or desktop.

Cross-Platform Availability and Ratings

Whether you’re an Apple app enthusiast or prefer Android, PocketGuard caters to both iOS and Android users. The app’s availability across these platforms has garnered positive ratings, with users appreciating the convenience of having their financial tools accessible from any device.

Institution Synchronization – Thousands Supported

One of PocketGuard’s strengths lies in its ability to synchronize with thousands of financial institutions. This extensive support allows users to consolidate their financial picture, integrating information from various accounts into a cohesive dashboard that reflects their overall financial health.

Security Measures in PocketGuard

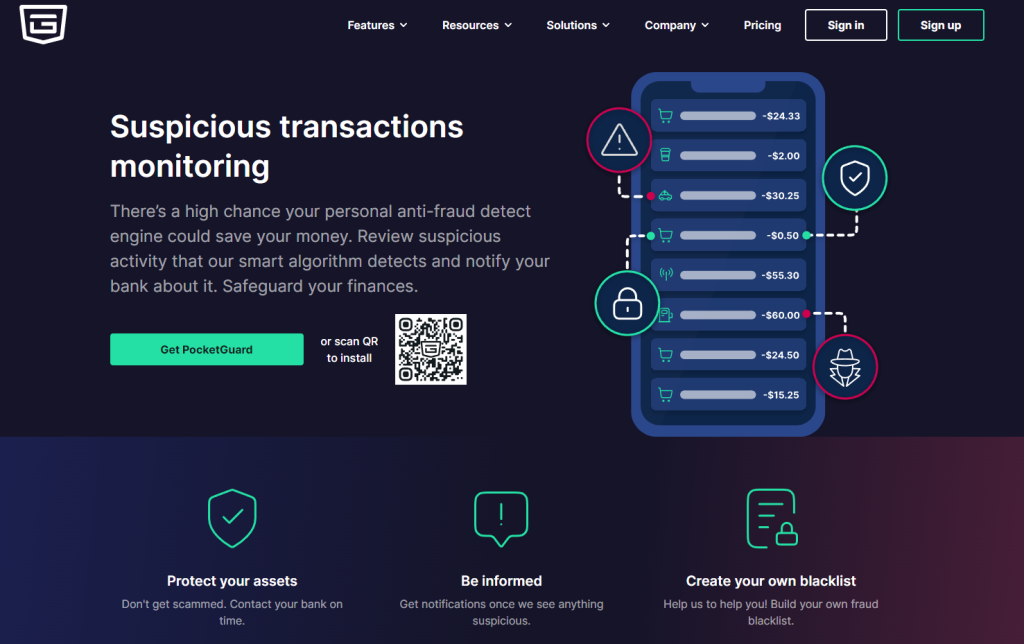

Security is a non-negotiable aspect of any financial app, and the PocketGuard app takes this seriously. The app employs robust security measures to ensure that users’ financial data remains protected from unauthorized access, giving them peace of mind as they manage their money.

How PocketGuard Protects Your Data

The PocketGuard app prioritizes the security of its users’ data by implementing advanced protection protocols. Users can rest assured that their sensitive financial information is shielded by industry-standard security measures. This commitment to data safety is a cornerstone of the PocketGuard experience, reflecting the app’s dedication to its users’ privacy.

Moreover, PocketGuard’s continuous monitoring for potential security threats ensures that users’ financial data is not only secure but also vigilantly guarded against emerging risks. This proactive stance on security demonstrates the app’s comprehensive approach to safeguarding users’ information.

User Privacy and Data Encryption Standards

User privacy is at the forefront of PocketGuard’s design philosophy. The app employs stringent data encryption standards that serve as a bulwark against data breaches. This encryption acts as a digital fortress, protecting users’ personal and financial information from the prying eyes of cyber threats.

Furthermore, PocketGuard’s commitment to privacy extends to how user data is handled and stored. Stringent protocols ensure that users’ information is not misused, guaranteeing that their financial integrity remains intact while using the app.

PocketGuard’s Pros: Why Users Love It

Many users lean towards PocketGuard’s ability to simplify the complex financial landscape. The app provides a comprehensive financial picture, allowing users to set and adhere to spending limits easily. This streamlined approach to managing complex financial data resonates with users who seek an intuitive way to stay on top of their finances.

Effortless Account Syncing

One of the shining attributes of PocketGuard is its seamless account syncing feature. The app accurately aggregates your transaction data by connecting all your financial accounts, from checking and savings to credit cards. This consolidation provides a comprehensive view of your finances, allowing you to track your spending and savings easily. The process is streamlined and secure, making it a hassle-free experience for users who want to manage their money without the manual labor of inputting each transaction.

Moreover, the synchronization is continuous, meaning your financial information is always up-to-date. This real-time update system affords you the luxury of having current transaction data at your fingertips, empowering you to make informed decisions on the go. PocketGuard’s ability to sync effortlessly elevates the app into a convenient tool for financial oversight.

Intuitive Budgeting Tools

PocketGuard’s intuitive budgeting tools simplify the budget creation process. By employing a budgeting method that analyzes your income, recurring bills, and spending habits, it provides personalized reports that help you understand where your money is going. These reports break down your expenses into categories, making it easier to identify areas where you can cut back and save more. The budgeting tools are user-friendly, catering to budgeting novices and seasoned savers alike.

The app does not just leave you with a set budget; it adapts as your financial situation changes. Whether it is an unexpected expense or a change in income, PocketGuard recalibrates your budget, ensuring that it remains relevant and effective. This dynamic approach to budgeting is a cornerstone of the app’s utility, offering users a flexible and responsive tool to manage their finances.

The Downsides of PocketGuard

Despite its many benefits, PocketGuard has its shortcomings. Users may find that while the app provides a solid foundation for financial management, it lacks depth in certain areas compared to other budgeting tools. Some features that could enhance the user experience, such as advanced analytics or investment tracking, are not as robust as those found in specialized financial apps. Additionally, the free version of PocketGuard has limitations that might prompt users to consider upgrading to unlock its full potential.

Limitations of the Free Version

The free version of PocketGuard offers a glimpse into the app’s capabilities, but it is not without restrictions. Users may encounter limitations in categorizing transactions, with multiple categories available but not fully customizable. This can lead to a less personalized experience, as the app may not fully adapt to every individual’s unique financial landscape. Moreover, the free version might not include all the budgeting tools and detailed reports that can make a significant difference in managing one’s finances.

These limitations may be a stumbling block for users serious about financial management. The inability to access certain advanced features could be a deterrent, prompting users to consider whether upgrading to the paid version is a worthwhile investment. Thus, while PocketGuard’s free version is a competent starting point, those seeking comprehensive financial oversight may find it lacking.

Necessity of Account Linking

Linking your financial accounts is needed to leverage PocketGuard’s capabilities completely. This requirement may raise concerns among users who are cautious about sharing their banking information. However, this integration enables the app to provide personalized insights and a real-time overview of your finances. Without account linking, the app’s effectiveness would be diminished significantly, as it relies on direct access to transaction data to perform its core functions.

Fortunately, PocketGuard employs stringent security measures, to ensure that your data remains protected. But it is crucial to acknowledge that the real power of PocketGuard lies in its ability to sync with your financial institutions, a process that is imperative for the app to function as intended. For users willing to embrace this integration, PocketGuard offers a comprehensive and automated approach to managing your money.

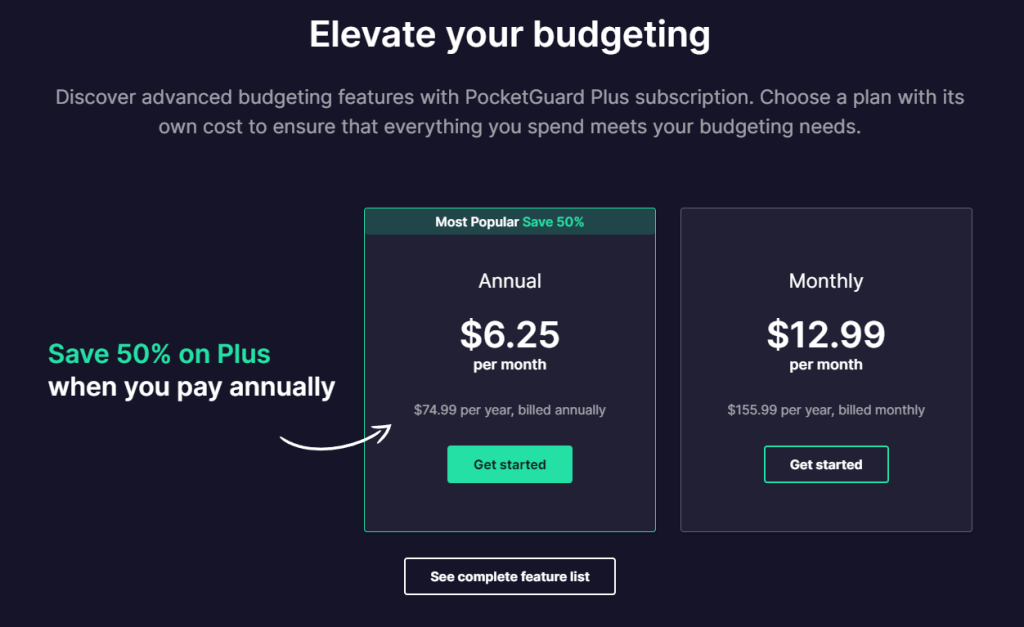

The Cost of Financial Vigilance

The pursuit of financial vigilance comes at a cost, and with PocketGuard, this translates into the monetary investment required to access the full suite of features. While the free version provides common tools for financial management, those seeking a more robust experience will need to consider the app’s pricing structure. Balancing the benefits of advanced features against the costs is a critical step for users determining the value of PocketGuard in their personal finance toolkit.

PocketGuard’s Pricing Structure

The pricing structure of PocketGuard is straightforward, offering users a choice between a free version and a paid version, the latter of which includes a monthly subscription. The paid version unlocks numerous additional features that can enhance your financial management capabilities, from more detailed budgeting tools to customized insights. The decision to upgrade to PocketGuard Plus will depend on the user’s willingness to invest in their financial health and the perceived value of the extra amenities provided.

Free vs Paid Features Breakdown

When comparing the free and paid versions of PocketGuard, one of the key differentiators is the projection of estimated income. The paid version allows users to forecast their income more accurately, considering various income streams and irregular earnings. This feature can be particularly valuable for freelancers or those with fluctuating incomes, as it enables a more precise budgeting process. Deciding whether to invest in the paid version will hinge on the user’s need for such advanced features and their financial priorities.

Exploring Alternatives to PocketGuard

While PocketGuard is a budgeting app with a loyal user base, it’s essential to recognize that it’s not the only option available. For those considering upgrading to PocketGuard Plus, it’s worth exploring other paid budgeting apps to ensure that you’re choosing the best tool for your needs. Each app comes with its own set of features and pricing models, and finding the right match requires a careful assessment of your financial goals and the functionalities that will help you achieve them.

• PocketGuard vs Empower: Feature Comparison

PocketGuard is a budgeting app that simplifies managing your money by tracking recurring bills and income alongside your finances. On the other hand, Empower offers unlimited savings goals and the ability to manage multiple cash accounts within the app. Both apps support biometric security features like Touch ID and Face ID, providing an additional layer of protection. When it comes to monitoring checking and savings accounts, both PocketGuard and Empower facilitate a comprehensive view of your financial health.

However, Empower stands out with its personalized financial coaching, a feature not present in PocketGuard. This coaching can prove invaluable for users looking to receive tailored advice on improving their financial situation. When deciding between the two, consider the importance of such personalized guidance in conjunction with the convenience of managing all aspects of your finances in one place.

• PocketGuard vs Mint: Choosing the Right Tool for You

Both PocketGuard and Mint allow users to sync transaction data and generate personalized reports to better understand their spending patterns. PocketGuard’s strength lies in its ability to help users categorize transactions easily and create a budget that aligns with their financial goals. Mint, however, offers investment tracking, a feature that appeals to users who want to monitor their investment portfolios alongside their day-to-day spending.

When deciding between PocketGuard and Mint, it’s essential to consider the specific features that will best support your financial journey. If investment tracking is a priority, Mint might be the more suitable choice. However, for those who prioritize ease of use and straightforward budgeting assistance, PocketGuard could be the optimal tool.

• How PocketGuard Stacks Up Against YNAB

YNAB, which stands for “You Need A Budget,” is another popular budgeting tool that competes with PocketGuard. YNAB’s approach is centered around giving every dollar a job, enforcing a more proactive budgeting style. PocketGuard, in contrast, focuses on simplicity and automation, making it easier for users to get started without a steep learning curve. Both apps aim to provide a clear picture of your finances, but they cater to different budgeting philosophies and user preferences.

For individuals who are new to budgeting or prefer a more hands-off approach, PocketGuard’s user-friendly interface and automated features may be more appealing. On the other hand, YNAB’s methodical approach to budgeting could resonate more with users who enjoy in-depth financial planning and hands-on control over their money. Ultimately, the choice between the two will depend on your budgeting method preference and the level of detail you desire in managing your finances.

Common Queries About PocketGuard Addressed

Many users have questions about the effectiveness of budgeting apps like PocketGuard. It’s important to understand that while apps can provide structure and tools for financial management, their success largely depends on user engagement and consistency. A budgeting app is a tool to facilitate financial awareness and discipline, but it cannot replace the personal commitment required to follow through with budgeting goals and make informed spending decisions.

The Reality of Budgeting App Effectiveness

The effectiveness of a budgeting app like PocketGuard hinges on its ability to reflect your financial reality accurately. These apps are designed to streamline the budgeting process, but their utility is contingent on the user’s input and regular maintenance of their financial data. To truly reap the benefits of PocketGuard, users must be proactive in reviewing their spending, setting realistic budgets, and adjusting as needed to stay on track with their financial objectives.

Determining the Best Free Budgeting Solution

When it comes to finding the best free budgeting solution, it is imperative to assess the features and limitations of each option. PocketGuard’s free version offers a solid foundation for managing your finances, but it is essential to recognize that the depth of its functionalities may be restricted. Users must weigh the importance of advanced features against the convenience of a free tool. Ultimately, the best budgeting solution is one that aligns with your specific financial needs and goals while providing the necessary support to maintain a healthy budget.

The Importance of Sound Budgeting Practices

Embracing sound budgeting practices is the cornerstone of financial well-being. With the right strategies, you can avoid debt, save for future goals, and handle unexpected expenses without difficulty. PocketGuard aids by allowing you to create custom categories, ensuring a personalized approach to managing finances that reflects your unique spending habits and financial goals.

Making the Most of PocketGuard

Maximizing the effectiveness of PocketGuard involves understanding its features and how they can cater to your financial management needs. By leveraging its intuitive interface, you can track your cash flow, monitor savings goals, and control your spending patterns securely, all contributing to a more robust financial life.

Step-by-Step Guidance for New Users

As a new user, begin by linking your bank accounts to PocketGuard. Set up your budget, categorize your expenses, and get familiar with the In My Pocket feature to know your available spending amount. Regularly review your financial standing and adjust your budget, ensuring it aligns with your financial aspirations.

Tips for Advanced Budget Management

For advanced budget management, PocketGuard offers premium features. Utilize the 256-bit SSL encryption for secure syncing of your debit cards and accounts. Export transactions for detailed analysis, and customize alerts for budget categories. Consider the premium membership, priced at $99 for a lifetime membership, for full access to all features.

Final Assessment of PocketGuard’s Offerings

PocketGuard’s offerings are vast, from basic budgeting tools to advanced financial tracking capabilities. Its ability to forecast “In My Pocket” amounts, based on recurring income and expenses, provides users with a clear and immediate understanding of their disposable income, empowering them to make informed spending decisions.

Putting It All Together: Who Should Choose PocketGuard?

PocketGuard is ideal for individuals who wish for a user-friendly and effective financial tool to manage their finances. Its intuitive design and comprehensive features cater to novices and seasoned budgeters who desire a holistic view and control over their monetary landscape.

Weighing the Benefits Against the Costs

While PocketGuard’s free version offers substantial benefits, the full spectrum of its capabilities is unlocked with a paid subscription. Potential users should consider their budgeting needs and whether the additional features in the paid version justify the investment into their financial health and planning.

Wrapping Up the PocketGuard Review With Key Takeaways

PocketGuard is a personal finance application that simplifies how you track your spending across various financial accounts. With the ability to download the app on any mobile device, connect your bank accounts, and effortlessly track your transactions, managing money becomes less of a chore and more of a strategic endeavor. The app’s design focuses on providing a clear picture of your finances, enabling you to set savings goals and budgets with precision and ease. Notably, the premium version offers a more robust set of tools for those ready to invest in their financial future.

Is PocketGuard safe? Absolutely. The developers have put substantial emphasis on security, ensuring that users can confidently manage their money without compromising personal information. Whether you’re utilizing the free version of the app or the premium version, PocketGuard offers a practical solution for those looking to gain better control over their finances. With features like “In My Pocket” to guide real-time spending decisions and the ability to create and manage budgets, PocketGuard earns its place as a valuable financial companion, meriting its high ratings of up to 5 stars from satisfied users.